ZUGFeRD – The e-invoice simply explained.

Digital transformation and new laws pose major challenges for companies. If you want to process invoices efficiently, error-free and in compliance with the law, you now need to get to grips with modern e-invoicing standards.

Since 2025, electronic invoicing has been mandatory for many companies. This is where ZUGFeRD comes in as a standard. Thanks to this standard, invoices can be processed not only faster, but also more securely and transparently.

Do you want to save time, cut costs, and minimize sources of error? Then you’re in the right place. In this guide, you’ll learn how to use ZUGFeRD profitably and what advantages it brings to your day-to-day work.

Look forward to a clear overview: from the origin and structure of the standard and its legal foundations to practical tips and a look into the future of e-invoicing.

What is ZUGFeRD? Origin, Development and Committee

ZUGFeRD is a key building block for the digitalization of accounting. The standard makes it easier for companies to create and process electronic invoices efficiently, securely and in compliance with the law. But how did ZUGFeRD actually come about, who is behind it, and what legal framework has shaped its development?

Background and origin of the ZUGFeRD standard

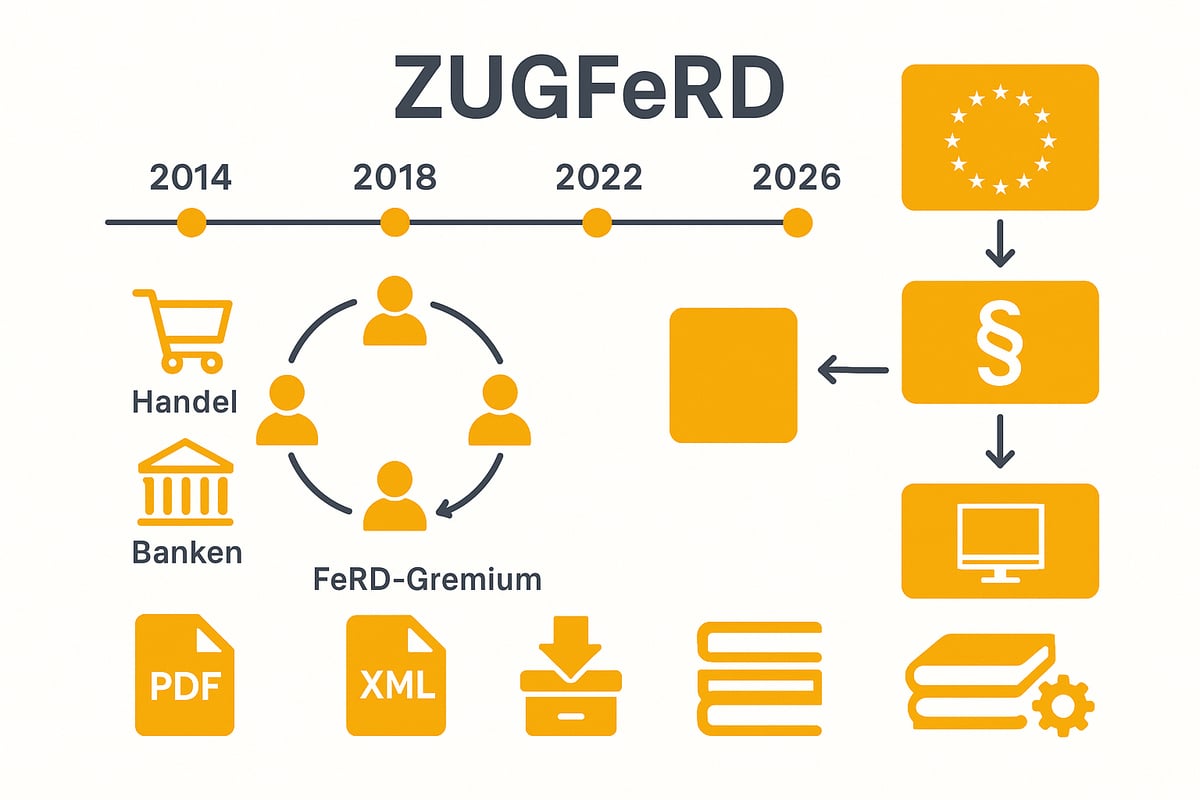

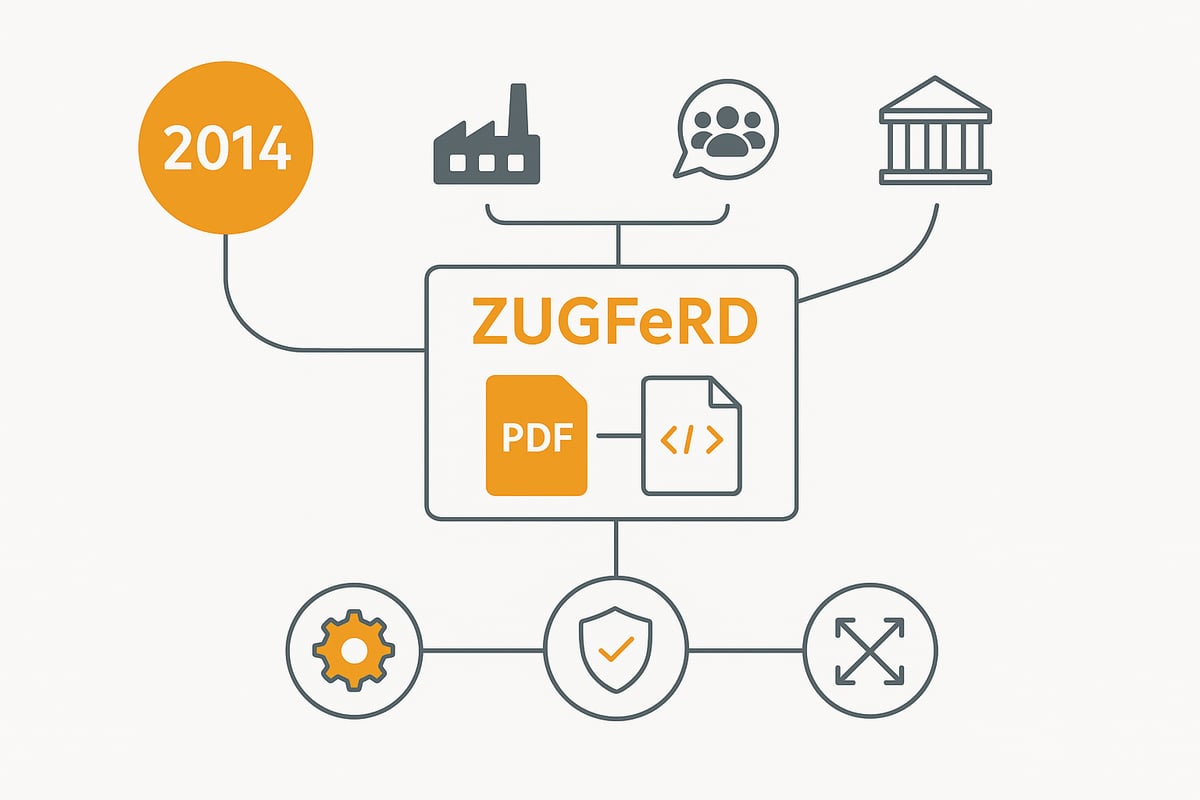

ZUGFeRD stands for “Zentraler User Guide des Forums elektronische Rechnung Deutschland” and is an open standard for the electronic exchange of invoices. The standard was developed by the Forum elektronische Rechnung Deutschland (FeRD), an alliance of companies from various industries, banks, software vendors, and representatives of the public sector.

The goal: a uniform, cross-industry format for e-invoices that can be used both in Germany and across Europe. The development was a direct response to EU Directive 2014/55/EU, which mandates electronic invoicing in public procurement.

Since its first publication in 2014, it has been continuously developed to meet new legal and technical requirements. With the introduction of the new ZUGFeRD version 2.4 from 2026, the standard remains future-proof and ensures even better interoperability. One example: in the FeRD committee, large corporations and SMEs work together on practical solutions.

Legal implications and standards

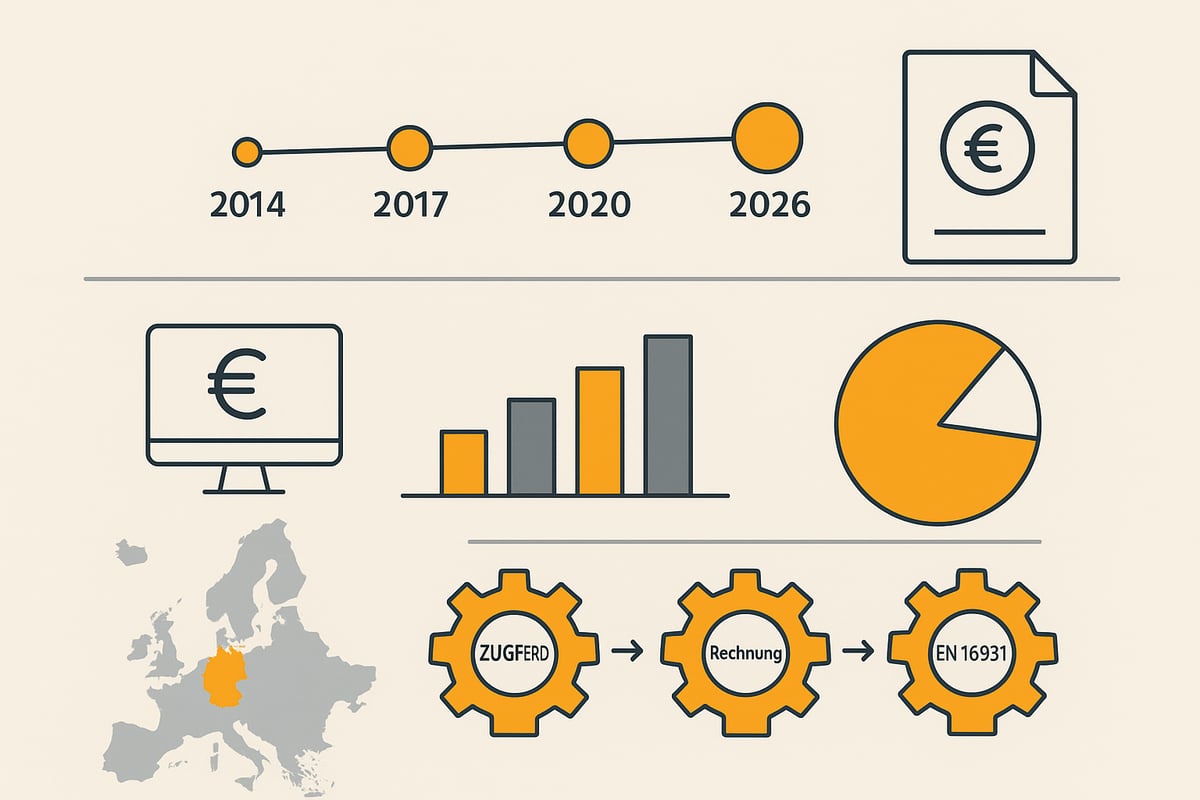

The legal requirements for electronic invoices have increased significantly in recent years. ZUGFeRD meets the requirements of EU Directive 2014/55/EU and is compatible with the European standard EN 16931. Since 2020, there has been an e-invoicing obligation for public sector clients in Germany, and since 2025 there has been an extension to the B2B sector.

The standard bridges the gap between human-readable PDF invoices and purely machine-readable XML invoices. Companies benefit from legally compliant archiving and complete traceability of all business transactions.

Role of the FeRD committee and standardization

The Forum elektronische Rechnung Deutschland (FeRD) is the central committee behind the standard. Representatives from industry, associations and public administration work together here. Their task is to develop, maintain and adapt the standard to new requirements.

FeRD works closely with international institutions such as the European Committee for Standardization (CEN) to ensure the interoperability of ZUGFeRD at the European level. The committee regularly publishes user guides and technical aids for companies and software providers. An example of successful collaboration: coordination with CEN ensures that the e-invoicing standard remains compatible with the Europe-wide PEPPOL network, enabling invoice exchange across borders without issues.

Structure and functionality of ZUGFeRD

ZUGFeRD stands for “Zentraler User Guide des Forums elektronische Rechnung Deutschland.” In recent years, the standard has established itself as a central building block for electronic invoice exchange. Companies and public authorities benefit from a uniform, legally compliant, and future-ready solution. But how did ZUGFeRD actually come about, who is behind it, and what legal foundations make the format so important?

Background and origin of the ZUGFeRD standard

Development began in 2014 in response to EU Directive 2014/55/EU. The aim was to create a uniform and cross-industry format for electronic invoices. The standard was initiated by the Forum elektronische Rechnung Deutschland (FeRD), a consortium of representatives from business, banking, the software industry, the public sector and associations.

Through close cooperation between large corporations and mid-sized companies, a format emerged that meets national and European requirements. The ongoing further development reflects the dynamic progress of digitalization. ZUGFeRD simplifies electronic invoicing for companies of all industries and sizes.

Legal implications and standards

With the introduction of the e-invoicing obligation for public sector clients in 2020 and the then planned expansion to B2B from 2025/26, the new invoicing standard has been gaining increasing importance. The standard meets the requirements of the EU directive as well as national laws. It is fully compatible with DIN EN 16931, the European standard for electronic invoices.

Distinction between ZUGFeRD and XRechnung

ZUGFeRD combines the advantages of PDF and XML, enabling legally compliant, audit-proof archiving of electronic invoices. While the embedded XML provides all structured invoice data for automated further processing in accounting, ERP and DMS systems, the PDF remains the leading visual representation for humans. This ensures traceability of all invoice data at any time.

In contrast to a pure XRechnung, which consists solely of an XML file and is not readable without technical aids, ZUGFeRD offers a decisive practical advantage:

Clerks, reviewers and auditors can open, read, check and trace the invoice directly without special viewers or specialized software. This increases transparency, reduces queries and significantly simplifies approval and audit processes.

Especially in cases of complaints, internal audits, tax audits or day-to-day business, the PDF is a clear advantage because it shows amounts, line items, taxes and sender information as people expect. At the same time, the XML ensures that exactly the same data is processed, validated and archived by machines—without media breaks or room for interpretation.

ZUGFeRD thus unites humans and machines in one document. It is readable, verifiable and legally compliant for people, while being structured, valid and automatable for systems. Particularly for companies that need efficiency, compliance and clarity in equal measure, ZUGFeRD is therefore the more practical alternative to a pure XRechnung.

Role of the FeRD committee and standardization

The FeRD committee coordinates the development, maintenance and further development of the standard. It consists of representatives from industry, associations and the public sector. Close cooperation with the European Committee for Standardization (CEN) and international partners is crucial to ensure interoperability.

FeRD regularly publishes user guides and implementation aids to support companies with adoption. An example of ongoing standardization is the coordination with CEN on compatibility with PEPPOL. Continuous development, such as with ZUGFeRD 2.4: New standard for digital invoices comes into force, strengthens Europe-wide recognition and legal certainty.

Benefits for companies and public administration

Implementation offers clear advantages:

-

Time and cost savings through automated processes

-

Reduction of errors and manual interventions

-

Legal certainty and transparency in accounting

-

Environmentally friendly alternative to paper documents

Companies benefit from a 50% time saving in accounting and a significantly more efficient handling of their invoice processes.

ZUGFeRD in practice: implementation and integration

Introducing ZUGFeRD in companies is a decisive step towards efficient and secure e-invoicing. But how does the transition work in everyday life? In this section, you’ll learn how to implement it step by step, which technical requirements to consider, and how to overcome typical stumbling blocks. Practical tips and an innovative automation solution round off the guide.

Step-by-step guide to implementation

Introducing ZUGFeRD begins with a thorough analysis of your current invoicing processes. Check which systems are already in use and what requirements exist for e-invoices.

The following steps have proven effective:

-

Record processes and IT landscape

-

Adapt or update accounting and ERP software

-

Provide targeted training for employees

-

Conduct a test phase sending and receiving ZUGFeRD invoices

-

Rollout and continuous optimization

A mid-sized trading company used this structured approach to not only reduce errors, but also significantly shorten invoice processing times. With the new invoicing standard, the invoicing process becomes transparent and traceable.

Integration into existing systems and workflows

Technical integration is easier today than ever. Many leading accounting and ERP systems, such as DATEV or Sage, already offer native support.

Legacy systems can be connected via interfaces and converters. A typical workflow looks like this: the ZUGFeRD invoice is automatically imported, processed and archived in an audit-proof manner. Document management systems (DMS) and automated approval processes complement the solution.

A table can make the comparison of integration options clearer:

|

System type |

Integration with ZUGFeRD |

|---|---|

|

Modern ERP |

Direct, mostly native |

|

Legacy system |

Via interfaces |

|

DMS |

Automated filing |

This is how ZUGFeRD integrates into any IT landscape.

Challenges and solutions

Typical challenges arise when introducing ZUGFeRD. Many companies struggle with legacy systems, missing interfaces, or data migration.

Common hurdles:

-

Technical adjustments to existing software

-

Lack of acceptance among employees

-

Legally compliant archiving and traceability

-

Industry-specific requirements (e.g., healthcare, automotive)

You can find solutions, for example, by working with specialized service providers, targeted training, and pilot projects. ERP vendors are responding to the standard and offering it in their current product versions. In some cases, an update of the existing software is sufficient to use the new invoicing standard directly for generating outgoing invoices.

Automated invoice workflows with filehub

For companies that want to integrate ZUGFeRD quickly and efficiently, filehub offers an innovative solution. The platform also automates the retrieval, processing and archiving of ZUGFeRD invoices from web portals and emails.

With no-code workflows you can connect accounting, DMS and ERP systems without programming. Security is guaranteed, as filehub is GDPR-compliant and C5-certified. SMEs benefit in particular because they can get started without major IT effort.

Find out more about automated invoice processing with filehub and how to optimally integrate the new invoicing standard into your processes.

Legal foundations and outlook to 2026

The legal requirements for e-invoices have changed massively in recent years. EU Directive 2014/55/EU paved the way for mandatory electronic invoices across Europe. In Germany, the e-invoicing obligation for public sector clients has been in force since 2020. From 2025 or at the latest 2026, a B2B obligation is expected. Companies must issue and archive invoices in a legally recognized format. The requirements relate to format, transmission and legally compliant retention. Violations can lead to fines or non-payment. A current example is the introduction of ZUGFeRD 2.3.3, which becomes legally effective from May 2025. This update brings important adjustments to European standards and makes it easier to comply with legal requirements.

Current and upcoming legal situation for e-invoicing

The legal framework is based on European and national requirements. EU Directive 2014/55/EU mandates a uniform invoice format for public sector clients. Germany has transposed these requirements into national law. Companies working with public authorities have been required to send e-invoices according to recognized standards since 2020. From 2025 or 2026, the obligation will be extended to the entire B2B sector. ZUGFeRD meets all requirements for format, data fields and archiving. Violations of the requirements can lead to significant disadvantages, such as exclusion from tenders or financial sanctions. The new version 2.3.3 brings extended code lists and validation rules to further improve compliance with the European standard EN 16931. Companies that switch early are on the safe side legally.

ZUGFeRD and European harmonization

The harmonization of electronic invoicing standards is a central goal of the EU. ZUGFeRD serves as a bridge between German and European requirements. Through the EN 16931 standard and cooperation with the European Committee for Standardization (CEN), a uniform framework is being created. ZUGFeRD is fully compatible with XRechnung and the PEPPOL network, which simplifies cross-border exchange. Particularly important is the close coordination between Germany and France, which are jointly further developing their e-invoicing standards. A current report shows how Germany and France are updating their joint e-invoicing standard to ensure compatibility with EN 16931 and the B2B obligation. EU funding programs support companies in switching to ZUGFeRD and similar standards.

Trends and developments through 2026

ZUGFeRD will continue to evolve through 2026. New profiles and industry-specific extensions are planned. Artificial intelligence and automation will become increasingly important in invoice processing. More and more companies are relying on cloud solutions and paperless processes, which are not only efficient but also sustainable. The forecast: by 2026, around 90 percent of all invoices in Germany will be sent as e-invoices. AI-supported checks and automated approvals provide additional security. The continuous further development of the standard ensures that companies will also meet future regulatory requirements.

Industry- and company-specific adaptations

ZUGFeRD offers flexible profiles tailored to different industries. The Extended profile in particular enables individual fields, for example for healthcare or logistics. This allows companies to automatically integrate customs or delivery data into their invoices. Small, medium-sized and large companies alike benefit from the standard’s adaptability and secure competitive advantages.

Best practices and tips for the efficient use of ZUGFeRD

If you want to use the new invoicing standard optimally in practice, you should focus on proven success factors. Clear planning, the right software, and involving all stakeholders are crucial. Implementation errors can be avoided if typical pitfalls are known. With the right tools and a bit of know-how, the switch to e-invoices will be seamless.

Success factors for implementation

A successful introduction begins with structured project planning. First analyze the existing invoicing processes and define clear goals. Involve all stakeholders at an early stage, especially IT and accounting.

-

Choose the right software solution that fully supports ZUGFeRD.

-

Use pilot projects to minimize risks.

-

Communicate transparently with business partners about the new procedures.

A mid-sized company that takes these points into account can make the switch efficiently and without stress. For additional support, solutions for finance processes offer a comprehensive overview of digital tools and best practices.

Sources of error and how to avoid them

Many companies underestimate typical sources of error with ZUGFeRD. Incomplete data fields in the XML part often lead to returns. Choosing the wrong profile, such as Basic instead of Extended, can also cause problems.

-

Ensure complete and correct invoice data.

-

Train all employees in handling ZUGFeRD.

-

Ensure legally compliant archiving of all documents.

Keep the software up to date and regularly inform yourself about developments in the standard. This way you avoid unnecessary delays and remain compliant at all times.

Tools, resources and support

There is a wide range of software solutions for the new invoicing standard, from leading providers such as Sage and DATEV to specialized tools. Open-source converters also make the transition easier. The invoicing process becomes particularly efficient with automated workflows. Here, accounting automation with ZUGFeRD provides insights into how to seamlessly connect accounting and e-invoicing.

Also use the user guides and checklists from the FeRD committee. Webinars and training help you keep track and prepare employees for a digital future.

Practical examples and success stories

Numerous companies report impressive successes after implementation. In retail and industry, time and cost savings of up to 50 percent have been achieved. SMEs in particular benefit from faster processing and fewer errors.

Experience shows that the new invoicing standard not only provides legal certainty, but also simplifies collaboration with business partners. Whether a large enterprise or a mid-sized company, the digital e-invoice is gaining ground and becoming the new standard.

You’ve now seen how ZUGFeRD makes your invoicing processes more efficient, legally secure and future-proof—whether in mid-sized companies or large enterprises. The next step is to put what you’ve learned into practice and truly experience the benefits: less manual work, more transparency, automated workflows and full GDPR compliance. With filehub, you can implement exactly that with ease: connect your systems, automate invoice workflows and save valuable time. Try it yourself—try filehub.one for free now and step into the digital e-invoicing world of tomorrow!