Amazon My Account Invoice: The Guide for 2025

You shopped on Amazon and are urgently looking for an invoice? You’re not alone—many users face exactly this challenge.

Invoices are essential, not only for keeping track of your expenses but also for tax purposes. In this guide, you’ll learn how to quickly find, download, and make the most of your Amazon My Account invoice.

Read on to discover all the important tips, legal notes, and the latest updates about Amazon invoices. This article walks you through the key areas of your account, shows you the best tricks, and explains what’s changing in 2025.

Amazon My Account: Navigation and overview

Want to quickly find and manage your Amazon My Account invoice? Your Amazon account offers a clear structure that lets you keep all invoices in one place. Whether private or business, the right navigation makes everyday life easier and ensures no important documents get lost.

The most important areas in your Amazon account

The heart of every Amazon My Account invoice is your account dashboard. Here you’ll find the key menu items: The “Orders” section is the central entry point for finding invoices. Business customers also have dedicated menus tailored to company requirements.

Private and business accounts differ mainly in how invoices are provided and how tax details, such as the VAT ID (USt-IdNr.), are stored. Under “Account settings,” you can set how and where invoices are delivered. Navigation varies slightly between desktop and app, but the core functions remain the same.

If you want more details on the different ways to find invoices in your Amazon account, check out the article Find and manage Amazon invoices.

Find and filter orders

Efficient filters help you search specifically for your Amazon My Account invoice. You can filter orders by date, status, or product. The search function is especially useful if you need a particular invoice from last year or you have many orders.

Sorting options keep things clear so you can quickly find the right order. For example, with a few clicks you can filter all orders from 2023 and find older invoices in no time. According to Amazon Help 2023, over 70% of users use the filter options to find invoices efficiently.

Important settings for invoice access

To ensure you always have access to your Amazon My Account invoice, you should check a few settings. Regularly verify your default shipping address and preferred payment method, as this information appears directly on the invoice.

For business customers, entering the VAT ID (USt-IdNr.) is essential to receive complete invoices. Enable notifications for invoice delivery so you don’t miss new documents. Helpful tip: Many users automatically save their invoices in the cloud. For added security, Amazon recommends two-factor authentication.

What’s new in Amazon accounts in 2025

In 2025, you can expect exciting updates around the Amazon My Account invoice. Amazon is introducing new menu structures and improved filter options that make searching for invoices even easier.

Business customers benefit from the integration of digital tax documents, speeding up bookkeeping. The new dashboard layout enables even faster access to key functions. Stay informed—Amazon regularly shares updates and helpful changes directly in your account.

Find, download, and print Amazon invoices

Want to quickly find, download, and print your Amazon My Account invoice? No problem! With the right steps, you’ll get the invoice you need in just minutes. Whether on desktop or in the app, the process is similar and easy to understand.

Step-by-step guide: Retrieve an invoice

To retrieve your Amazon My Account invoice, follow this guide:

- Log in: Sign in to your Amazon account.

- Navigate to “Your Orders”: Click “Orders” in the main menu.

- Select the order: Use filters or the search function to find the order you want.

- Open the invoice: Click “Invoice” or “View invoice details” for the order.

- Download: Download the invoice as a PDF or print it directly.

These steps work on both desktop and the Amazon app. In the browser, you’ll usually find the functions in the top right, while in the app they’re in the “Orders” menu.

Common issues when retrieving your Amazon My Account invoice include using the wrong account, guest checkouts, or technical problems like an outdated browser cache. Always check that you’re signed in to the correct account and that the order has been completed. If problems persist, try a different browser or clear your cache.

Differences between private and business customers

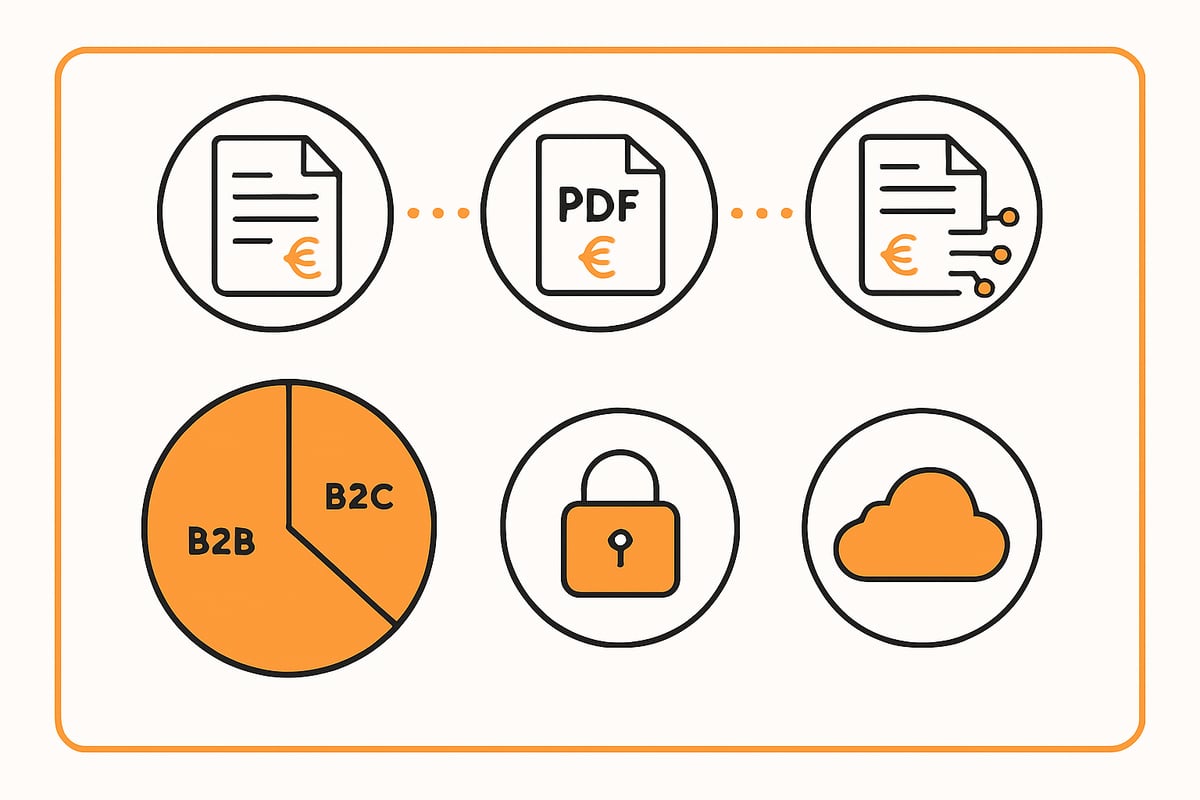

The type of Amazon My Account invoice varies by account type. Business customers automatically receive invoices with VAT shown and all required information. Private customers typically receive an invoice without a separate VAT breakdown.

Here’s a comparison:

| Feature | Private customer | Business customer |

|---|---|---|

| VAT shown | No | Yes |

| Automatic invoice delivery | No | Yes |

| Access to Amazon Business | No | Yes |

For companies, an Amazon Business account is recommended to receive all tax-relevant documents correctly. Around 30% of Amazon users already use business features for their invoice management.

Invoices for digital products and services

For digital products like eBooks, Prime subscriptions, or Audible, there are special considerations when retrieving your Amazon My Account invoice. You’ll often find these invoices not in the classic orders area but under separate menus like “Digital orders.”

Example: For a Kindle eBook, select “Digital content and devices” in the menu, then “Orders.” There, you can download the invoice you need.

Note that country-specific tax rules apply to digital goods. Especially for services like Prime or Audible, VAT may be shown differently.

Problems retrieving invoices and solutions

Sometimes an Amazon My Account invoice doesn’t appear as expected. The reasons vary:

- Guest checkout: Invoices aren’t always created automatically.

- Wrong account: Make sure you’re signed in to the correct Amazon account.

- Order canceled: Canceled orders usually don’t have invoices.

- Technical issues: An outdated browser, app errors, or cache problems can prevent display.

Solutions:

- Restart the browser or clear the cache.

- Check orders in both the app and on desktop.

- Contact Amazon Support if the Amazon My Account invoice still isn’t available.

- Regularly back up your invoice archives to avoid losses.

Users report in forums that support requests for missing invoices are usually handled quickly. Regular backups and using the notification feature help you stay on top of things.

Automation and external tools for invoice management

Especially if you place many orders, automating the processes around your Amazon My Account invoice pays off. For example, you can automatically forward invoices by email, store them in the cloud, or connect them to accounting software like DATEV or Lexware.

Companies can use specialized tools that archive Amazon invoices in a GDPR-compliant way and integrate them directly into bookkeeping. Practical tips for digital management and archiving can be found in the article Digital document management tips.

When choosing external solutions, pay attention to data protection, encryption, and regular backups. That way, your Amazon My Account invoice remains secure and accessible at all times.

Legal aspects and tax requirements in 2025

For private individuals and companies, invoices are more than just receipts—they serve important legal and tax functions. If you manage your Amazon My Account invoice correctly, you’ll be on the safe side and benefit from tax advantages. In 2025, new legal regulations will come into force that will further change the handling of digital invoices.

Legal requirements for online invoices

Every Amazon My Account invoice must include specific mandatory information under Section 14 UStG. This includes the name and address of buyer and seller, tax number or VAT ID, invoice date, consecutive invoice number, description of services, net amount, tax rate, and tax amount.

Digital invoices must also be stored in an unalterable and tamper-proof manner. The retention period is 10 years. A sample invoice helps verify the required details and avoid errors.

VAT and input tax deduction for Amazon invoices

For input tax deduction, a correct Amazon My Account invoice with VAT shown is necessary. Only then can a company claim the VAT paid from the tax office.

It’s important to check whether the invoice was issued directly by Amazon or by a marketplace seller. Only invoices with all mandatory details entitle you to deduct input tax. If information is missing, no deduction is possible—so always check carefully.

Specifics for business customers and freelancers

Business customers benefit from special functions with the Amazon My Account invoice, such as automatic invoices with VAT shown and integration into accounting systems. Amazon Business offers interfaces to ERP and accounting software, significantly simplifying the workflow.

For intra-community supplies, additional requirements apply, such as verifying the VAT ID and the reverse-charge procedure. Freelancers should keep these specifics in mind to avoid tax errors.

Changes in tax law and impact on Amazon invoices in 2025

Starting in 2025, electronic invoicing will be mandatory for B2B transactions in Germany. Companies must then issue and receive invoices in a structured electronic format. There will also be changes for private customers, such as digital access to receipts and archiving.

More details on the legal changes can be found in this guide to the Mandatory e-invoices from 2025. If you manage your Amazon My Account invoice digitally early on, you’ll stay compliant and save effort.

Data protection and security in invoice management

The GDPR requires that every Amazon My Account invoice be stored securely and protected from unauthorized access. Digital invoices should be encrypted and backed up regularly to prevent data loss.

Two-factor authentication in your Amazon account and strong passwords further increase security. If you archive digital receipts, choose cloud solutions that meet data protection standards and offer access controls.

Common problems and solutions for Amazon invoices

Problems with the Amazon My Account invoice are not uncommon. Many users face hurdles when retrieving, archiving, or choosing a format. This section offers practical solutions to the most common challenges.

Invoice missing or incorrect

It happens that an Amazon My Account invoice doesn’t appear at all or contains incorrect information. Common causes include orders from marketplace sellers, guest checkouts, or technical issues within the account.

In such cases, it’s worth checking:

- Was the order placed using the correct account?

- Is it a third-party seller?

- Are all order and payment details stored correctly?

If the invoice is incorrect, contact the seller or Amazon Support directly. Often a correction by the seller or a resend can be initiated. For complaints, it’s a good idea to have screenshots and the order number ready to speed up the process.

Invoices for marketplace orders

Especially with marketplace purchases, the Amazon My Account invoice isn’t always available as usual. Third-party sellers are required to provide invoices, but sometimes this doesn’t happen automatically through the Amazon system.

Here’s how to find the invoice:

- Go to “Your Orders”

- Find the order in question

- Contact the seller using the “Contact seller” button

If there are problems, a brief note to the seller that you need a proper invoice usually helps. If there’s no response, you can use Amazon’s A-to-z Guarantee. The difference compared to Amazon’s own orders often lies in the invoice format and VAT display.

Problems with archiving and retention

Long-term storage of the Amazon My Account invoice is important for both private individuals and companies. Data loss can occur due to device changes, defective hard drives, or accidental deletions.

For digital archiving, we recommend:

- Using cloud services or external storage media

- Regular backups and reminders to download new invoices

- Automated archiving solutions

Always observe data protection and legal requirements. Privacy-compliant storage of invoices is essential under the GDPR, especially for sensitive tax documents.

Different invoice formats and what they mean

Amazon offers various formats for the Amazon My Account invoice, such as PDF, HTML, or email attachment. Each format has specific pros and cons:

| Format | Advantages | Disadvantages | Compatibility |

|---|---|---|---|

| Universal, unalterable | Large, sometimes not editable | Ideal for DATEV & tax tools | |

| HTML | Quickly viewable in the browser | Formatting varies | Limited for accounting |

| Directly in your inbox | Risk of landing in spam | Suitable for private filing |

For accounting, the PDF format is usually the best choice, as it’s supported by many tax programs. Importing into DATEV or similar software is straightforward.

Support and help with complex problems

Sometimes checking your own account isn’t enough to find an Amazon My Account invoice or resolve special cases. In those situations, Amazon Support is your first point of contact.

You can get help via:

- Phone hotline

- Live chat in the customer area

- Email support

- Community forums with user experiences

For international orders, refunds, or specific tax cases, support can usually help quickly. For particularly tricky issues, it’s also worth checking the help pages and engaging with other users in forums.

Manage and automate Amazon invoices efficiently

Efficiently managing your Amazon My Account invoice is more important than ever in 2025. Whether you’re a private user or a business owner, digital tools and automation save time, prevent errors, and reliably secure your documents. Modern solutions give you full control over all invoices and receipts.

Best practices for private users

With just a few steps, you can bring order to your Amazon My Account invoice. Regularly download your invoices and save them in a dedicated folder. Use cloud services like Google Drive or Dropbox so you don’t lose any documents.

- Create a separate invoice folder for each year.

- Make monthly backups to an external hard drive.

- Use the Amazon app for quick access to your receipts.

A well-maintained overview helps you manage warranties and keep better track of expenses. You’ll also be ready to answer tax-related questions quickly.

Efficient processes for companies and freelancers

For companies, integrating the Amazon My Account invoice into bookkeeping is crucial. Automated workflows capture new invoices right after purchase and store them in a GDPR-compliant way.

- Automatic import of invoices into DATEV or Lexware

- Monthly summary reports for your tax advisor

- Reminder functions for missing documents

A structured process minimizes sources of error. This makes month-end closing efficient and eliminates manual sorting. Automation pays off especially for high-volume buyers.

Tools and software for automating invoice management

The market offers numerous tools that automatically download, archive, and integrate your Amazon My Account invoice into accounting solutions. Important selection criteria include compatibility, security, and user-friendliness.

| Software | Automatic download | Cloud integration | Accounting interface |

|---|---|---|---|

| DATEV | Yes | Yes | Yes |

| Lexware | Yes | Yes | Yes |

| filehub | Yes | Yes | Yes |

Automation saves you time, reduces errors, and ensures complete retention of all documents.

Integration and automation with filehub

With filehub, you can fully automate your Amazon My Account invoice. The platform retrieves invoices directly from Amazon and forwards them to your accounting software or cloud—no coding required.

filehub guarantees GDPR-compliant, secure storage of your documents. For companies and freelancers, it offers an end-to-end workflow that saves time and ensures compliance. Check out the options for automating your bookkeeping to learn more about the integration.

Security and data protection in automation

Data protection is paramount when managing your Amazon My Account invoice. With automated processes, ensure encrypted storage and clear access controls.

- Enable multi-factor authentication for all tools.

- Create regular backups in separate systems.

- Regularly review who has access to your documents.

This ensures your invoices don’t fall into the wrong hands and all legal requirements are met.

Future trends: Digital receipt management in 2025 and beyond

The future of the Amazon My Account invoice is digital and automated. E-invoices are becoming standard in B2B and increasingly in B2C.

Artificial intelligence takes over receipt recognition and assignment, while interfaces to national tax platforms enable direct data exchange. Fully automated tax returns based on digital invoices will become reality soon.

Amazon invoices: Tips, tricks, and frequently asked questions

To get the most out of your Amazon My Account invoice, you should know a few practical tips. Use quick access via the Amazon app or browser to have invoices at your fingertips at any time. Set calendar reminders so you don’t forget important documents. Enable notifications for new invoices directly in your account. The one-click download feature is especially helpful, letting you save multiple invoices at once. Organize your documents in clear folders, for example by year or product category. This way, you’ll keep everything in view and quickly find any invoice again.

FAQ: The most frequently asked questions about Amazon My Account invoice

Many users have basic questions about the Amazon My Account invoice. Where do you find your invoice? In the “Your Orders” section, you can usually access it directly. How long are invoices available? Usually for several years, but regular downloading is advisable. What to do if data is incorrect? Contact Amazon Support or the respective seller. Changes after purchase are often not possible, but corrections can be requested. Returns? An invoice is usually provided even for refunded orders. From 2025, you should also learn about Electronic invoices: Mandatory from 2025, as legal requirements are changing.

Expert tips for advanced users

Advanced users can manage their Amazon My Account invoice even more efficiently. Use API interfaces to retrieve invoices automatically. Sync your documents with accounting or tax software so you never lose track. For high-volume buyers, an automated workflow is recommended: invoices go directly to your cloud or accounting program. This saves time and minimizes sources of error. With these tools, you’ll keep control even with large volumes of documents and be optimally prepared for audits.

You now know all the key steps to quickly find your Amazon invoices for 2025, store them securely, and use them efficiently for taxes or accounting. Especially if you manage many orders or want to prepare for legal and tax requirements, an automated workflow is worth it. That’s exactly where filehub supports you: You can automatically retrieve your Amazon invoices, integrate them into existing workflows, and store all documents securely and GDPR-compliantly—without any programming skills. Try it yourself and take your invoice management to the next level: try filehub.one free now