Hospitality Receipt Template – How to Create the Document

Want to have entertainment expenses recognized for tax purposes without making mistakes? This is exactly where the entertainment receipt template comes in. Many business owners wonder what the perfect receipt has to look like in 2026 and which details really matter.

With a professional entertainment receipt template you save time, minimize errors, and secure tax advantages. This guide gives you a clear step-by-step manual, all mandatory details, and practical tips for preparing your document correctly.

You’ll learn what to watch out for in the 2026 template, which legal foundations apply, and how to make optimal use of digital tools. This way you have all key information at a glance, compact and easy to understand.

Legal foundations and tax significance of the entertainment receipt

An entertainment receipt is a central document for companies when it comes to claiming business meals for tax purposes. Only with a complete and correct entertainment receipt template can you ensure that the entertainment expenses are recognized by the tax office.

What is an entertainment receipt?

An entertainment receipt documents business-related entertainment, for example business meals with clients or business partners. Unlike a simple restaurant invoice, it includes additional mandatory information such as the purpose, participants, and the host’s signature. An entertainment receipt template helps you meet these requirements in a structured way.

The statutory requirements for entertainment receipts are set out in section 4(5) no. 2 of the German Income Tax Act (EStG) and in the BMF circular on the tax recognition of entertainment expenses. From 2026, stricter rules apply: entertainment receipts must often be created electronically and secured with a certified technical security device (TSE).

Especially relevant: only if all mandatory details are complete and correct will the tax office recognize the costs. Current statistics show that around 70% of entertainment expenses are deductible as business expenses; input VAT can even be reclaimed at 100%.

Practical example: A business meal with a clearly documented purpose and list of participants is recognized; however, if the signature is missing or the purpose is too general, rejection looms. With an up-to-date entertainment receipt template you can avoid such mistakes and secure tax advantages.

Which costs qualify as entertainment expenses?

Recognized entertainment expenses typically include:

-

Food and beverages

-

Tips (if receipted)

-

Cloakroom fees

Not recognized, however:

-

Private entertainment (e.g., family celebrations)

-

Nightclub or bar visits

-

Small courtesies such as coffee and rolls at the office

Be careful with mixed occasions: only the business-related portion is deductible. The reasonableness of the costs plays a major role. The tax office checks in particular whether the level of expenses is proportionate to the occasion.

A complete audit trail is also important. An entertainment receipt template provides a secure basis for this, as it covers all relevant fields. Tip: Keep a checklist so that no mandatory detail is forgotten. Only then can you ensure that entertainment expenses are recognized for tax purposes.

Structure and mandatory details of an entertainment receipt template 2026

A professional entertainment receipt template is the key to having the tax office recognize entertainment expenses. The documentation requirements will increase further from 2026, especially due to digital processes and new regulations. Mistakes here risk losing tax benefits.

Mandatory details for tax recognition

Every entertainment receipt template must contain certain mandatory details, otherwise the tax office will not recognize the costs. These include:

-

Name and address of the restaurant or host

-

Date and place of the entertainment

-

Purpose of the entertainment – as specific as possible, e.g., “Negotiation with client Müller on project X”

-

Names of the participants and the host

-

Itemized list of food and beverages

-

Amounts: net, gross, VAT, tip

-

Signature of the host

For invoices of 250 euros or more, additional information is required: tax number or VAT ID, invoice number, name and address of the invoice recipient.

A correct entertainment receipt template looks like this:

|

Mandatory field |

Example |

|---|---|

|

Restaurant |

„Gasthaus Sonne, Musterstraße“ |

|

Purpose |

„Project meeting with client X“ |

|

Participants |

„Max Mustermann, Anna Beispiel“ |

|

Food/Beverages |

„2x menu, 2x water“ |

|

Amount |

„Net 80 €, VAT 7 €, Gross 87 €“ |

A common mistake: details that are too general, such as “business meal,” are not sufficient. If you want to complete the mandatory fields digitally and in a legally compliant way, you’ll find vetted Digital templates for entertainment receipts, which are easy to adapt.

Differences: entertainment receipt vs. restaurant invoice

The entertainment receipt template supplements the restaurant invoice; it does not replace it. The restaurant invoice documents the services consumed as well as the total amount. The entertainment receipt template, by contrast, secures additional information such as purpose, participants, and signature.

For amounts up to 250 euros, a so‑called simplified invoice is sufficient, showing the most important details. From 250 euros, all invoice data must be present pursuant to section 14 of the German VAT Act (UStG). In any case, both documents — restaurant invoice and entertainment receipt template — must always be submitted together.

In practice, it looks like this:

|

Type of document |

Purpose |

Mandatory details |

|---|---|---|

|

Restaurant invoice |

Proof of payment |

Amount, restaurant, VAT |

|

Entertainment receipt template |

Ensure tax recognition |

Purpose, participants, signature |

Only if both documents are filled out correctly will the tax office recognize the entertainment expenses. This way you avoid unnecessary queries and secure your tax advantages.

Step-by-step guide: fill out the entertainment receipt template correctly

Creating an entertainment receipt template may seem complicated at first glance. With a structured step-by-step guide, however, you will manage to meet all requirements safely and avoid mistakes. This ensures your entertainment receipt will also be recognized for tax purposes in 2026.

Step 1: Preparation and choosing the right template

Before you start filling it in, the right entertainment receipt template is crucial. Use a current, legally compliant template — ideally in PDF or Word format. Digital solutions often offer practical additional features and make later archiving easier.

Make sure the template covers all mandatory details. Templates from trustworthy providers such as tax advisors or online services are recommended. If you want to be on the safe side, you can find, for example, a free entertainment receipt template from FastBill that is updated regularly.

Check the template for up-to-dateness and legal status before using it to avoid later corrections.

Step 2: Completing the mandatory fields

An entertainment receipt template is only valid if all mandatory fields are completed correctly. These include:

-

Name and address of the restaurant

-

Date and place of the entertainment

-

Purpose (e.g., “Client meeting project X”)

-

Names of all participants and the host

-

Itemized list of food, beverages, and amounts

-

Signature of the host

Be as specific as possible about the purpose to avoid questions from the tax office. Tips can be shown separately — it is important that they are receipted and included in the total amount.

Clear, neat handwriting or digital entries ensure legibility and legal certainty.

Step 3: Compile and check the documents

After filling in the entertainment receipt template, all relevant documents must be brought together. This means: the restaurant invoice must always be included with the entertainment receipt — both documents together form the tax proof.

Go through the following checklist:

-

Do all details match on both documents?

-

Is the entertainment receipt complete and legible?

-

Has the thermal paper invoice been copied?

A final check before submission prevents unnecessary queries by the tax office. This way you ensure tax recognition of the entertainment expenses.

Step 4: Retention and archiving

After the entertainment receipt template has been completed, proper retention is crucial. Business entertainment receipts must be archived for at least ten years — digitally or on paper.

Digital archiving is now widespread because it saves time and simplifies searches. Ensure that all digital copies are immutable and available at any time. Suitable tools and accounting software help you comply with legal requirements.

Regular backups and a clear folder structure provide additional security and clarity.

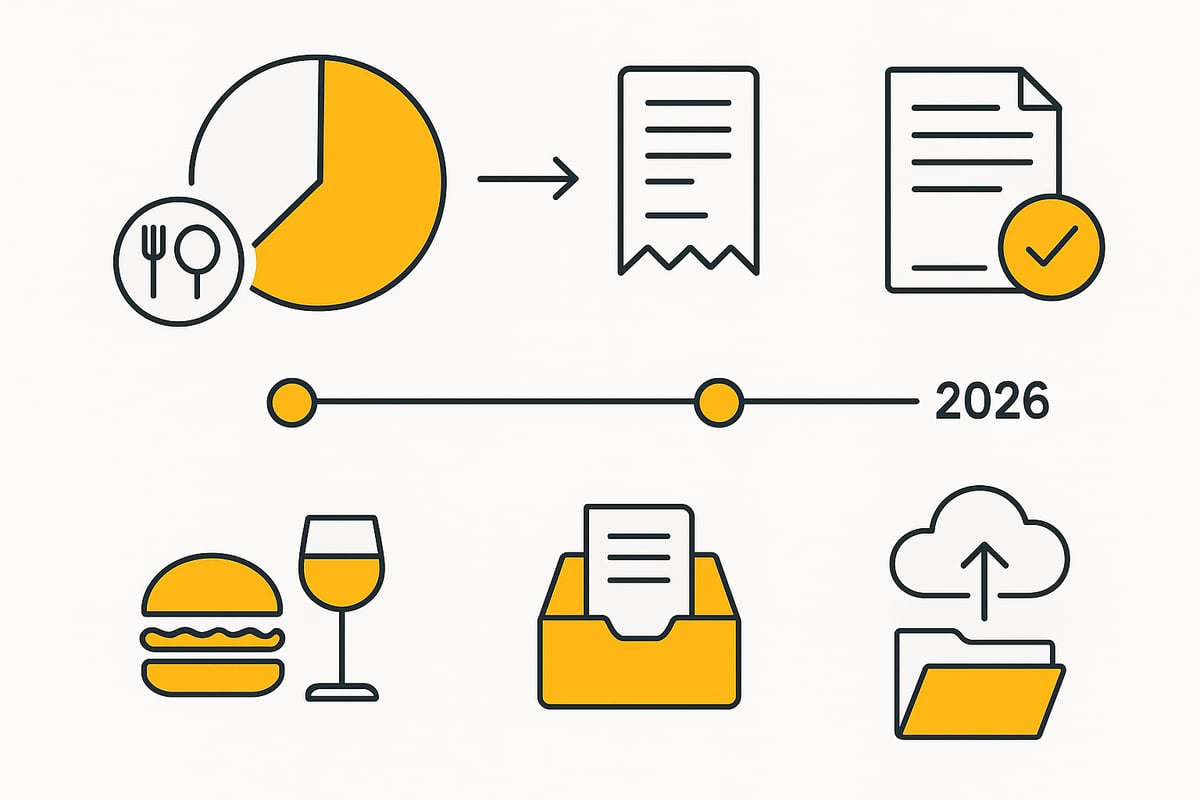

Digital entertainment receipts and automation options

More and more companies are relying on digital solutions to organize their entertainment expenses. The classic paper-based entertainment receipt template is increasingly being replaced by modern electronic processes. This saves time, reduces errors, and creates transparency. Digital entertainment receipts are not only practical, but from 2026 are even legally required in many cases.

Electronic creation and archiving

The electronic creation of an entertainment receipt template follows clear legal requirements. Since the 2021 BMF circular and at the latest from 2026, digital self-generated receipts must meet certain requirements. These include immutability, traceability, and a qualified digital signature.

Digital solutions offer many advantages:

-

Time savings in processing and review

-

Fewer sources of error through automated mandatory-field checks

-

Easy transfer to tax advisors or accounting

Many companies already rely on software solutions that support the entire process. If you want to know how automated capture and processing of forms such as entertainment receipts works, you will find helpful information at Process forms digitally.

Integration into digital workflows

Integrating the entertainment receipt template into digital workflows brings enormous efficiency gains. Restaurant invoice and self-generated receipt are automatically merged, for example via a barcode, index, or an electronic reference number.

This ensures that all documents are uniquely assigned and archived in a way that is traceable for the tax office. The requirements for immutability and seamless documentation are central here. Modern tools enable the direct transmission of all documents to accounting or the tax advisor.

This turns the entertainment receipt template into a fixed component of a fully digital process. Companies benefit from clear procedures and avoid typical sources of error in documentation.

filehub: Manage entertainment receipts automatically and securely

filehub offers German companies in particular a secure and automated way to manage entertainment receipts. The platform is GDPR-compliant and can be flexibly linked to common accounting software.

The workflow: After the business meal, the entertainment receipt template is filled out digitally and archived directly together with the restaurant invoice. Through digital approvals and automatic checking mechanisms, errors are avoided. Searching for receipts is possible at any time.

Especially for companies with many entertainment transactions, filehub delivers enormous time and cost savings. Freelancers also benefit from a professional digital solution that reliably manages the entertainment receipt template.

Common mistakes and tips for practice

Mistakes when creating an entertainment receipt can, in the worst case, lead to the tax office not recognizing the costs. If you work with a current entertainment receipt template, you can avoid many of these pitfalls. Below you will learn which errors occur particularly often and how you can deliberately circumvent them in practice.

Typical sources of error with entertainment receipts

Many companies rely on an entertainment receipt template, but errors still creep in. Particularly critical are missing or incomplete mandatory details. For example, the purpose is often stated too generally — instead of “business meal,” the exact purpose such as “negotiation with client Müller at project start” should be given. Many also forget to record all participants correctly.

Another source of error is tips: if they are not receipted or noted on the receipt, they cannot be taken into account for tax purposes. Thermal paper receipts fade quickly, which is why copying them for archiving is essential. It also happens that the link between the restaurant invoice and the entertainment receipt template is missing — both must be submitted together.

Errors in retention, such as the loss of original receipts or missing digital backups, also lead to problems. According to statistics, numerous entertainment receipts are rejected by the tax office each year, mostly due to formal deficiencies. The current New BMF requirements for the tax recognition of entertainment expenses from 2026 tighten the requirements further.

Typical errors at a glance:

|

Source of error |

Impact |

|---|---|

|

Incomplete mandatory details |

No tax recognition |

|

Non-specific purpose |

Rejection by the tax office |

|

Missing/unclearly receipted tip |

No deduction possible |

|

Thermal paper fades |

Receipt becomes worthless |

|

Missing link between receipt/invoice |

Proof issue |

|

Insecure retention |

Loss of tax benefits |

If you know these mistakes, you can avoid them deliberately and thus ensure smooth recognition of entertainment expenses.

Practical tips to avoid errors

With a current entertainment receipt template, many typical sources of error can be ruled out from the outset. Always use vetted and current samples that contain all mandatory fields. After every business meal, you should complete the template immediately and in full. Particularly important are the precise wording of the purpose and the complete listing of all participants.

Create a digital copy of all receipts immediately to prevent thermal paper from fading. Secure the documents both digitally and on paper to comply with statutory retention obligations. Working with your tax advisor helps to resolve uncertainties when using the entertainment receipt template.

Digital tools provide additional security and efficiency. They automatically check mandatory details and support archiving. Those who digitize their processes benefit from fewer errors and more time savings. Solutions such as the automation in accounting make it easier to manage entertainment receipts and minimize the risk of rejections.

Checklist for practice:

-

Use a current entertainment receipt template

-

Complete mandatory fields carefully and directly on-site

-

Describe the purpose specifically

-

Receipt and document the tip

-

Copy receipts and archive them securely

-

Use digital tools for checking and archiving

-

Involve a tax advisor if unsure

If you implement these tips routinely, you’ll secure tax recognition and reduce effort and risks when dealing with entertainment receipts.

Entertainment receipt template 2026: downloads, samples, and checklists

Are you looking for a current and legally compliant entertainment receipt template for 2026? The right template saves time and ensures that all mandatory details are recorded correctly. Whether PDF, Word, or Excel — there are numerous free and vetted samples that you can use right away.

Free and vetted templates

You can find an entertainment receipt template from trustworthy sources such as tax advisor portals, accounting software providers, or specialist publishers. Free samples usually offer all mandatory fields but are often less individually customizable than paid variants. When selecting, be sure to check the current legal status and whether the template has already been adapted to the requirements from 2026.

Paid samples score with additional features such as automatic calculation, digital signature, or integration into accounting software. For many companies, vetted free templates are sufficient as long as they are updated regularly. Important: do not use outdated documents to avoid trouble with the tax office.

Checklists and sample examples

With a checklist, you ensure that nothing is missing from your entertainment receipt template. The most important mandatory details are:

-

Name and address of the restaurant

-

Purpose of the entertainment, place and date

-

Names of all people entertained

-

Itemized list of food, beverages, and amounts

-

Signature of the host

A completed sample helps avoid typical mistakes. Always adapt the example to your occasion instead of using general terms such as “business meal.” Many providers offer anonymized samples for download. Check whether you want to use the template for digital or paper filing and whether it can be easily adapted to individual requirements.

Recommendations for companies and self-employed people

Update your entertainment receipt template regularly, especially when legal changes occur. Train your employees in how to use the templates and integrate them into internal processes. Digitization offers enormous advantages: automated workflows, secure archiving, and fewer mistakes.

With digital solutions such as the solutions for finance, you can manage entertainment receipts smartly and link them directly with your accounting software. This saves time and reduces the risk of formal errors. Whether a small team or a large company — a well-thought-out template and smart processes provide more security and efficiency in day-to-day work.

You have now seen how crucial a cleanly completed entertainment receipt is for your tax recognition and how much time digital solutions can save you. With filehub you can not only create and archive receipts digitally with ease, but also automate your entire document workflows — fully GDPR-compliant and without any programming skills. This way you always keep an overview and reduce errors to a minimum. Take this opportunity and try filehub without obligation to manage your entertainment receipts for 2026 and many other documents efficiently: Try filehub.one for free now