Domainfactory

The insurance world faces major changes in 2025. New risks, opportunities, and digital possibilities challenge us while at the same time opening up new paths.

Are you wondering how to keep an overview in this environment? Itzehoer Versicherungen accompanies private individuals, companies, and farmers with tailored solutions. This keeps you flexible, secure, and well advised, no matter how your life changes.

This guide shows you how to get financial security and first-class service with the right products and services. Step by step, you’ll learn how to make the most of the offerings from Itzehoer Versicherungen.

Want to know what makes Itzehoer special? Look forward to insights into history, product variety, digital services, modern advisory, current trends, and practical tips on taking out insurance.

Itzehoer Versicherungen at a glance

Since its founding, Itzehoer Versicherungen has developed into one of the most important mutual insurance associations in Germany. Its path from a regional provider to a modern all-finance service provider reflects the industry’s dynamism. Today, more than one million customers benefit from a broad range of products and services that combine tradition and innovation.

History and development

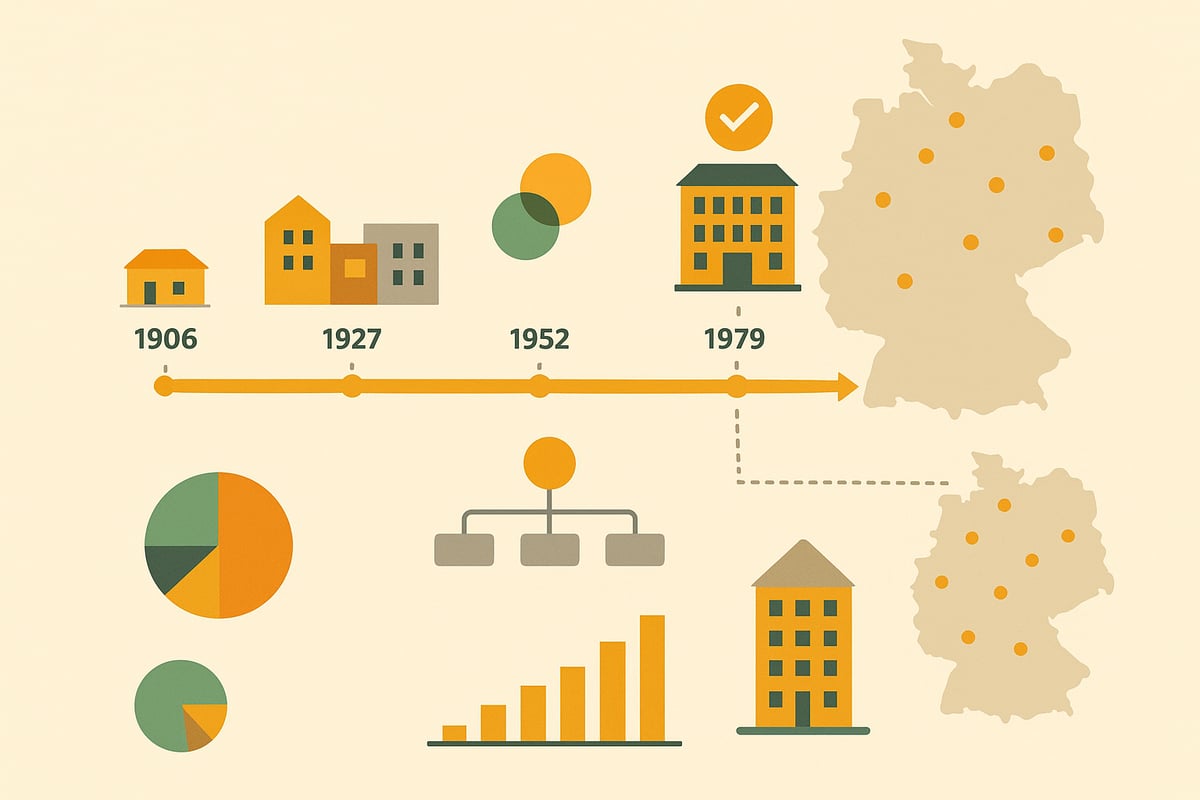

The history of Itzehoer Versicherungen begins in 1906 as a liability association for farmers. Even then, the principle of mutuality was at the center. With the merger with the Brandgilde of 1691 in 1996, the course was set for a new era. From a specialist for agriculture, a versatile all-finance provider emerged.

Over the decades, the insurer expanded its portfolio: motor and property insurance were added, the life insurance company was founded, and entry into legal protection and health insurance marked the step toward a full-range provider. Significant milestones include the acquisition of AdmiralDirekt.de in 2011 and the legal protection division of ALTE LEIPZIGER in 2018. These steps brought over 360,000 new contracts and strengthened the position in the German market.

Continuous growth is also reflected in the figures: over one million customers, 845 employees (as of 2021), and total assets of just under 2 billion euros. As a mutual insurance association, members benefit twice – they are both policyholders and owners. Those who want to dive deeper into the development will find many more details in the company history of Itzehoer Versicherungen.

Corporate structure and group

The insurer is headquartered in Itzehoe, but is present throughout Germany. The network of appointed representatives, brokers, online sales, and cooperation partners ensures that customers receive personal advice everywhere. The company’s structure is designed for flexibility and customer proximity.

The group includes several subsidiaries: life insurance, legal protection, sales and service, IT, broker office, and future energies. This diversity makes it possible to respond specifically to different customer needs. Administration relies on modern infrastructure – new office buildings, a conference center, and a comprehensive digitalization offensive characterize the location.

Decisions are made by the executive board, supervisory board, and advisory board. The interests of the members are always the focus. Through this structure, Itzehoer Versicherungen creates a solid basis for sustainable growth and offers tailored solutions for both private and business customers. The combination of tradition and innovation makes the difference.

Product world of Itzehoer: insurance for every life situation

The product world of Itzehoer Versicherungen stands for variety and adaptability. Whether you are a private individual, entrepreneur, or farmer, you’ll find insurance solutions that fit your life. From mobility to property to health and travel. The insurer offers a suitable product for every life situation.

Motor and mobility insurance

Mobility is a central part of life for many. The insurer offers comprehensive solutions for all types of vehicles. These include:

-

Motor liability insurance for basic protection for all drivers

-

Partial and comprehensive coverage for extended protection

-

Passenger accident insurance for all occupants

-

Roadside assistance services such as breakdown assistance and mobility guarantee

-

Special tariffs for electric and hybrid vehicles

-

Insurance solutions for e-scooters, mopeds, motorcycles, and camping vehicles

Companies also benefit from offers for small fleets or machinery. The TOP DRIVE tariff is aimed specifically at frequent drivers and e-mobility customers. With flexible tariff options, you can tailor your insurance protection precisely to your needs. Itzehoer Versicherungen constantly develops its mobility products and responds to new trends. Especially in e-mobility and sustainable drives, the company relies on innovative solutions. That way you’re always safe on the road.

Liability and legal protection insurance

A mishap can quickly become expensive. The insurer protects you and your company from the financial consequences. The most important liability insurances include:

-

Personal liability for singles, families, and shared apartments

-

Business and professional liability for self-employed and companies

-

Pet owner liability, homeowner and landowner liability

-

Builder’s liability and hunting liability

When it comes to legal protection, you’re also well covered with Itzehoer Versicherungen. There are offers for private individuals, road users, landlords, companies, and farmers. With the acquisition of the legal protection division of ALTE LEIPZIGER, Itzehoer is among the top 20 providers in Germany. Especially for entrepreneurs, legal protection for businesses is a decisive advantage. You benefit from modular solutions that can be tailored individually.

Home, property, and property insurance

Your home and your property deserve special protection. The insurer has a wide portfolio ready for you:

-

Household contents insurance for damage caused by fire, tap water, burglary, and more

-

Residential building insurance for owners and landlords

-

Construction all-risk insurance for new builds or renovations

-

Photovoltaic insurance for solar installations

-

Electronics and contents insurance for businesses

Farmers and self-employed professionals will find special solutions tailored to their operational risks. By combining various property insurances, you can comprehensively protect your property. Itzehoer Versicherungen always offers you personal advice and tailored offers. Particularly practical: many policies can be flexibly expanded and adjusted.

Life, retirement provision, and health

Provision is a central topic for this insurer. Here you will find offers that secure you and your family in the long term:

-

Endowment and term life insurance for survivor protection

-

Occupational disability insurance for financial security if you’re unable to work

-

Retirement products such as basic pension, Riester pension, and unit-linked pensions

-

Immediate annuity and single-premium annuity for flexible retirement planning

-

Accident insurance for adults, children, and special care benefits

-

Health insurance: from full coverage to outpatient, inpatient, and dental supplemental insurance

Itzehoer Versicherungen scores with transparent terms and high service quality. Young people in particular benefit from inexpensive entry-level offers. Those who combine multiple products often save premiums and benefit from attractive bundle discounts.

Travel insurance

Whether family vacation, business trip, or work & travel – Itzehoer Versicherungen offers comprehensive travel protection. These include:

-

Annual international travel health insurance for any number of trips per year

-

Trip cancellation insurance for unforeseen events

-

COVID travel protection for current risks

-

Young Travel for young travelers and exchange students

-

Coverage for foreign guests in Germany

Through cooperation with HanseMerkur, you receive particularly comprehensive benefits. The insurer’s travel insurance policies can be taken out quickly and easily online. This way, you’re well protected worldwide and can enjoy your stay without worries.

Examples and data

Itzehoer Versicherungen convinces with figures: after the acquisition of the legal protection division in 2018, the company manages over 360,000 legal protection contracts. In direct sales, for example via AdmiralDirekt.de, more than 100,000 policies have already been concluded. The offer is aimed equally at private individuals, entrepreneurs, and agricultural businesses. With its wide product range and personal advice, the insurer stands out from pure online providers. The combination of digital service and individual support makes the difference. Those who bundle multiple insurances benefit from attractive terms and comprehensive protection.

Consulting, service, and customer support at Itzehoer

You don’t just want any contact person for your insurance, but a real partner at your side? That is exactly the claim of Itzehoer Versicherungen – personal, digital, and always close. Here you can find out what consulting, service, and support look like in 2025.

Personal advice and agency model

The heart of Itzehoer Versicherungen is the dense network of appointed representatives and general agencies. Whether you live in a big city or in the countryside, a personal contact is always close by.

-

Individual advice on equal footing

-

A fixed contact person for all concerns

-

Flexible appointment scheduling, including outside usual hours

In contrast to pure online insurers, you benefit here from personal support – from the preparation of the offer to assistance in the event of a claim. This creates trust, which counts especially in difficult situations. The insurer focuses on proximity and long-term customer relationships.

Digital services and customer portal

Digitalization is a major priority at Itzehoer Versicherungen. With the online portal "Meine Itzehoer," you have access to your contracts at any time, can report claims, or submit changes – quickly, securely, and conveniently.

-

Contract management around the clock

-

Digital advice via video or chat

-

Online appointment booking and service documents

Consistent automation in insurance services makes processes more efficient and transparent. You benefit from short response times and uncomplicated procedures without having to forego personal support. Itzehoer Versicherungen combines modern technology with individual service.

Claims management and additional services

Every minute counts in the event of a claim. The insurer offers you various ways to report a claim quickly – online, by phone, or directly through your personal contact.

-

Fast processing and straightforward settlement

-

Auto glass service and roadside assistance

-

Legal protection services, international insurance card

Additional offers such as the refer-a-friend program or the praise and criticism system show how seriously Itzehoer Versicherungen takes your opinion. This turns service into a real strength.

Customer satisfaction and reviews

Customer satisfaction is at the center. Numerous positive reviews attest to this, such as a 4.2-star rating on Google for individual agencies.

-

Friendliness and reliability are particularly highlighted

-

Quick help in the event of a claim is standard

-

Long-term customer loyalty through personal support

Customers value the combination of digital convenience and human proximity. That’s exactly what makes Itzehoer Versicherungen special in the industry.

Examples and insights

You benefit from a unique combination of personal and digital support. The insurer offers tailored insurance packages that can be flexibly adapted to your life situation.

-

Premium advantages through product bundling

-

Individual solutions for private individuals, companies, and farmers

-

Practical example: after water damage, your personal contact handles all coordination while you track the status digitally

Whether digital or on site – with Itzehoer Versicherungen you are always in good hands.

Step-by-step: How to find the right insurance with Itzehoer

Do you want optimal protection for yourself, your family, or your company? With this insurer, you’ll find exactly the products that fit your situation in just a few steps. Follow this guide to keep everything under control from the initial needs assessment to contract management.

1. Needs assessment and risk analysis

It starts with an analysis of your current situation. Consider which risks are relevant to you. Do you have a family, your own home, a car, or a business? Check whether topics such as liability, illness, accident, retirement provision, or legal protection are important to you. Itzehoer Versicherungen offers suitable solutions for every life situation.

Take your time to capture all eventualities. This ensures that no gap in protection arises.

2. Product comparison and tariff selection

In the next step, compare the various offers. Use the insurer’s online premium calculators to determine individual premiums and benefits. Pay attention to differences between basic and premium tariffs as well as additional services such as roadside assistance or legal protection.

|

Tariff |

Benefits |

Target group |

|---|---|---|

|

Basic |

Basic protection, low premium |

Bargain hunters |

|

Premium |

Extended protection, extras |

Demanding customers |

Example: For a moped or e-scooter, you can calculate the premium in just a few minutes and take out the policy directly online.

3. Consultation and purchase

Personal consultation helps you make the best decision. Contact an appointed representative of Itzehoer Versicherungen and arrange an appointment on site, by phone, or digitally. Together, you’ll check whether discounts, combination advantages, or special tariffs are suitable for you.

After an individual offer is prepared, you can conclude the contract online or at the agency. This way you receive exactly the protection that suits you.

4. Manage your contract and use services

After conclusion, the "Meine Itzehoer" customer portal is your central hub. Here you manage contracts, download documents, and report changes. You can easily submit claims digitally. For everyone who appreciates digital solutions, digital solutions for finance offer additional management options.

With Itzehoer Versicherungen, you always have a full overview of your policies and services.

5. In the event of a claim: Act correctly

A loss can happen quickly. Report it immediately online or by phone. Your contact person will support you from the start. Thanks to quick settlement and additional services such as roadside assistance or legal protection, you’re never alone.

Keep all important documents ready to ensure smooth processing.

Examples and tips

-

Take out trip cancellation insurance for your vacation conveniently online.

-

Combine multiple products from the insurer for premium advantages and comprehensive protection.

-

Use digital consultation to find flexible appointment times.

-

Regularly check whether your life situation has changed and adjust your insurance cover.

With these steps, you are well positioned and benefit from the flexibility and service quality of Itzehoer Versicherungen.

Digitalization and innovation at Itzehoer

The insurance industry is undergoing a digital transformation that also shapes this insurer. Anyone seeking modern insurance protection today expects digital services, efficient processes, and high IT security. Itzehoer Versicherungen invests specifically in innovative technologies to improve customer experiences and set new standards in service and efficiency.

Advanced IT infrastructure and automation

In recent years, Itzehoer Versicherungen has invested massively in its IT infrastructure. New office buildings and state-of-the-art data centers form the backbone of digitalization. Automated workflows ensure faster processing of applications and claims. Digital processes increase efficiency and offer customers greater transparency.

A central goal is to improve service quality through digitalization. Itzehoer Versicherungen is focusing on process automation in claims management and seamless integration of customer and contract data. Employees and customers also benefit from modern tools in administration.

Online purchase and self-service

More and more insurance products from the insurer can be concluded directly online. Particularly popular are motor, moped, and travel insurance policies that can be applied for digitally in just a few minutes. After completion, customers receive immediate insurance coverage and transparent premium calculation.

Self-service portals make it possible to manage contracts independently, report claims, or retrieve documents. This trend reflects the expectations of modern customers. Those who want to learn more about the key trends in digital transformation will find interesting insights under Digital transformation in the insurance industry.

Data protection and IT security

Data protection is a central topic for Itzehoer Versicherungen. All customer data is processed exclusively in Germany to ensure the highest security and data protection standards. The systems are GDPR-compliant and rely on modern encryption technologies.

C5-certified data centers offer additional protection against cyberattacks. Customers can trust that their data is secure with Itzehoer Versicherungen. Continuous review and adjustment of security measures is an integral part of the IT strategy.

Innovation in sales and service

Itzehoer Versicherungen relies on innovative sales channels and hybrid advisory models. Digital advice via video or chat enables flexible support, while personal contacts remain available. Partnerships with InsurTechs and the expansion of online sales, for example via AdmiralDirekt.de, broaden the service offering.

Customers benefit from a combination of personal ties and digital flexibility. The service can be tailored individually, which makes the insurer particularly attractive for modern policyholders.

Examples and data

The digitalization offensive of Itzehoer Versicherungen can also be measured in numbers. Over 7,000 square meters of new office space were created for IT modernization. Modern IT solutions enable efficient administration of over one million contracts.

A comparison of traditional and digital processes highlights the advantages:

|

Process |

Traditional |

Digital at Itzehoer Versicherungen |

|---|---|---|

|

Contract conclusion |

Paper-based |

Online in a few minutes |

|

Claim notification |

By phone |

Portal, app, or chat |

|

Document management |

File folder |

Digital, available anytime |

These advances make Itzehoer Versicherungen one of the most innovative insurers in Germany.

Current trends and challenges in the insurance industry 2025

The insurance industry is undergoing profound change in 2025. Itzehoer Versicherungen meets these changes with innovative solutions. Sustainability, digitalization, and new regulatory requirements shape the market environment. For customers, this opens up new opportunities for individual and flexible insurance solutions.

Sustainability and social engagement

Sustainability is moving ever more into focus at Itzehoer Versicherungen. The company invests specifically in renewable energies and develops sustainable products. With the founding of Itzehoer Zukunftsenergien GmbH, new paths are being taken to promote environmental and climate protection.

Social engagement is also a core value. Itzehoer Versicherungen supports regional initiatives and social projects to make a positive contribution to the community. The demand for sustainable policies is continuously increasing.

Regulatory developments and consumer protection

New legal requirements pose challenges for the industry. Itzehoer Versicherungen regularly adapts products and processes to current regulations. Data protection, transparency, and sustainability reporting obligations are in focus.

Consumer protection is a top priority. The insurer ensures understandable information, fair conditions, and high-quality advice. This creates the basis for long-term trust and security.

Technological trends

Technology is rapidly changing the industry. The focus is on automation, digital claims processing, and self-service portals. Artificial intelligence helps make processes more efficient and customer-friendly. Those who want to know more about the most important developments will find current studies and analyses in trends in the insurance industry 2025.

By investing in modern IT and mobile applications, new standards for service and speed are being set. Itzehoer Versicherungen thus remains up to date.

Market and customer behavior

Customer behavior is changing noticeably. More and more people want digital, flexible, and transparent insurance solutions. At the same time, the desire for personal advice remains.

The insurer combines classic support with innovative online offerings. The importance of customer loyalty is growing, as shown by customer loyalty in the insurance industry. Individual communication and tailored offers are the focus.

Examples and insights

Itzehoer Versicherungen is considered a pioneer in digitalization and sustainable initiatives. The combination of personal advice and digital services provides a decisive competitive advantage.

Challenges such as competition from InsurTechs and rising customer expectations require continuous development. Nevertheless, the goal remains clear: in 2025, Itzehoer Versicherungen aims to stand for security, fairness, and innovation.

Practical tips for taking out insurance and contract management

Do you want to do everything right when taking out your Itzehoer insurance and benefit in the long term? With the right tips, you’ll secure not only optimal protection but also flexibility and convenience in ongoing contract management. This is how you get the most out of your policies.

Contract optimization and premium savings

Through smart contract optimization, you can save real money with your Itzehoer Versicherungen policies. Regularly check whether your existing policies still fit your life situation. Switching to a combination tariff or bundling multiple contracts often brings attractive discounts.

-

Bundle multiple insurances and use combination discounts

-

Make adjustments for changes such as moving, family growth, or job change

-

Review contracts annually for up-to-dateness and value for money

This way, you benefit long-term from strong benefits and low premiums with Itzehoer Versicherungen.

Deadlines, terms, and termination

Meeting important deadlines is crucial for all insurances. Keep an eye on when your contracts expire and which notice periods apply. This makes it easier for you to switch tariffs or move to new products.

-

Notice periods are usually three months before the end of the contract

-

Ask for better terms in good time before expiry

-

Plan the switch to Itzehoer Versicherungen in a targeted way

Tip: Note deadlines in your calendar to avoid missing any opportunity for premium savings.

Document management and service access

With the “Meine Itzehoer” customer portal, you can manage your insurance conveniently online. Here you’ll find all contracts, can report changes, and submit claims. Data protection is particularly important – as you can read in this data protection and data processing guide, your data is processed securely.

-

Digital storage of all policies and documents

-

Report a claim online and track processing status

-

Easily and securely update personal data

This way, you always keep an overview and benefit from maximum convenience.

Claim: preparation and processing

In the event of a claim, a quick and correct response counts. Your Itzehoer Versicherungen makes it easy to report the claim and submit the necessary evidence.

-

Report the claim immediately in the portal or by phone

-

Have important documents ready, such as photos, invoices, or expert reports

-

Use your agency contact for questions and support

The better you are prepared, the faster you’ll get help and can rely on settlement.

Advice and information sources

Good advice is the alpha and omega at Itzehoer Versicherungen. Use the guides on the website, read up on topics such as work, property, or health, and contact your personal advisor if you have questions.

-

Guide content on all insurance topics available online

-

Personal advice by phone, email, or on site

-

Tips for premium savings and optimal contract design

That way, you’ll always find the right solution and be fully informed.

You’ve now learned how versatile and digital Itzehoer Versicherungen is – from personal advice to smart online services. But you can also save time and nerves in your own daily work by automating tedious document processes. That’s exactly what filehub is for: here you can easily store and retrieve documents such as insurance papers or invoices and integrate them directly into your workflows. This way you always keep an overview, save manual steps, and remain flexible with every change. Try it yourself and test filehub.one for free now.