Cash Discount Calculator - Make the Most of Your Discount

How much cash are you leaving on the table because cash discounts aren’t being used optimally? Many companies and self-employed professionals underestimate how big an impact cash discounts can have on liquidity and profit.

In practice, cash discounts are often applied incorrectly or not used at all. As a result, money is unnecessarily given away year after year.

With the cash discount calculator 2025, you can apply discounts in a targeted way and avoid common mistakes. In this guide, you’ll learn step by step how cash discounts work, how to use the cash discount calculator correctly, and which strategies deliver the greatest economic benefit.

Look forward to practical examples, easy-to-understand calculations, tips for integration into your accounting, and a compact overview of the legal framework.

What is a cash discount and why is it so relevant in 2025?

A cash discount is a time-limited price reduction granted if an invoice is paid within a specified period. A typical phrasing is “2% cash discount if paid within 10 days.” Unlike standard discounts, a cash discount is a targeted incentive to strengthen the supplier’s liquidity and improve payment behavior. Cash discounts are particularly relevant in 2025 because the interest rate environment remains volatile and many companies are struggling with late payments. If you use the cash discount calculator, you’ll quickly see how great the savings potential can be through early payment. You can also find detailed definitions and calculation methods in the guide Cash discount: definition and calculation.

A look at current statistics shows that 60 to 80% of companies actively use cash discounts. The use of digital tools, such as a cash discount calculator, is steadily increasing. In 2025, experts expect further growth, as digital accounting solutions and automation significantly simplify cash discount management.

What are the concrete advantages of cash discounts? Companies benefit from faster incoming payments, lower bad debts, and better liquidity planning. Risks include margin losses if cash discounts are granted too generously and the additional effort for re-calculation. Cash discounts are not sensible in every industry, so a careful analysis is worthwhile.

A practical example: A trades business grants a 2% cash discount for payment within 7 days. The result: Most customers pay significantly faster, which improves the company’s liquidity and strengthens customer loyalty. With a cash discount calculator, you can easily estimate the effect on annual revenue and profits.

From a legal perspective, there is no obligation to offer cash discounts. However, if you grant a cash discount, you must state the terms clearly and understandably on the invoice. This includes the discount rate, the period, and the standard payment term. Especially in the context of digitization and the 2025 e-invoicing obligation, clear wording is essential so that the cash discount can be processed and posted correctly.

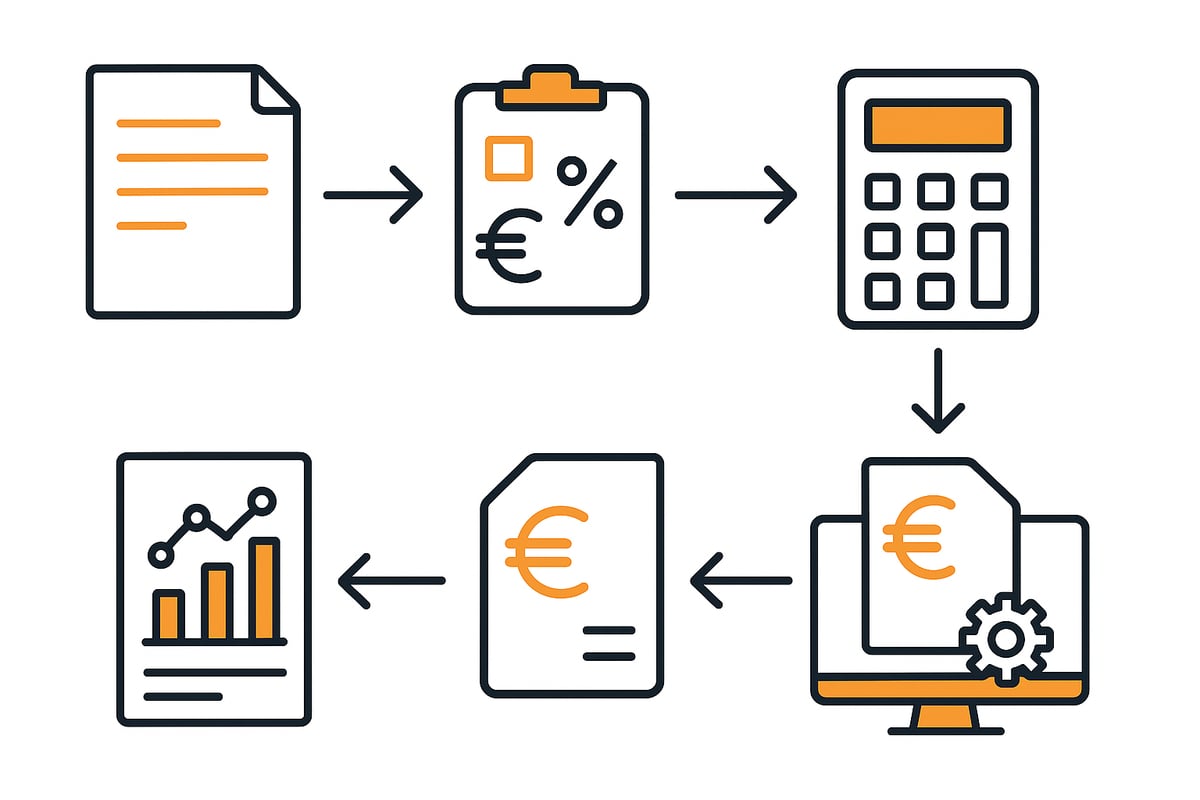

Calculating cash discounts correctly: step-by-step guide with the Cash Discount Calculator 2025

With the cash discount calculator you can calculate cash discount benefits quickly and accurately. That saves real money and minimizes errors. Here you’ll learn step by step how the calculation works in practice—from the basic data to integration into your accounting.

1. Capture baseline data

Before you get started with the cash discount calculator, you need some basic data: invoice amount, cash discount rate, and cash discount period. Also note the normal payment term. Important: Cash discounts are usually calculated from the gross amount (including VAT), not the net amount. Check the invoice to see exactly which amounts and deadlines apply.

2. Apply the cash discount formula

The calculation is simple once you know the formula. The basic formula is: Cash discount amount = Invoice amount × Cash discount rate ÷ 100. The remaining amount is: Invoice amount – Cash discount amount. Example: For €1,000 and a 2% cash discount, that’s €20 discount; the amount payable is €980. Use this formula as a foundation before you use the cash discount calculator.

| Invoice amount | Cash discount rate | Cash discount amount | Amount payable |

|---|---|---|---|

| €1,000 | 2% | €20 | €980 |

3. Use a cash discount calculator

Digital cash discount calculators offer clear advantages: They calculate error-free, compare scenarios, and save time. Required fields usually include invoice amount, cash discount rate, and deadlines. Many tools offer additional features such as considering discounts or partial payments. You can find a comprehensive overview of formulas and examples in the guide Cash discount calculation and posting.

4. Special considerations when combining discounts and cash discounts

Pay attention to the correct order: Apply a price discount first, then calculate the cash discount. Example: 5% discount on €1,000 gives €950. Then 2% cash discount on €950 = €19. The final amount drops to €931. The cash discount calculator can often handle such chained calculations automatically.

5. Cash discounts for partial payments and mixed invoices

A cash discount does not always apply to the total amount. In practice, often only materials are subject to cash discount, not labor costs. Modern cash discount calculators allow you to exclude individual items or calculate different portions. Check how your tool handles this and enter the values accordingly.

6. Avoid common mistakes

Common mistakes when using a cash discount calculator:

- Incorrect deadline calculation (wrong start date)

- Cash discount mistakenly deducted from the net amount

- Unclear cash discount terms on the invoice

Avoid these mistakes to prevent disputes and financial disadvantages.

7. Tips for use in 2025

Integrate the cash discount calculator directly into your accounting software. Many solutions offer automatic cash discount checks and deadline reminders. This way you make full use of the benefits and stay compliant. Regularly check whether your invoicing and accounting correctly reflect all cash discount cases.

Make optimal use of cash discounts: economic and strategic assessment

In 2025, cash discounts remain a decisive lever for companies and self-employed professionals. Why? Those who use cash discounts smartly improve their liquidity and save real money. But how big is the economic advantage really? And how does a cash discount calculator help you get the optimal benefit? The answer lies in a precise analysis of the financial effects.

Liquidity benefits and effective annual rate

A cash discount is not just a small reduction; it’s a real liquidity advantage. When you use cash discounts, you pay invoices sooner and receive a price reduction in return. The real kicker: The effective annual rate you achieve by using cash discounts is often surprisingly high.

The formula is: (Cash discount rate × 360) ÷ (Payment term – Cash discount period). Example: 2% cash discount for payment in 10 days instead of 30 days yields an effective annual rate of 36%. That’s significantly cheaper than most bank loans, which in 2025 are typically calculated at 5–10% per annum. With a cash discount calculator, you can compare these values precisely and optimize your payment strategy.

Who does a cash discount pay off for?

Cash discounts are particularly attractive for companies whose liquidity is strong enough to settle invoices promptly. Self-employed professionals and SMEs benefit because they are less dependent on expensive overdraft credit. From the customer’s side, using cash discounts makes sense when financing costs are lower than the cash discount benefit.

Want to know how cash discounts and other financial tools can support your business? You can find more information at Financial solutions for businesses.

Risks and limitations

Of course, there are risks. Cash discounts reduce your margin, so you should always include them in your pricing. Those who are too generous risk their own liquidity bottlenecks. A cash discount calculator helps simulate different scenarios and identify risks early.

Typical mistakes include setting the cash discount too high or neglecting re-calculation. Regularly check whether your cash discount policy still fits the current market situation.

Industry differences

Not every industry benefits equally. In retail, cash discounts are a proven way to encourage fast payments. In trades, many companies use cash discounts strategically to build customer loyalty. Service providers often use cash discounts selectively, for example with major customers or long-term partners.

The optimal cash discount strategy depends on payment terms, customer structure, and margins. With a cash discount calculator, you can easily compare industry-specific terms.

Practical example and statistics

According to current studies, over 70% of small businesses actively use cash discounts for liquidity management. A practical example: A company receives monthly material invoices totaling €10,000. By using a 2% cash discount, it saves €2,400 per year.

A cash discount calculator makes such savings transparent and easy to document over the course of the year. This turns cash discounts into a real competitive advantage.

Representing cash discounts correctly in invoices and accounting

Correctly reflecting cash discounts in invoices and accounting is crucial to using the benefits effectively and avoiding tax risks. If you use the cash discount calculator correctly, you must also know how to document and post cash discounts in a compliant manner.

Legally compliant cash discount information on the invoice

Legally compliant cash discount information is the foundation of clean accounting. What matters are clear details on the discount rate, the discount period, and the payment term. Typical templates: “3% cash discount if paid within 7 days, otherwise payable within 30 days without deduction.”

This information must be clearly visible and comply with GoBD and the 2025 e-invoicing obligation. Only then can the cash discount calculator be used correctly afterwards.

Cash discounts in accounting

Cash discounts are posted only when the payment is received, not when the invoice is issued. A distinction is made between gross and net posting, and input VAT must be adjusted accordingly. In practice, tools and step-by-step guides help with implementation, as described in detail in the article Cash discounts in accounting.

For the cash discount calculator, it is essential that the posting entries are correct—otherwise tax disadvantages may arise.

Common errors and their consequences

Many companies post cash discounts incorrectly, for example as a subsequent price reduction or without correct input VAT adjustment. This quickly leads to tax disadvantages or disputes with customers.

Pay attention to:

- Always post cash discounts as a price reduction

- Communicate cash discount terms unambiguously

- Monitor deadlines precisely

This way, the cash discount calculator remains a real advantage instead of a source of errors.

Integration into accounting software

Modern accounting programs offer the option to automate cash discount calculations and postings. That saves time and reduces sources of error. Automatic cash discount checks and reminder functions help meet deadlines.

Especially with many transactions, integrating the cash discount calculator into your software is a real efficiency gain.

FAQ: Frequently asked questions about cash discount posting

How do cash discounts work with partial payments? What should be considered for progress invoices or cross-border transactions? The answers often depend on individual software solutions.

Anyone using the cash discount calculator should regularly check the settings and consult their tax advisor for special cases.

Practical tips and strategies for companies & self-employed professionals

Do you want to turn cash discounts into a real advantage? Then you need the right strategy. Here are the most important practical tips to help you integrate the cash discount calculator optimally into your daily business.

Use cash discounts as a targeted competitive factor

A cash discount is more than just a price reduction. Use it strategically to set yourself apart from competitors. A fair discount rate and clear communication strengthen customer loyalty. Especially with new customers, an attractive offer can make the difference.

Flexible cash discount models are another plus. Different terms for regular customers, high-volume buyers, or first-time buyers make your pricing more dynamic. With the cash discount calculator, you can find the right solution for each target group.

Choose optimal cash discount periods

The right period determines how effective a cash discount is. Common periods are 5 to 14 days. Periods that are too short deter customers; periods that are too long delay incoming payments. Align with industry standards and analyze your customers’ payment behavior.

A table can help determine the optimal period for different customer groups:

| Customer segment | Usual period (days) | Recommendation |

|---|---|---|

| Regular customer | 7–10 | 7 |

| New customer | 10–14 | 10 |

| High-volume buyer | 5–7 | 5 |

The cash discount calculator helps you play through different scenarios and choose the best period.

Factor cash discounts into your pricing

Never forget to include cash discounts in your pricing. If you grant cash discounts, your margin must be able to absorb them. Always calculate “in the hundred,” not “from the hundred.” This avoids unpleasant surprises at final billing.

An example: Sales price €1,000, cash discount 2%. With the cash discount calculator, you immediately see how the reduction affects your profit. This keeps your pricing stable and transparent.

Combine cash discounts and price discounts smartly

Many companies offer both: price discounts and cash discounts. The order matters: Deduct the price discount first, then calculate the cash discount. Only then do you maintain control over your margins.

Practical tip: Let the cash discount calculator apply the deductions automatically in the correct order. This minimizes errors and protects your profit.

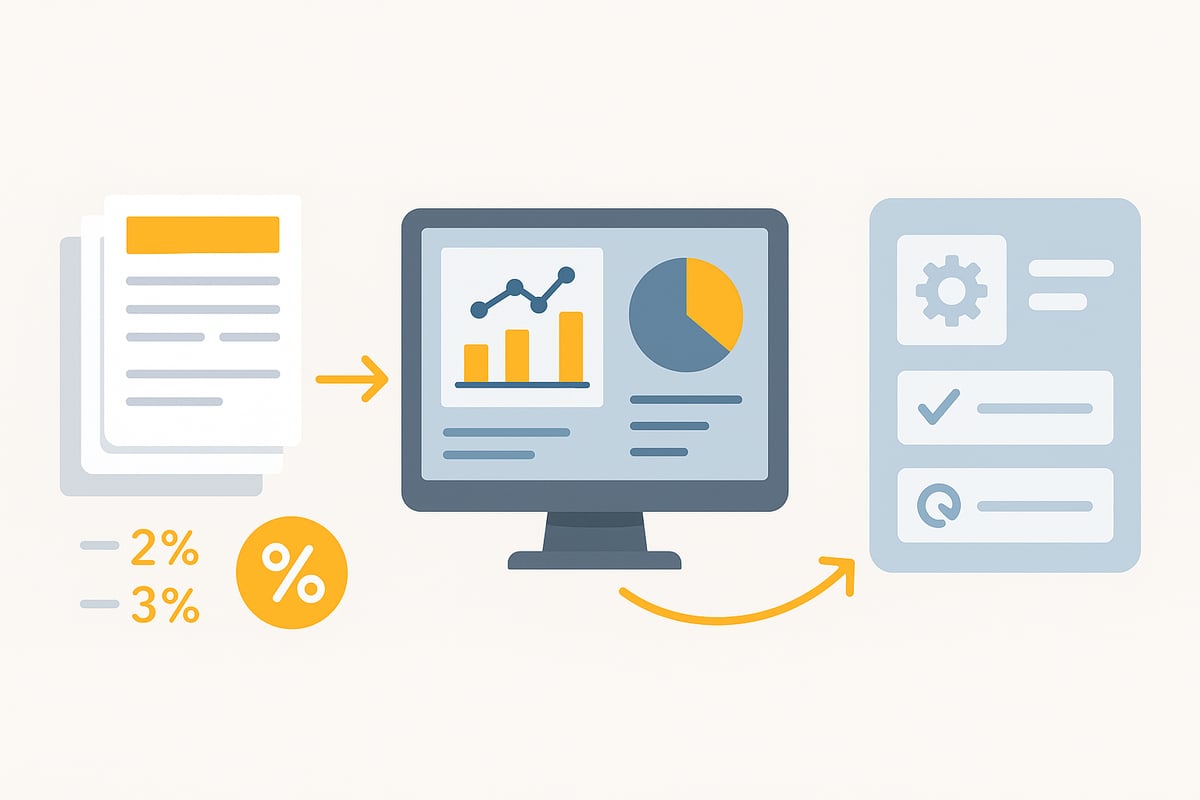

Leverage digitization and automation

Use digital solutions to manage cash discounts efficiently. Modern accounting software checks discount periods, reminds you of payments, and posts cash discounts automatically. This saves time and greatly reduces sources of error.

How does this work in practice? Here’s an overview of how you can automate digital accounting to manage cash discount postings and payment reconciliations even more efficiently. This makes the cash discount calculator a fixed part of your workflow.

Statistics, benchmarks, and best practices

In 2025, according to current studies, over 80% of companies use digital cash discount calculators. The average cash discount rate in Germany is 2 to 3%. Successful companies regularly review their cash discount policy and adjust terms to the market and customer behavior.

Avoid common mistakes: unclear communication, incorrect deadline calculation, or overlooking cash discounts in pricing. With structured organization and the right tool, you stay on the safe side.

Cash Discount Calculator 2025: selection, comparison, and practical application

A modern cash discount calculator is indispensable in 2025 if you want to use cash discounts efficiently. Choosing the right tool affects your accounting, saves time, and prevents errors. What should you look for in a cash discount calculator, and how do the leading solutions differ?

Key criteria for choosing a cash discount calculator

When choosing a cash discount calculator, pay attention to the following criteria:

- Usability: Intuitive input forms and clear navigation make work easier.

- Feature set: Look for support for discounts, partial payments, and different tax rates.

- Integration: Integration with accounting and invoicing software is crucial so that all data can be transferred seamlessly.

Tip: Check whether the cash discount calculator offers automatic reminders and cash discount checks. This helps you make optimal use of deadlines.

Comparison of leading cash discount calculators (Lexware, easybill, others)

The most well-known providers differ in usability and additional features. An overview helps with the choice:

| Provider | Usability | Feature set | Integration |

|---|---|---|---|

| Lexware | High | Discounts, partial payments | Very good |

| easybill | Very high | Automated calculation | Excellent |

| Others | Variable | Basic functions | Varies |

easybill scores with fast calculation and direct integration into invoicing. Lexware is particularly suitable for self-employed professionals and small businesses, as the cash discount calculator there is very practical.

Steps for everyday work

A cash discount calculator simplifies daily workflows:

- Enter data such as invoice amount, cash discount rate, and deadlines.

- Have the cash discount calculated and check the result.

- Transfer the values directly into your accounting.

With digital tools, you save time and minimize the risk of errors. You can find more tips for efficient accounting here: Organize your accounting the right way.

Avoid mistakes when using the calculator

Typical mistakes when using a cash discount calculator are:

- Incorrect entries for amounts or deadlines.

- Not calculating price discount and cash discount in the correct order.

- Overlooking special terms such as partial payments.

Make sure your data is correct, check all details, and use the control functions of modern tools.

Outlook: cash discount calculators and the 2025 e-invoicing obligation

With the 2025 e-invoicing obligation, digital processes become even more important. A cash discount calculator that checks automatically and integrates into digital workflows gives you a clear advantage.

More and more companies are relying on process automation to meet cash discount deadlines and optimize accounting. Why this is important and the advantages automation brings are covered in the article Process automation.

Common questions include: How do cash discounts work for cross-border transactions? Can I combine multiple cash discount rates? Modern cash discount calculators often answer these questions directly in the tool.

You’ve now seen how much potential there is in handling cash discounts correctly and how digital tools can help you save time and real money. If you want not only to understand your cash discount processes, but also to automate them and avoid mistakes, just give it a try: With filehub you can streamline your document workflows, automatically retrieve invoices, and integrate cash discount calculations seamlessly into your processes—without any coding. See the benefits for yourself and get started right here: Try filehub.one for free now