Invoices on Amazon : Easily find and manage them

Every year, many users face the challenge of finding invoices on Amazon quickly and reliably. Efficient management of receipts is especially crucial for warranty claims or accounting.

In this guide, you’ll learn how to effortlessly retrieve all Amazon invoices in 2025, store them securely, and organize them optimally. Step-by-step instructions, practical tips, and the best tools help you save time and stay on top of things.

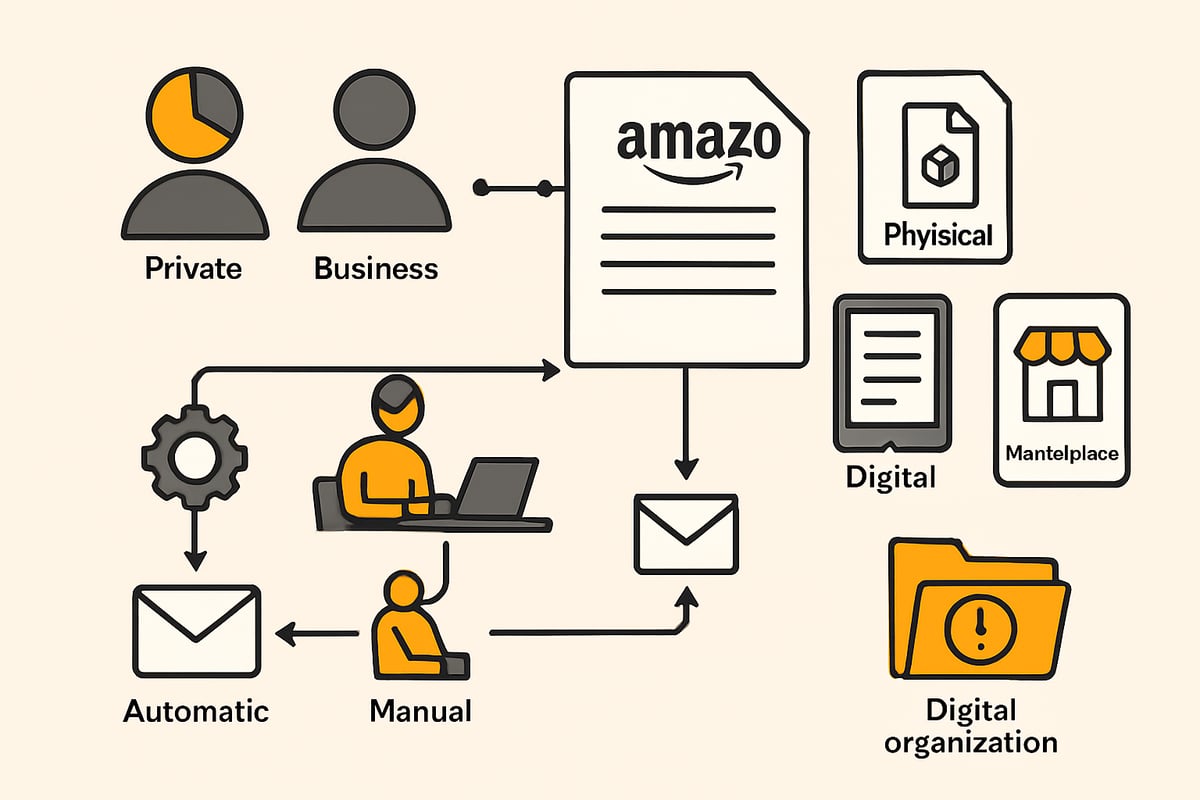

This article shows you how to access your invoices in no time—whether you’re a private customer or running your business with Amazon.

Invoices on Amazon: Basics and Particularities

What is an Amazon invoice?

Invoices on Amazon are official documents that prove the purchase of a product or service. They fulfill clear legal requirements in online retail. An Amazon invoice differs from a receipt or delivery note because it contains all tax-relevant information.

Typical contents include the buyer’s name and address, invoice date, the seller’s tax number or VAT ID, and the exact breakdown of VAT. For private customers, invoices on Amazon are often important for warranty or returns. Business customers mainly need them for bookkeeping and tax purposes.

For digital products or third-party sellers, the invoice may look different. Amazon Business users now account for a significant portion of purchases. The exact form depends on the respective seller and product.

| Document | Purpose | Includes VAT? |

|---|---|---|

| Receipt | Proof of payment | No |

| Delivery note | Shipping confirmation | No |

| Invoice | Tax document | Yes |

How are invoices provided on Amazon?

Invoices on Amazon are usually generated automatically after completing a purchase. For direct sales by Amazon, the invoice is often available directly in the customer account under “My Orders.” For Marketplace sellers, the process may vary.

Some sellers only provide the invoice upon request or with a delay. Provision depends on whether the seller participates in the Marketplace or sells directly via Amazon. By law, there is a deadline for issuing an invoice, which in Germany is usually seven days.

Typical problems with invoices on Amazon include missing documents or delayed provision. Especially with third-party sellers, it can happen that invoices are not generated automatically. Always check whether all details are complete.

Challenges in invoice management on Amazon

Many users find managing invoices on Amazon challenging. The order history is often confusing, especially with many purchases. There are different file formats, and some documents are missing entirely.

Companies and frequent buyers face particular issues. Without proper filing, there may be difficulties with taxes or in the event of a warranty claim. On average, a German Amazon customer places around 41 orders per year. Missing documentation means a risk to traceability.

Be sure to regularly back up all invoices on Amazon. Otherwise, proof of purchase or tax recognition may be lost in case of problems.

Importance of digitalization and automation

The digital management of invoices on Amazon is becoming increasingly important. Automated processes offer many advantages for individuals and companies. You save time, reduce errors, and optimize accounting.

Cloud solutions and automated accounting tools are becoming more widespread. Trends such as the use of artificial intelligence for document management are on the rise. For tax audits and compliance, digital archiving is a clear advantage.

Those who rely on modern solutions today remain efficient and legally compliant. Information on Automated invoice management for Amazon provides a good introduction to current tools and possibilities.

Step by step: How to find your Amazon invoices in 2025

Anyone who orders from Amazon regularly knows the problem: invoices on Amazon are often hard to find or scattered. With the right approach, however, you can quickly locate any invoice—whether for private purchases, digital products, or as a business. Here you’ll learn how to find and optimally manage your invoices on Amazon step by step in 2025.

Find invoices in the Amazon customer account

To find invoices on Amazon directly in your customer account, first log in to the Amazon website. Then navigate to “My Orders.” Here you’ll see an overview of all orders, sorted by date.

Select the desired order. Click “Invoice” or “View order details.” You will usually find a link to download the PDF there. On desktop, this button is usually directly visible, while in the mobile app you often have to open an additional menu.

Tip: If no invoice is displayed, check whether the seller is a third-party. In some cases, the invoice may be provided with a delay. Check your overview regularly so you don’t miss any invoices on Amazon.

Request invoices from Marketplace sellers

For orders via Marketplace sellers, invoices on Amazon are not always provided automatically. First check whether the seller is listed as a third-party in your order overview. If so, click “Contact seller.”

Formulate your request clearly: provide the order number, product name, and desired invoice format. Many sellers respond within 48 hours. If there is no response, you can involve Amazon customer service.

Standard templates help you save time. Use deadlines to receive your invoices on Amazon promptly and avoid issues with returns or tax questions.

Invoices for digital products and services

For digital products such as eBooks, music, software subscriptions, or Prime, special invoices on Amazon are often issued. You will usually find these not in the classic order overview, but under “Digital orders” in your customer account.

Click the corresponding purchase to download the invoice as a PDF. The documents often differ from physical invoices, for example through different tax rates or missing shipping information. Use the search function to quickly find invoices on Amazon for digital purchases.

If you have problems with digital invoices, Amazon Support often helps. Carefully document all purchases to be prepared for inquiries or tax audits.

Invoices for Amazon Business customers

Amazon Business customers benefit from extended options for managing their invoices on Amazon. In the business account, you can download invoices in bulk, activate automatic delivery, and use integration with accounting software.

For frequent buyers, it is advisable to use tools for automatic capture and filing. A guide to automatic management of Amazon invoices shows how to save time and avoid errors.

Make sure your invoice database remains up to date. This way, you keep an overview and can quickly access individual documents if necessary.

Problems retrieving invoices: solutions and tips

Sometimes invoices on Amazon are missing or incorrect. In such cases, you should first check whether the order was completed correctly and the correct seller is displayed.

If the invoice is missing, contact the seller or Amazon customer service directly. For incorrect invoices, you can request a correction. Subsequent requests are usually possible within a few weeks.

Observe legal deadlines and regularly back up all documents. Only then can you avoid problems with warranty, returns, or tax returns when it comes to invoices on Amazon.

Important notes for 2025: changes and innovations

There are a few innovations for invoices on Amazon in 2025. Amazon continuously adapts processes, for example due to new legal requirements such as the e-invoice obligation. Check the Amazon platform regularly for updates on invoicing and download options.

New features can affect both private and business customers. Stay informed about planned changes so you can continue to retrieve and manage all invoices on Amazon correctly from 2025 onward.

Keep an eye on current developments to remain both compliant and efficient.

Manage invoices efficiently: organization, storage & security

Efficient management of invoices on Amazon is crucial to staying on top of things and saving time. With the right organization, automated processes, and secure storage solutions, you’re well equipped for the digital future.

Digital organization of your Amazon invoices

A clear structure is essential if you want to manage invoices on Amazon digitally. It’s best to create separate subfolders for each year and purpose, for example for private and business expenses. Use descriptive file names so you can find invoices quickly later.

Cloud storage such as Google Drive or Dropbox is suitable for storing your invoices on Amazon centrally and securely. Tools for automatic tagging make finding them even easier. If you’re looking for inspiration, this article on trends in digital document management provides many more tips and methods for efficient filing.

Automation solutions for invoice management

Many tasks related to invoices on Amazon can be automated today. With modern workflows, you can set up, for example, the automatic forwarding of invoice emails to a specific archive. Integration with accounting software such as Lexoffice or DATEV also saves a great deal of time.

Setting up automatic processes is particularly worthwhile for companies and frequent buyers. Artificial intelligence takes on tasks such as reading invoice data or assigning it to projects. This leaves more time for what matters.

Security and data protection in invoice archiving

When storing invoices on Amazon, you should place great value on data protection. Use only cloud services that comply with the GDPR and offer data encryption. It is also important to protect access to sensitive documents with passwords or two-factor authentication.

Observe statutory retention periods and regularly back up your data. Insecure storage locations or missing backups can lead to data loss in an emergency. With a good strategy, you’re protected against unpleasant surprises.

Paperless accounting: advantages and implementation

The paperless management of invoices on Amazon brings many advantages. You not only save space, but also find documents again in no time. The transition is made step by step: scan old paper receipts, set up a digital filing system, and have all new invoices delivered directly in digital form.

Digital invoices are recognized by the tax authorities as long as they are archived in an unalterable manner. Many companies report noticeable time and cost savings after the switch. With a little planning, paperless accounting becomes the standard.

Sources of error and how to avoid them

Errors can easily creep in when managing invoices on Amazon. Common problems include duplicate filings, missing backups, or incorrectly named files. A checklist helps you keep track and regularly check all required steps.

Automatic reminders help ensure you don’t miss deadlines or backups. Regular backups are mandatory to avoid data loss. Learn from practical examples and continuously optimize your processes.

Practical tools and apps for invoice management

There are numerous tools that help you manage invoices on Amazon efficiently. The range extends from simple cloud solutions to specialized apps for receipt management. When choosing, pay attention to compatibility with Amazon and other platforms.

Compare features, prices, and user reviews to find the right tool for your needs. Many programs offer trial versions so you can try out different solutions. This way, you’re sure to find the optimal system for your digital invoice management.

Special requirements for companies and the self-employed

Companies and the self-employed face particular challenges when managing invoices on Amazon. In addition to legal requirements, digital processes, automation, and efficient integration into accounting must function optimally. In the following sections, you’ll find all relevant requirements, helpful tips, and practical examples for implementation in your business.

Tax requirements and GoBD compliance

Strict tax requirements apply in Germany to invoices on Amazon. The GoBD (Principles for the proper management and storage of books, records, and documents in electronic form) are central here. Digital invoices must be archived completely, unalterably, and traceably.

The retention period is at least ten years. During audits, every invoice must be quickly retrievable. Ensure that archiving is GoBD-compliant. Use suitable software that guarantees immutability and logging. A clear process protects against later problems with the tax office.

Integration of Amazon invoices into accounting

The automatic transfer of invoices on Amazon into accounting programs is a real efficiency boost for companies. Many solutions offer interfaces to Amazon and enable direct assignment of documents to cost centers or projects.

With Accounting automation for companies, you can automatically import, process, and archive Amazon invoices in an audit-proof manner. Workflows for document assignment reduce errors and save time. When integrating, pay attention to compatibility with your ERP or accounting system and regularly test the interfaces.

Invoice management with high order volumes

Especially with many orders, structured management of invoices on Amazon is crucial. Tools for mass export support you in efficiently creating monthly or collective invoices and automatically assigning them to projects.

A clear database with filter functions makes controlling and preparing for tax audits easier. Statistics show that business customers place significantly more orders per year on average than private users. Automated processes and clear filing structures are therefore essential to keep track.

Particularities of international orders

Invoices on Amazon from abroad come with special challenges. You often receive documents in foreign currencies and with different tax rates. Invoicing must comply with the respective legal requirements, for example when showing VAT or for imports with customs.

Pay attention to correct information and check whether the invoices are suitable for input tax deduction. Accounting must take international differences into account and maintain corresponding accounts. If in doubt, consult a tax advisor to avoid errors in international business transactions.

Common mistakes and how companies can avoid them

Typical mistakes in managing invoices on Amazon include missing or incorrect information, duplicate filing, and problems with digitization. A structured checklist helps you check the most important points:

- Are all mandatory details present?

- Are invoices archived in compliance with GoBD?

- Are regular backups in place?

You can find more tips in the article on efficient organization of company invoices. With clear processes and automation, you can eliminate many sources of error and ensure compliance.

Automation and future trends: invoices on Amazon 2025

The world of invoices on Amazon is changing rapidly. Digitalization, new laws, and smart tools are shaping how you find, manage, and archive invoices in 2025. Here you’ll learn which trends are shaping the market, what the e-invoice obligation means, which automation solutions exist, and how you can best prepare for the future.

Current trends in invoice automation

Automation is the key to efficient management of invoices on Amazon. More and more companies are relying on automated workflows to save time and avoid errors. Modern tools use artificial intelligence to automatically capture invoices, assign them, and pass them on to accounting.

Typical trends in 2025:

- AI-supported document recognition and assignment

- Cloud solutions for location-independent invoice management

- Cross-platform integration with Amazon, banks, and accounting software

- Automatic reminders for outstanding invoices

The growing number of automated invoice processes in German companies shows how far automation has already come. If you want to dive deeper, the article on workflow automation for invoice processes provides practical implementation tips and current developments.

E-invoice obligation and legal developments in 2025

2025 brings important innovations for invoices on Amazon. The e-invoice obligation in Germany and the EU ensures that companies are only allowed to accept electronic invoices. This also affects Amazon customers and sellers, who must prepare for new formats, digital signatures, and stricter deadlines.

Key points:

- Introduction of standardized electronic invoice formats (e.g., XRechnung, ZUGFeRD)

- Legally required retention of electronic invoices

- Transitional regulations and deadlines for companies

Amazon is also adapting: from 2025, the format of the VAT invoice number will change. Details can be found in the official forum on change of the VAT invoice number format from 2025. Check early on whether your accounting is compatible.

filehub: automated invoice management for Amazon

A smart solution for automated invoices on Amazon is filehub. With filehub, you connect your Amazon account and other platforms to automatically retrieve, store, and archive invoices.

Advantages at a glance:

- Time savings through automated download and filing

- Error avoidance thanks to end-to-end workflows

- GDPR-compliant storage on secure servers in Germany

- Easy integration with accounting software

Typical use cases: automatic retrieval of Amazon invoices, central storage in the cloud, forwarding to tax advisors. Filehub offers a compelling overall package, especially for companies.

Tips for the future: how to stay efficient and compliant

Preparation is everything to ensure that invoices on Amazon are managed optimally in 2025. Use scalable tools that respond flexibly to new requirements. Regularly review your processes and keep up to date with legal changes.

Specifically, it is advisable to:

- Invest in modern, cloud-based solutions

- Set up automated backups and reminders

- Train employees regularly

- Continuously optimize your own workflows

With a clear checklist and the right mindset, you’re well equipped for the future of invoice management.

You’ve now seen how much time and effort searching for and managing Amazon invoices can take—especially if you order regularly or work for your business. With modern automation solutions like filehub, you can save recurring clicks, reduce errors, and keep all receipts safe and GDPR-compliant in one place. You don’t have to set up complicated tools or do any programming—you can get started right away and noticeably simplify your processes.

Try filehub easily and see for yourself: test filehub.one for free now