E-Invoicing 2026: Easily Implement Digital Invoices

Since 2025, the e-invoice has been the mandatory standard in German business transactions. As a result, many companies are facing one of the biggest changes in accounting in recent decades.

Many businesses are asking how they can implement the new legal requirements efficiently and in a legally compliant way. There is a lot of uncertainty, but those who act now can benefit from greater efficiency, lower error rates, and tangible cost savings.

In this post, we explain step by step how to introduce e-invoices easily and securely in 2026, which formats such as ZUGFeRD and XRechnung are relevant, and how to optimally prepare companies for the digital future.

You can expect a concise overview of legal requirements, various invoice formats, technical implementation, archiving, and proven best practices.

1. Importance of the e-invoice in modern accounting

The e-invoice is the engine of digital transformation in accounting. It enables companies to automate their processes and thus work not only faster but also with fewer errors. Instead of stacks of paper and lengthy manual entry, machine-readable data move into focus. This speeds up invoice verification enormously because data is transferred directly into the system. Whether a small business or a large corporation, the electronic invoice brings more efficiency and transparency to processes everywhere.

The digital transformation in accounting

Digitalization is fundamentally changing accounting. With the mandatory e-invoice, processes become not only faster but also more reliable. Sources of error due to manual entries are eliminated because invoice data is processed directly in digital form. That means: fewer queries, less paper, more oversight.

Companies benefit from optimized workflows. Incoming invoices can be automatically checked and forwarded. The time savings are enormous because document flows are traceable digitally. Even small companies can keep up with larger ones because the electronic invoice offers standardized processes.

Legal requirements in Germany and Europe through 2028

As of 2025, the e-invoice is mandatory in the B2B sector in Germany. The background is the EU initiative ViDA, which aims for a uniform digital invoicing system across Europe. The legislator has set a clear roadmap: Initially, paper or PDF invoices are still permitted with consent; from 2028, all B2B transactions must be issued exclusively as structured electronic invoices.

Over 90 percent of companies will have to fully digitize their invoicing processes by then. This also affects international business, as cross-border transactions are subject to the new requirements. Anyone who wants to learn more can find a comprehensive overview of legal foundations and implementation guidance.

Benefits of the e-invoice for companies

The electronic invoice offers tangible benefits: It saves costs by eliminating paper, postage, and lengthy processing. Every e-invoice is traceable and can be found at any time, which increases transparency. Digital archiving—such as for ZUGFeRD invoices—is mandatory for ten years and must preserve the original format unchanged.

There are also different formats with specific strengths:

|

Format |

Type |

Use case |

Special feature |

|---|---|---|---|

|

ZUGFeRD |

Hybrid (PDF+XML) |

B2B, B2C, international |

Visual & machine-readable |

|

XRechnung |

XML |

Mandatory in the public sector |

Machine-readable only |

With the electronic invoice, you are well prepared for future reporting systems, stronger compliance, and fewer tax audits. The e-invoice is the key to modern, digital accounting.

2. Legal requirements and deadlines for the e-invoice mandate

The e-invoice is at the center of accounting’s digital transformation. It not only creates efficiency but will be mandatory for companies in Germany from 2025. The legal requirements affect not only large enterprises but also small businesses and freelancers. Across Europe, the electronic invoice also plays a key role in harmonizing processes and strengthening tax transparency.

Overview of the new legal requirements

Since 2025, the e-invoice has been legally required in the B2B sector in Germany. The basis is the European standard EN 16931, which clearly defines what counts as a genuine electronic invoice. Only structured, machine-readable formats are permitted—simple PDFs, JPGs, or TIFs do not meet the requirements.

The obligation to use electronic invoices applies to all VAT-liable companies based in Germany, regardless of size or industry. The goal is full digitization and automation of invoicing processes. You can find more information on the legal details and transitional periods at E-invoice obligation from 2025 – IHK Frankfurt am Main.

Transition periods and timeline through 2028

The introduction of the e-invoice obligation is gradual. Between 2025 and 2026, companies may still use paper and PDF invoices with the recipient’s consent. From 2027, there is a special rule for small businesses (up to 800,000 euros in revenue). From 2028, the exclusive use of structured electronic invoices for all B2B transactions is mandatory.

Deadline overview:

|

Year |

Which companies? |

Permitted formats |

|---|---|---|

|

2025 |

All |

E-invoice, paper/PDF* |

|

2027 |

Small businesses (<€800,000 revenue) |

E-invoice, paper/PDF* |

|

2028 |

All |

E-invoice only (XML, ZUGFeRD, XRechnung) |

*With the recipient’s consent

These requirements also apply in the European context. With ViDA, the EU aims to create uniform digital invoicing for cross-border transactions. This makes the electronic invoice the new standard in European business.

Rights and obligations of invoice issuers and recipients

From 2025, all companies are required to be able to receive and process e-invoices. The recipient’s consent is no longer required if the format complies with EN 16931. Special rules apply to private customers and certain cross-border transactions.

Consistent digital processing and archiving are crucial—especially for formats such as ZUGFeRD or XRechnung. ZUGFeRD combines PDF and embedded XML, ensuring both human and machine readability. XRechnung, by contrast, is a purely machine-readable XML format primarily mandated for the public sector.

The following applies to both formats: Invoices must be archived in their original format for ten years in an audit-proof manner. Only then is the electronic invoice compliant and traceable in the event of a tax audit.

3. E-invoice formats compared: ZUGFeRD, XRechnung & more

The e-invoice is now a central element of modern accounting. With digitalization, efficiency, transparency, and automation are becoming increasingly important in companies. From 2025, driven by the EU initiative ViDA and national regulations, almost all companies in Germany and Europe will be required to use structured e-invoice formats. Adhering to these standards is not only a legal necessity but also the foundation for future-proof and audit-proof processes.

What is an e-invoice? – Technical and legal basics

An e-invoice within the meaning of current legislation is more than a digital copy of paper. It consists of structured, machine-readable data according to EN 16931. Only then can accounting systems automatically read and process the information. Classic formats such as PDF, JPG, or TIF do not meet these requirements because they do not contain standardized data fields.

It is important that mandatory information such as invoice number, date, tax rate, and recipient data is stored correctly and unambiguously in a machine-readable way. Electronic processing of the electronic invoice significantly reduces sources of error and speeds up processing. Companies benefit from faster approvals and better traceability of all processes.

ZUGFeRD vs. XRechnung: Differences and use cases

In German-speaking countries, the ZUGFeRD and XRechnung formats have become established in particular. ZUGFeRD combines a PDF with embedded XML, allowing both people and machines to read the e-invoice. XRechnung, by contrast, is a pure XML format and is primarily required by public authorities and in the public sector.

A practical comparison of the two formats shows:

|

Feature |

ZUGFeRD |

XRechnung |

|---|---|---|

|

Format |

PDF + XML |

XML |

|

Target group |

Companies, B2B/B2C |

Authorities, B2B |

|

International |

Yes (Factur-X) |

Limited |

|

Readability |

Human & machine |

Machine only |

If you want to know when each format makes sense, you will find a detailed comparison of the two e-invoice formats ZUGFeRD and XRechnung. The right choice depends on your customer structure and legal requirements.

Choosing the right format for your company

The choice of the right format depends on your industry, customer base, and technical prerequisites. Companies with international business relationships often benefit from hybrid formats such as ZUGFeRD or Factur-X. When working with public-sector clients, XRechnung is usually mandatory.

Important: The digital processing and archiving of the electronic invoice must be GoBD-compliant. This means invoices must be stored in their original format (e.g., XML in ZUGFeRD) for at least ten years without alteration. Modern accounting and ERP systems today offer interfaces that enable seamless integration and automatic archiving. This creates legal certainty and relieves companies in their day-to-day operations.

4. Implementing e-invoicing in the company: steps & best practices

The introduction of the e-invoice is a significant milestone for the digital transformation of accounting. Companies benefit from more efficient processes, fewer errors, and greater transparency. The key is to approach the transition in a structured way and to comply with the legal requirements by 2028. Below you will find the most important steps and proven methods for successfully introducing the electronic invoice in your business.

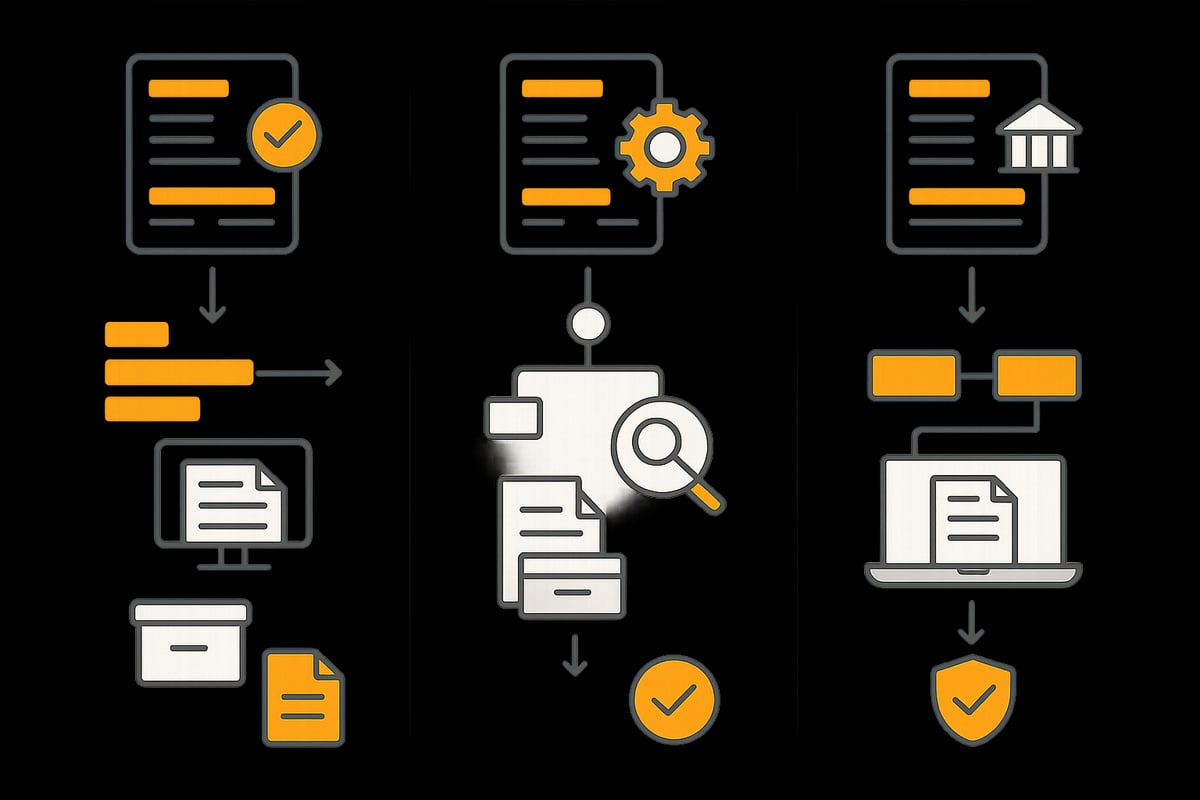

Step 1: Analyze your current invoicing processes

The first step toward successfully introducing the e-invoice is to analyze all existing invoicing processes in detail. Record both incoming and outgoing invoices to identify weaknesses such as media breaks or manual entry. This analysis reveals where automation offers potential and which processes are particularly relevant for switching to the electronic invoice.

Typical questions:

-

What types of invoices are currently used?

-

Are there already digital workflows?

-

Where do errors or delays occur?

With this foundation, you can decide specifically which processes should be digitized.

Step 2: Select and implement suitable software solutions

When selecting a solution for e-invoicing, compliance with EN 16931, interfaces to accounting software, and user-friendliness are crucial. Modern tools enable automated processing that saves time and minimizes errors. Particularly helpful is the automation of e-invoices to capture, verify, and forward invoices without media breaks.

Key criteria:

-

Support for ZUGFeRD and XRechnung

-

Integration into existing systems

-

Scalability and ease of use

Compare different providers and check which solution fits your company.

Step 3: Integrate into existing systems and workflows

Integrating the electronic invoice into ERP and accounting software is key to success. Only then can invoices be automatically routed, checked, and approved. Training for employees ensures that all stakeholders understand and accept the new digital processes.

Typical integrations:

-

Connection to document management

-

Automated validation and approval workflows

-

Smooth collaboration between departments

This way you achieve end-to-end digital and efficient invoice processing.

Step 4: Ensure legally compliant archiving

For the e-invoice, there is a retention obligation of 10 years in the original format, usually XML. Digital archiving is essential, especially for ZUGFeRD invoices, to meet legal requirements. Immutability and GoBD compliance must be guaranteed at all times.

What to look for?

-

Storage in the original format (e.g., ZUGFeRD XML)

-

Protection against manipulation and data loss

-

Fast retrievability during audits

With a digital archive, you are well equipped for all requirements related to the electronic invoice.

Step 5: Continuous optimization and monitoring

The work is not done after the introduction. Regularly monitor the processes and optimize them based on evaluations and dashboards. This ensures that all workflows remain efficient, compliant, and future-proof.

Recommended measures:

-

Use monitoring tools for process analysis

-

Feedback rounds with employees

-

Adjustments to new legal requirements through 2028

Since its introduction, the electronic invoice format has undergone continuous updates. Software vendors are also adapting their solutions to provide more convenience in processing. With these ongoing improvements, the processing of e-invoices remains up to date and your company benefits sustainably.

5. filehub: Automation of e-invoice processes

Automation is the key to integrating the e-invoice into accounting efficiently and error-free. With filehub, companies get a powerful platform that digitizes and accelerates the entire e-invoice processing workflow.

filehub enables the automated importing, processing, and forwarding of e-invoices such as ZUGFeRD and XRechnung—without any programming knowledge. The platform connects seamlessly to common accounting programs, ERP systems, and web portals. This way, invoices automatically end up in the right system and are immediately ready for further processing.

A typical practical example: With the automatically download invoices feature, e-invoices are retrieved directly from online portals and integrated into the accounting workflow without manual steps. This saves time, minimizes sources of error, and ensures end-to-end transparency.

Archiving is also fully digital and GDPR-compliant. Access controls and secure, ten-year retention in the original format (e.g., ZUGFeRD XML) are integrated. Companies thus meet all legal requirements for the e-invoice without complex IT projects.

filehub offers decisive advantages especially for SMEs: rapid integration, no need for in-house IT resources, and a free trial period. Those who automate e-invoice processes gain a clear edge in digital accounting.

6. Challenges and solutions when switching to e-invoicing

The switch to e-invoicing presents many companies with numerous challenges. Especially in view of the legal requirements in Europe by the end of 2028, the pressure to fully digitize existing processes is increasing. Different formats such as ZUGFeRD and XRechnung place additional demands on technology and organization. Modern accounting requires purely digital processing and archiving, especially for ZUGFeRD invoices.

Common pitfalls during introduction

Many companies encounter similar problems when introducing the electronic invoice. Often there is a lack of compatible software, or existing systems do not support the necessary formats such as ZUGFeRD or XRechnung. Technical interfaces to existing accounting solutions are also often a bottleneck.

Internal resistance within teams, uncertainty about legal details, and ambiguities regarding archiving lead to delays. The obligation to digitally archive, especially ZUGFeRD invoices in XML format, is often underestimated. Errors in choosing the right format or misunderstandings in distinguishing between ZUGFeRD and XRechnung are additional stumbling blocks.

-

Lack of software compatibility

-

Unclear legal requirements

-

Resistance and lack of knowledge within the team

-

Errors in format selection and archiving

Approaches and recommendations from practice

To successfully introduce the electronic invoice, early and structured planning is advisable. It pays to involve all departments—from IT and accounting to management. Checklists and templates help maintain an overview and avoid mistakes.

Working with external service providers specializing in digital invoicing processes has proven practical. For companies that want to optimize their finance processes, platforms such as solutions for finance processes offer targeted support for selecting, integrating, and automating e-invoicing solutions.

Regular training and information sessions for employees strengthen acceptance and reduce uncertainties. Ongoing process reviews also help make the electronic invoice efficient and compliant.

-

Involve all relevant areas

-

Use external expertise and tools

-

Train and inform employees

-

Regularly review processes

Outlook: Future developments and trends

With the ongoing digitalization of accounting, the e-invoice will become even more important in the coming years. The EU initiative ViDA and the full obligation to use e-invoices by 2028 are driving the development. Companies should therefore engage early with international standards such as Factur-X as well as automation and AI-supported validation.

The requirements for purely digital processing and archiving—especially for ZUGFeRD invoices—will continue to increase. Interoperability and integration into various systems will become the decisive success factor. Those who invest in flexible solutions now will benefit in the long term from more efficient processes and better compliance.

You have now seen how to introduce the e-invoice step by step and what benefits automation brings to your everyday work. Especially if you want to work more efficiently and avoid common sources of error, it pays to use smart tools like filehub. This connects your accounting directly with web portals, saves time, and ensures legally compliant archiving—without any programming effort. It’s best to just give it a try: try filehub.one for free now and experience for yourself how simple digital invoicing processes can really be.