Cost Center Accounting – Efficient Cost Controlling

If you don’t have costs under control, you lose competitiveness. Cost center accounting provides the tool to make costs transparent and manage them in a targeted way. In this overview, you’ll learn in a practical way how modern cost center accounting works—from the basics to digitalization. Look forward to clear structures, numerous examples, and concrete tips so you can future-proof your cost structure and sustainably increase efficiency in your company.

What is cost center accounting? Basics & importance

Companies in 2026 face the challenge of managing costs transparently and efficiently more than ever before. Cost center accounting is the central tool for systematically recording costs and keeping an overview.

Definition and objectives

Cost center accounting refers to dividing the company into individual internal accounting units, known as cost centers. The goal is to allocate costs as closely as possible to their originators and thus create transparency. In contrast to cost type accounting, which classifies costs by type, and cost object accounting, which assigns costs to products or services, cost center calculation focuses on the internal structure.

Whether a large corporation or an SME, every organization benefits from clearly defined cost centers. For example, production and administrative areas are considered separately to maintain an overview. A comprehensive overview of fundamentals and practical applications is provided by this Foundations of cost center accounting guide.

Tasks and functions in the company

The differentiation of costs makes overhead transparent and enables the targeted measurement of the profitability of individual business areas. It forms the basis for costing and controlling and is therefore an indispensable management tool. The most important tasks include:

-

Recording and allocation of overhead

-

Analysis of the cost structure of individual areas

-

Identification of potential savings

-

Support for corporate planning

With structured cost accounting, companies can react specifically to changes and optimally manage their resources.

Benefits of cost center accounting

Differentiating costs offers numerous advantages. It ensures better cost control and creates transparency about how costs arise. Management receives a sound basis for decisions and can specifically optimize processes and the use of resources.

Further advantages include:

-

Traceability of cost drivers

-

Optimized pricing

-

Rapid identification of inefficient areas

-

Support in budget planning

This makes cost center accounting the key to sustainable business success.

Structure of cost center accounting: Structure & categories

A structured cost center calculation is the foundation for efficient cost management. Companies benefit from clearly defined categories because they create transparency and enable cost control. The classification and allocation of costs are crucial for identifying optimization potential and taking targeted action.

Classification of cost centers

Cost center accounting distinguishes between main, auxiliary, and secondary cost centers. Main cost centers are directly involved in creating value, such as production or sales. Auxiliary cost centers like IT or maintenance support the main areas. Secondary cost centers, such as waste disposal, capture supplementary processes.

The size of the company influences the level of detail. Small businesses often use rough structures, while large companies need more differentiated cost centers. A guide to cost centers offers practical examples and in-depth knowledge on this classification.

Allocation keys & cost types

Within cost allocation, the distribution of overhead is a central step. Typical allocation keys include area, labor hours, or machine runtime. This assigns costs to the respective cost centers based on causation.

Direct costs can be assigned directly to a cost center, while overhead (indirect) costs are distributed using keys. A classic example: Rent is allocated to production, administration, and sales according to the floor space used. This keeps the differentiation of costs traceable and fair.

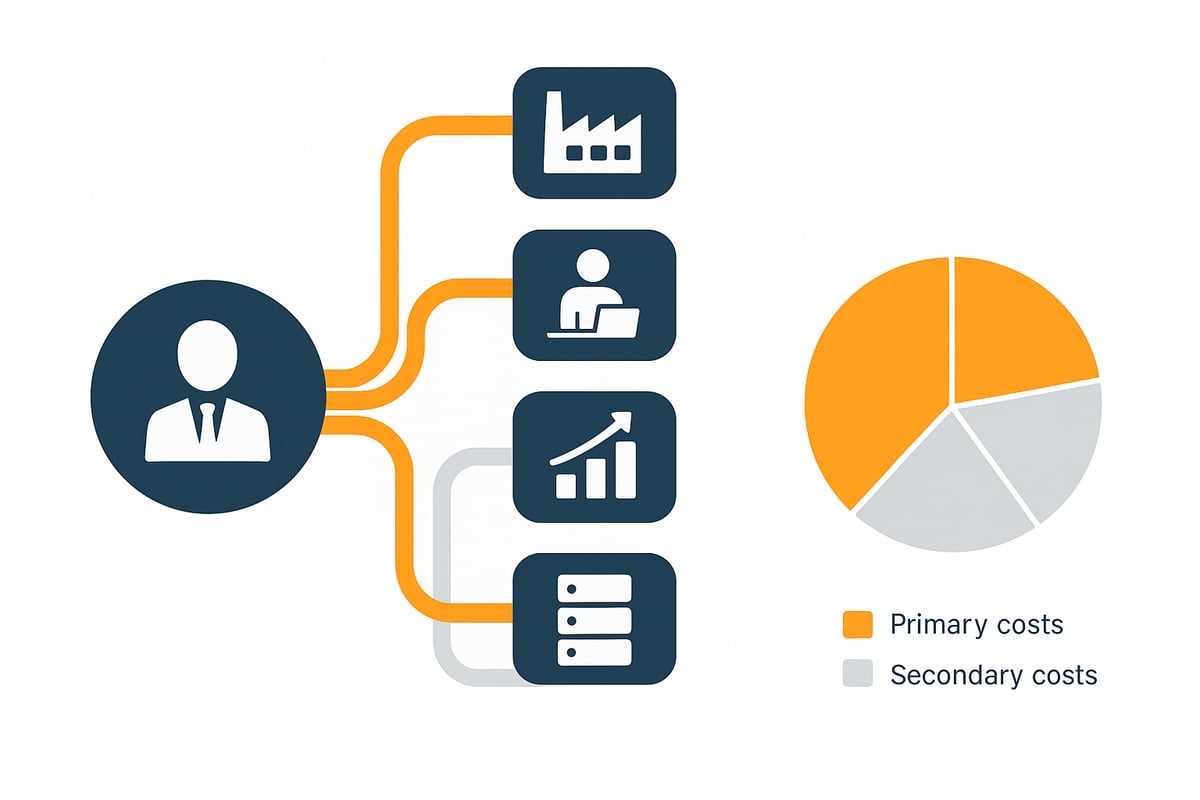

Primary and secondary cost accounting

The differentiation distinguishes between primary and secondary costs. Primary costs come from external sources such as electricity or rent. Secondary costs arise from internal cost allocation, for example when the IT department charges its services to production.

For cost center accounting, allocation methods such as the direct method or step-ladder method are important. They provide a realistic representation of service interdependencies and increase the accuracy of cost analysis. Accurate allocation supports precise management decisions.

Betriebsabrechnungsbogen (BAB) as a central tool

The Betriebsabrechnungsbogen (BAB) is the heart of cost center accounting. It structures the distribution of overhead step by step across the respective cost centers.

In the BAB, all cost types are systematically recorded and distributed according to defined keys. A typical BAB excerpt shows how, for example, electricity or rent costs are allocated from auxiliary cost centers to main cost centers. This creates a transparent and meaningful cost overview.

The process of cost center accounting: Step-by-step guide

A structured differentiation is the key to making costs transparent and controllable. Below you’ll find a practical step-by-step guide to establish this instrument efficiently in your company and use it optimally.

Step 1: Define and set up cost centers

It starts with a precise delineation of the cost centers. Consider which areas or departments in your company incur costs that are clearly separate from each other. In a manufacturing company, these could be production, administration, and sales, for example. For service providers, a finer breakdown is often useful. Cost center accounting benefits from sensible granularity—too many or too few cost centers make it hard to maintain an overview. Create a cost center plan that reflects your company’s key processes.

Step 2: Recording and assignment of costs

In the second step, all relevant cost types are collected and assigned to the previously defined cost centers. This concerns both direct costs, which can be assigned directly to a cost center, and overhead, which is distributed later. Differentiation requires clean documentation here. Use structured cost center plans to avoid errors and create a solid data basis for subsequent analysis.

Step 3: Cost distribution using allocation keys

Now the overhead is distributed to the respective cost centers. Typical allocation keys include square meters, machine hours, or number of employees. These keys allocate costs based on causation. Errors often arise when keys are not reviewed regularly. Modern software workflows for cost control simplify this step significantly and ensure transparent cost center accounting. Consider which keys best fit your processes.

Step 4: Internal service cost allocation (secondary costs)

In the fourth step, auxiliary cost centers such as IT or maintenance are allocated to main cost centers. There are various methods—for example the direct method (Anbauverfahren), step-ladder method (Stufenleiterverfahren), or reciprocal method (Gleichungsverfahren). This increases the accuracy of cost center calculation because all internal services are correctly taken into account. An example: IT costs are allocated proportionally to production and administration depending on how intensively these areas use IT.

Step 5: Control, analysis, and reporting

Finally, the collected data is checked and analyzed. Target–actual comparisons help identify deviations and take targeted countermeasures. Informative reports support corporate management and provide a solid basis for planning. The results enable you to optimize processes and continuously improve the profitability of individual areas.

Cost center accounting in practice: Tips, examples & best practices

Cost center accounting only unfolds its full impact in practice. It doesn’t just provide numbers—it gives you real transparency in your company. How is the assignment to cost centers applied in concrete terms? What pitfalls should you be aware of, and how can you use it optimally for management? Here you’ll find tips, best practices, and a practical example to make cost center analysis a real success factor.

Practical example: Cost center accounting in a manufacturing company

In a medium-sized manufacturing company, production, administration, and sales are managed as main cost centers. A cost center accounting system assigns all overhead, such as energy costs or rent, to these areas based on causation.

With the Betriebsabrechnungsbogen, overhead is first allocated to auxiliary cost centers such as IT and then to the main cost centers. This precise allocation enables the company to see where high costs arise and where there is optimization potential. Cost center accounting thus specifically supports the analysis of profitability indicators and the management of individual departments.

Sources of error and challenges

A common source of error is a structure that is too broad or too granular. If cost centers are too broad, cost drivers remain hidden. Structures that are too detailed, on the other hand, lead to high administrative effort.

Outdated allocation keys, for example when allocating rent, also distort results. An insufficient data basis makes it difficult to use cost center accounting as a sound basis for decisions. Therefore, regularly check whether your allocations and keys still match current operations.

Best practices for efficient cost control

For effective cost center accounting, it is advisable to regularly review and adjust the cost center structure. Modern software solutions enable automation of data collection and analysis, minimizing errors and saving resources.

Train your employees in how to use it and leverage tools specifically designed for process optimization. It’s worth taking a look at automation in accounting to increase efficiency across the entire finance function. This way, you can fully leverage cost center accounting as a strategic management instrument.

Relevant metrics & KPIs

Assignment to cost centers provides you with key metrics for measuring the profitability of individual areas. The most important KPIs include:

|

Metric |

Meaning |

|---|---|

|

Contribution margin |

Contribution after deducting costs per center |

|

Overhead rate |

Share of overhead per cost center |

|

Departmental efficiency |

Efficiency of individual departments |

These KPIs help you quickly see where action is needed and how well cost center controlling is working.

Digitalization & automation in cost center accounting

Ongoing digitalization is fundamentally changing cost center accounting. Companies benefit from modern technology that automates processes, minimizes errors, and creates transparency. Digital tools make managing cost centers more efficient and offer new ways to capture data in real time.

Modern software solutions and automation

Digital solutions are revolutionizing cost center accounting. They enable automated data collection and processing, saving time and resources. Integration with accounting and ERP systems ensures a seamless flow of information. Companies thus always have up-to-date figures and can react faster.

Typical advantages of modern software:

-

Efficiency gains through automation

-

Reduction of error sources

-

Better transparency and traceability

Software such as financial solutions for companies helps users design cost center accounting digitally and efficiently. This lays the foundation for future-proof cost control.

Data security & compliance (e.g., GDPR)

With digitalization, the requirements for data protection and compliance increase. Sensitive company data must be protected against unauthorized access. Cloud solutions and finance software must meet high security standards and comply with GDPR requirements.

Key aspects of data security:

-

Encrypted data transmission

-

Clearly defined access rights

-

Regular updates and audits

Practical examples and concrete implementation tips are provided by GDPR-compliant data processing. Those who adhere to these standards not only secure cost center calculation but also the trust of stakeholders.

Future trends: AI & analytics in cost control

Artificial intelligence and analytics open up new possibilities for cost center accounting. AI systems analyze large volumes of data and identify patterns that remain hidden to humans. Predictive analytics helps recognize cost developments at an early stage and create well-founded forecasts.

Innovative applications at a glance:

-

Automated action recommendations from data analyses

-

Early warning systems for cost drivers

-

Optimized planning based on intelligent algorithms

This turns cost center accounting into a strategic management instrument and gives companies a clear competitive advantage.

Cost center accounting as the key to efficient cost control

Cost center accounting is far more than a mere control instrument. It forms the strategic foundation for managing costs in a targeted way, creating transparency, and securing sustainable competitiveness. Anyone who wants to understand processes, resources, and cost structures cannot avoid modern cost center evaluation.

Strategic importance for management

With cost center accounting, management receives a precise tool to make cost structures transparent and influence them in a targeted manner. It provides the basis for sustainable profit increases and supports investment decisions through precise analyses of individual business areas.

Efficient cost center calculation strengthens competitiveness by helping to build lean cost structures and identify potential savings. It is indispensable, especially for budgeting and forecasting, to make well-founded decisions and recognize risks at an early stage.

Identify and leverage optimization potential

A cost center accounting system makes it possible to systematically identify cost drivers and savings potential. Regular analyses allow you to optimize processes in a targeted manner and deploy resources efficiently. Controlling benefits from early warning systems that enable immediate responses to deviations.

Best practices include continuously reviewing the cost center structure, using automation solutions, and training employees. This turns cost center accounting into a driver of process improvements and sustainable profitability across all areas of the company.

|

Potential |

Measure |

Benefit |

|---|---|---|

|

Find cost drivers |

Analyze overhead |

Lower expenses |

|

Optimize processes |

Introduce automation |

Time and cost savings |

|

Increase transparency |

Digitalize reporting |

Better basis for decisions |

Outlook 2026: Requirements and success factors

Cost center evaluation faces new challenges. Digitalization and market changes require flexible, adaptive systems that enable rapid adjustments. Modern software solutions and automated analyses are becoming increasingly important to meet rising demands.

Those who adopt digital tools early ensure sustainable growth and resilience. In particular, the digitalization of cost accounting opens up new efficiency potential and ensures future-proof cost center accounting that reliably maps even complex corporate structures.

Do you finally want to make your cost center accounting efficient, transparent, and future-proof? In this article, you’ve seen how important modern tools and automated workflows for cost control in 2026 are—from clear structures and digitalization to GDPR-compliant processes. With filehub, you can master exactly these challenges and intelligently automate your document processes without coding. This leaves more time for strategic decisions and ensures you always have an overview of your costs. Try it yourself and get started now with filehub.one free trial now.