Invoice at Amazon - The Ultimate Guide in 2025

Wondering how to get your invoice at Amazon quickly and securely? You’re not alone. More and more individuals and companies face the challenge of needing invoice at Amazons for accounting, taxes, or warranty purposes.

This guide shows you every way to obtain your invoice at Amazon efficiently, legally compliant, and without detours. Whether you’re a private customer, business customer, or frequent buyer, you’ll find the right solution here.

Learn step by step how to proceed, what’s important for Marketplace orders, and which legal requirements apply in 2025. You’ll also get tips on automation and practical solutions for common problems.

Why are invoice at Amazons so important?

More and more people and businesses are asking why an invoice at Amazon is indispensable. The reasons are many: from tax obligations to warranty processing, the invoice plays a central role. Every invoice is an important proof and brings clear advantages in everyday life and business.

Tax and accounting requirements

For companies and self-employed people, an invoice at Amazon is a must. It serves as evidence for input tax deduction and proof of business expenses for accounting. According to the German Commercial Code (HGB) and Fiscal Code (AO), invoices must be kept for up to ten years. Without these documents, the tax office may not recognize expenses.

Especially if you buy from Amazon regularly, you should know how to get your invoice efficiently. A practical step-by-step guide can be found in the article Amazon Invoice Step by Step.

Warranty, returns, and complaints

An invoice at Amazon isn’t just relevant for taxes. It’s also the proof needed for warranty claims and is essential for returns. Many manufacturers and sellers explicitly require an original invoice for warranty cases.

In practice: Those who complain without an invoice often have to cover the costs for repair or replacement themselves. That’s why securely storing every invoice, including one from Amazon, is crucial.

Differences between private and business customers

Private customers usually receive an invoice at Amazon without a detailed VAT breakdown. Business customers, on the other hand, need this breakdown for their own accounting. The difference is especially relevant under the small business regulation.

|

Customer type |

VAT shown |

Use case |

|---|---|---|

|

Private customer |

Usually no |

Warranty, returns |

|

Business customer |

Yes |

Taxes, accounting |

An invoice at Amazon must therefore meet different requirements depending on the customer group.

Importance for international orders

Special rules apply to orders to other EU countries or Switzerland. The invoice often has to include additional information such as tax or customs numbers. Without correct information, imports can be delayed or incur additional charges.

Tip: For international orders, always check whether the invoice at Amazon contains all the necessary fields for customs processing.

Proof for insurance and damage claims

In the event of damage, such as theft or burglary, insurers require proof of purchase. An invoice is key here to proving the value of the stolen or damaged product.

Without an invoice at Amazon, it’s difficult to enforce claims with the insurer. Therefore, every invoice should be carefully archived.

Digital accounting and automation

In the digital age, invoices are increasingly processed electronically. The invoice at Amazon can be easily imported into digital accounting systems today. Automated filing and cloud solutions save time and minimize sources of error.

Many companies rely on automatic capture of every invoice at Amazon to optimize processes and keep track.

Step by step: How to find and manually download an invoice at Amazon

The invoice at Amazon is a must for many, whether for taxes, warranty, or accounting. With the right step-by-step guide, you can find your documents quickly and securely. Below, we show how to proceed in 2025 to efficiently find and download every invoice in your Amazon account.

1. Log in to your Amazon account

Start by logging in to your Amazon account. Whether you’re working on desktop or using the app, logging in is the first step to access your invoice.

Use secure passwords and enable two-factor authentication for added protection. This prevents unauthorized access to your data and ensures that only you can retrieve your invoice at Amazon.

If you have multiple accounts, make sure to check which account the order is in. This saves time and avoids confusion when you download the invoice later.

2. Navigate to “Orders”

After logging in, you’ll find the “Orders” section in the menu. On desktop, it’s usually visible directly in the top navigation. In the app, you can access it via the main menu.

All past purchases are clearly displayed here. For targeted searches for an invoice at Amazon, you can use filters such as date, order status, or category. This saves time, especially if you have many orders.

More tips and a detailed guide are provided in the article Finding invoices on Amazon, which explains several ways to quickly locate documents.

3. Select the right order

Now select the order for which you need the invoice. Especially for frequent buyers, the filter by date or product is helpful.

You can search for specific items or pull up older orders. Make sure you select the correct order so the invoice actually matches your desired product.

Check at a glance whether the invoice link is available. This saves unnecessary clicks and helps you find the right invoice in your Amazon account.

4. Download or view the invoice

For each order, you’ll find a link or button labeled “Invoice.” Click it to download the invoice as a PDF or view it directly online.

Sometimes there are differences between the PDF download and the online view. Downloading the PDF is ideal for archiving and forwarding to your tax advisor. The invoice at Amazon can then be made readily available at any time and stored in a tamper-proof way.

Note: The link may be placed differently depending on the device. Check both desktop and app views to quickly find the invoice at Amazon.

5. What to do if the invoice link is missing?

If the link to the invoice is missing for an order, you can request it via the “Request invoice” function. For Marketplace orders, the seller is often responsible for issuing it.

Contact the seller directly via Amazon’s messaging system. State your request clearly: Please send the invoice at Amazon for the respective order. Respond promptly, as complete documentation is important for tax purposes.

If the seller doesn’t respond, you can contact Amazon customer service. This usually provides a quick solution to issues with the invoice at Amazon.

6. Invoices for digital products and services

For digital products like e-books, Prime, or Audible, the provision of invoices works a bit differently. They often appear only after payment has been processed or can be retrieved in the relevant area of the account.

For third-party providers, you may need to request the invoice directly from the provider. Check the order overview and note any instructions in the email confirmation.

Make sure that all mandatory information is included on the invoice at Amazon even for digital goods. Only then are warranty and tax proof ensured.

7. Mobile app vs. desktop: Differences and tips

Some functions are limited in the Amazon app. You can’t always download every invoice directly. Often, the PDF export is only possible on desktop.

Workaround: Open the desktop site in your smartphone’s browser or use the “Request desktop site” option. This way you can also retrieve the invoice at Amazon on mobile.

For frequent buyers, it’s still advisable to access via desktop regularly to take full advantage of all invoice-related features.

8. Save, print, and forward the invoice

After downloading, you should save the invoice securely. The standard format is PDF, ideal for digital archiving. Create a clear folder structure, for example sorted by year or project.

For companies and self-employed people, it’s advisable to forward the invoice at Amazon directly to the tax advisor or accounting department. Many accounting programs support importing PDF documents.

Only print the invoice if it’s really necessary. Digital storage is more efficient and saves space.

9. Video tutorials and help

Official Amazon help pages offer detailed instructions on the invoice at Amazon, often as video tutorials. Check these if you get stuck at any step.

YouTube channels run by tax advisors or accounting professionals provide additional tips on how to manage your invoices optimally. You’ll also find hints on common problems and their solutions there.

Use these resources to make your invoice at Amazon workflow even more efficient.

Amazon Marketplace: Getting invoices from third-party sellers correctly

If you need an invoice at Amazon for a purchase via the Marketplace, different rules apply than for direct purchases. Especially for companies or self-employed people, it’s crucial how to retrieve the correct invoice. Here you’ll find all key specifics, pitfalls, and solutions when dealing with third-party sellers.

Differences between Amazon and Marketplace sellers

Many buyers think that every invoice at Amazon is issued directly by Amazon. But that’s only true if you buy directly from Amazon. With Marketplace sellers, the respective seller is responsible for the invoice.

In plain terms:

-

Amazon only issues the invoice for its own sales.

-

On the Marketplace, the seller must provide the invoice on Amazon.

-

Legally, the seller is obliged to include all mandatory information correctly.

Pay attention to whether the order overview says “Sold and shipped by Amazon” or another name. That affects where and how you find your invoice.

How to request a missing invoice from the seller

If an invoice at Amazon is missing in your account, you can request it directly from the seller. Amazon provides a simple contact function in the order area for this.

Here’s how to proceed:

-

Select the relevant order and click “Contact seller.”

-

Write a request for the invoice, ideally including the order number.

-

Wait for the seller’s response; you’ll often receive the invoice as a PDF by email.

Tip: Save all communications for your records. Many sellers respond quickly, but you should follow up in case of delays.

What to do with foreign sellers?

Especially with international sellers, the invoice at Amazon can be a challenge. Make sure the invoice contains all necessary information such as tax ID and VAT shown.

Tips for communication:

-

Write in English or in the seller’s language.

-

Explicitly request an invoice at Amazon with all legal information.

-

Check whether the invoice is suitable for input tax deduction.

If problems arise, Amazon customer service often helps. International sellers must comply with European requirements to ensure your invoice is recognized for tax purposes.

Problems with missing or incorrect invoices

If the invoice at Amazon is missing or contains errors, you’re not alone. Common errors include missing VAT shown or incorrect address details.

What can you do?

-

Contact the seller first and ask for a correction.

-

If the seller doesn’t respond, you can involve Amazon customer service.

-

Document every step, especially if you need the invoice at Amazon for tax or warranty purposes.

Especially after multiple inquiries, it helps to remain friendly but firm. In many cases, Amazon can mediate and put pressure on the seller.

Specifics for digital goods and services

For digital products such as vouchers, software, or subscriptions, invoicing often works differently. Here, Amazon usually issues the invoice, but sometimes the third-party provider does.

Key points:

-

Check whether the invoice is automatically stored in your customer account.

-

If the invoice at Amazon is missing: Request it directly from the provider.

-

Ensure correct details, especially if you need the invoice for tax purposes.

For subscriptions or recurring services, the invoice is often issued monthly. It’s worth checking your account regularly here too.

Rights and obligations under EU law and German tax law

The invoice at Amazon must meet certain legal requirements for Marketplace orders. These include complete details such as name, address, tax number, and VAT shown.

For businesses, these details are crucial to claim input tax. Since August 2024 there are new requirements, about which invoice at Amazons and VAT: Important changes since August 2024 provides detailed information.

Make sure your invoice meets these standards; otherwise, you risk tax disadvantages. If in doubt, consult your tax advisor.

Legal requirements for invoice at Amazons in 2025

Want to know what makes an invoice at Amazon legally compliant? The legal requirements are clear and equally important for individuals and companies. Only with a correct invoice do you meet your tax and accounting obligations. Below you’ll find the most important requirements and practical tips.

Mandatory information on an invoice

An invoice must contain certain mandatory information to be recognized for tax purposes. These include the name and address of buyer and seller, tax number or VAT ID, a consecutive invoice number, and the invoice date.

The following table gives you a quick overview:

|

Mandatory item |

Description |

|---|---|

|

Name and address |

Buyer and seller |

|

Tax number/VAT ID |

Seller |

|

Invoice number |

Unique, sequential |

|

Date |

Issue date |

|

Itemized list |

Purchased products and prices |

|

VAT shown |

Amount and rate of tax |

Without this data, the invoice at Amazon is not legally valid.

Electronic invoices: What is allowed?

Electronic invoices have long been standard for invoice at Amazons too. The tax office accepts digital invoices without restriction, provided they are stored immutably. It’s important to archive them in the original format, usually as a PDF.

Use secure cloud solutions or specialized accounting software to store your invoice at Amazon. You can find more details and practical tips in the guide Amazon Accounting & Taxes: The complete guide.

Special rules for small businesses and private individuals

Different rules apply to small businesses and private individuals for invoices. Small businesses do not show VAT and must note this on the invoice. Private individuals don’t need a VAT indication if they’re not pursuing business purposes.

In practice, this means: Always check whether your invoice contains all necessary details, depending on the seller’s status.

Retention periods and archiving

Companies must keep every invoice at Amazon for ten years. Archiving must be audit-proof and compliant with data protection. Encrypted cloud storage or dedicated accounting programs are recommended.

Tips for secure storage:

-

Use structured folders by year and month

-

Set up regular backups

-

Protect sensitive data from unauthorized access

Risks of missing or incorrect invoices

If an invoice at Amazon is missing or contains errors, you risk tax disadvantages and, in the worst case, fines. This can become expensive, especially during audits. Act immediately if you find discrepancies and request a correct invoice at Amazon.

This way you’ll be legally compliant for 2025 and always have your Amazon purchases under control.

Automation and digital filing: Handling invoice at Amazons efficiently

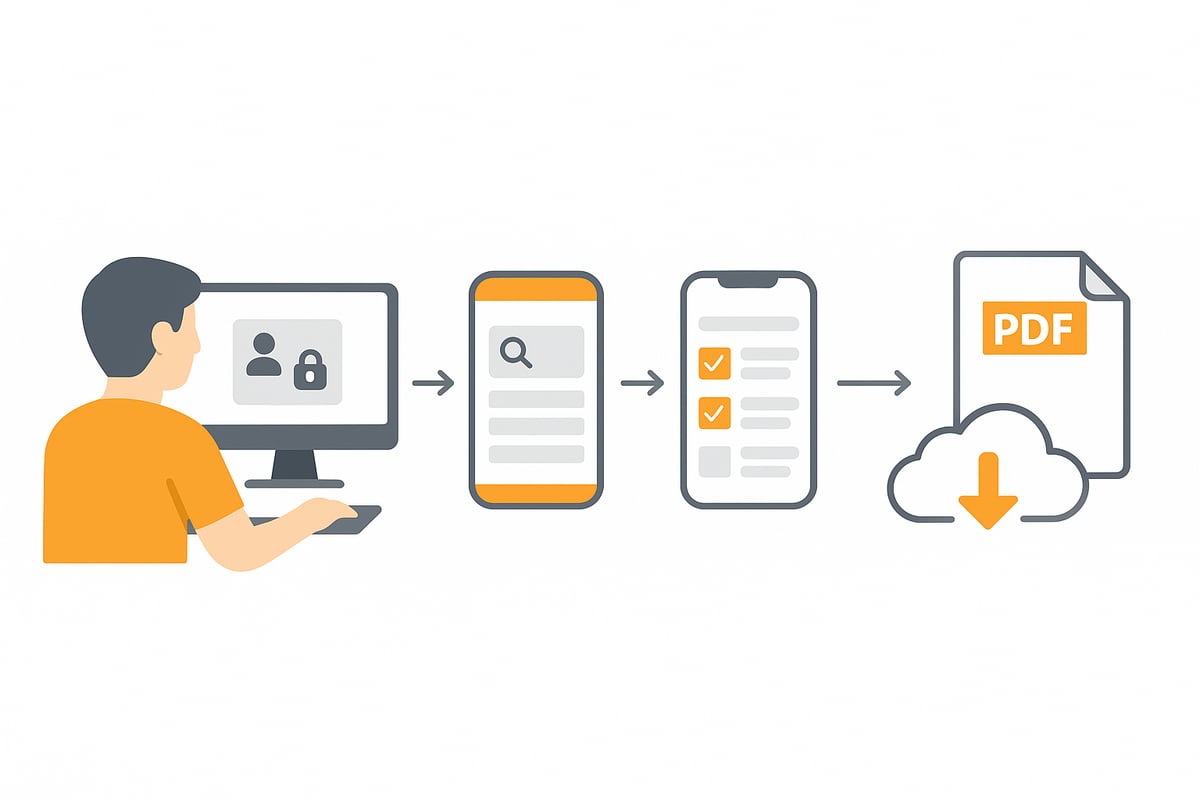

Automation is the key to handling the invoice at Amazon efficiently. Those who process many orders save time and reduce errors with digital processes. Modern tools enable not only automatic filing, but also seamless integration into existing accounting systems.

Tools and methods for automatic invoice filing

Automatic filing of invoice at Amazons is easy today with specialized tools. These solutions retrieve invoices directly from the Amazon account and store them securely in the cloud or on local servers.

Popular methods include:

-

Email forwarding to accounting software

-

Cloud storage with automatic assignment

-

Special automation tools for Amazon

Some tools, as presented at Automated invoice retrieval, offer additional filters and export options. This makes organizing the invoice at Amazon a breeze.

Integrating invoice at Amazons into accounting

The invoice at Amazon can be easily integrated with modern accounting programs. Many providers support importing PDF or XML files directly from cloud storage or via email.

Typical workflows use:

-

Automatic assignment to business transactions

-

Synchronization with DATEV, Lexoffice, or sevDesk

-

Export functions for tax advisors

How Digital accounting with Amazon works efficiently is shown in a practical example in the linked article. The invoice at Amazon is thus seamlessly integrated into digital accounting.

Security and data protection in digital archiving

Data protection is particularly important when it comes to the invoice at Amazon. Digital archiving solutions use encryption and access protection so that only authorized persons can access financial documents.

Key aspects:

-

Storage on servers in Germany or the EU

-

Two-factor authentication for sensitive data

-

GDPR compliance across all processes

Anyone using digital filing should use regular backups and strong passwords. This keeps the invoice at Amazon protected and accessible at all times.

Tips for companies with high order volumes

Companies that receive many invoice at Amazons benefit particularly from automated workflows. Batch downloads and centralized filing structures save valuable time.

Best practices:

-

Monthly or weekly batch retrievals

-

Use of templates and folder structures

-

Automated notifications for new invoices

This keeps you on top of things and the invoice at Amazon is always ready for tax audits or internal evaluations.

filehub: The smart solution for automated invoice retrieval

filehub offers an automated solution for the invoice at Amazon that integrates seamlessly into existing workflows. The platform handles retrieval, archiving, and forwarding of invoices to accounting or cloud systems.

Benefits of filehub:

-

No programming skills required

-

GDPR-compliant storage in Germany

-

Flexible pricing models and a free trial

Especially for companies with many Amazon orders, filehub is an efficient, secure, and future-proof option for digital invoice management.

Common problems and solutions around invoice at Amazons

Problems around the invoice at Amazon are not uncommon. Whether you order as a private individual or a company, typical errors or delays occur time and again. Here you’ll find the most common challenges and practical solutions.

Missing or delayed invoices

Buyers often wait in vain for invoices. The causes vary:

-

Seller doesn’t provide an invoice automatically

-

Technical system disruptions

-

Changes at Amazon or on the Marketplace

What to do? First check whether the invoice appears after a few hours or days. Use the “Request invoice” function if available. For Marketplace orders, it’s advisable to contact the seller directly. If the invoice at Amazon still doesn’t show up, Amazon customer service usually helps.

Incorrect information on the invoice

Sometimes invoices don’t match your data. Common errors:

-

Incorrect name or address

-

Incorrect tax number or VAT ID

-

Incomplete item description

In such cases, you should initiate a correction promptly. Go to your Amazon account and use the “Report an issue with invoice” function. For Marketplace orders, contact the respective seller directly. A detailed guide on how to create a correct invoice for Amazon can be found here: Make your tax office happy: How to issue a correct invoice to Amazon.

Difficulties with international orders

The invoice at Amazon can be challenging for international orders. The following problems arise:

-

No VAT shown or shown incorrectly

-

Foreign currencies on the invoice

-

Customs and tax formalities not considered

Tip: Check whether all legal mandatory details are present. If in doubt, contact the seller or Amazon. For deliveries to Switzerland or other EU countries, special rules often apply to invoices.

Problems with digital products and services

There are special features with the invoice at Amazon for e-books, software licenses, or Prime subscriptions:

-

No automatic invoicing

-

Different contacts for third-party providers

-

Delayed availability of the invoice

In most cases, a look at the order overview under “Digital Orders” helps. If the invoice at Amazon is missing, use the contact functions or check the FAQs in the help section.

Technical issues: App, browser, PDF download

Sometimes access to the invoice at Amazon fails due to technical hurdles:

-

The invoice can’t be downloaded

-

The PDF doesn’t display correctly

-

Functions are missing in the app

Solutions: Try another browser or update the app. Check pop-up blockers and your PDF viewer. If problems persist, switching devices can help. For an invoice at Amazon, accessing via desktop is also recommended.

Support from Amazon customer service

If all else fails, Amazon customer service is the last resort. You can reach them via chat, email, or phone. Response times vary, but you’ll usually receive an answer within 24 hours. In particularly difficult cases, the matter can be escalated.

Important links and resources

There are numerous points of contact for the invoice at Amazon:

|

Problem |

Contact point |

|---|---|

|

Missing invoice |

Amazon Help, seller contact |

|

Tax questions |

Tax advisor, Amazon FAQs |

|

Correct invoice |

Make your tax office happy: How to issue a correct invoice to Amazon |

|

Tax return |

|

|

Video tutorials |

YouTube, Amazon help pages |

Use these resources to manage your invoice at Amazon efficiently and solve problems quickly.

You’ve now seen how important it is to manage invoice at Amazons correctly and efficiently—especially if you have many orders or need to comply with legal requirements.

Digitized workflows save time, minimize errors, and make accounting much easier. With filehub, you can optimize the entire process around automatically retrieving and securely storing your invoice at Amazons—without any programming skills. Give it a try and discover how much more relaxed and productive your workday can be.