The Incoming Invoice – All the Important Details at a Glance

A turning point for incoming invoices, because new laws and digitalization have been bringing major changes for companies since 2025. The e-invoice mandate is prompting many to rethink their processes around control and archiving.

Many companies are uncertain about the transition. Those who know the legal requirements early and optimize their workflows not only save time and money, but also minimize tax risks.

This overview gives you a concise and practical guide to what matters now: from the definition and requirements under §14 UStG, the differences between paper and digital documents, through to review processes, automation, and best practices.

Prepare in good time and leverage the opportunities of digitalization – this overview helps you confidently master all requirements around incoming invoices.

What is an incoming invoice? Definition, significance & legal foundations

Definition and function of the incoming invoice

This document is, in everyday business, the record a company receives in order to make payment for goods or services received. It documents operating expenses and serves as the basis for accounting. The principle “No entry without a document” applies without restriction.

Typical examples are invoices for goods purchases or external services. The document is also relevant for tax purposes, because input tax deduction is only possible with properly issued invoices. Incorrect incoming invoices can lead to the loss of input tax, which means financial disadvantages.

In accounting, the incoming invoice is clearly distinct from the outgoing invoice, as it reflects the role of the recipient. Those who check carefully here minimize the risk of errors and save costs.

Tax requirements pursuant to §14 UStG

Every incoming invoice must, according to §14 UStG, contain certain mandatory details. These include the name and address of the supplier and recipient, tax number or VAT ID, invoice number, issue date, description of services, amount, VAT, and delivery date.

These details are crucial for the input tax deduction. If they are missing or incorrect, the tax office can refuse the refund of input tax. Particularly for small businesses or tax-exempt supplies, differing requirements may apply. Typical errors include incomplete addresses or missing descriptions of services.

With the legislative changes in 2025/2026, the requirements for GoBD-compliant accounting are increasing further. A correct invoice is therefore not only mandatory, but also protects against unpleasant surprises during tax audits.

Differences to outgoing invoices & distinction

The incoming invoice fundamentally differs from the outgoing invoice. While the incoming invoice is recorded as a liability by the recipient, the outgoing invoice represents a receivable for the issuer.

Example: If a company purchases goods, it receives an invoice and records the expense. If, on the other hand, it sells products, it issues an outgoing invoice. For VAT purposes: Only valid incoming invoices entitle the recipient to an input tax deduction, while outgoing invoices trigger VAT liability.

Statistics show that around 20 percent of input tax deductions are jeopardized by incorrect incoming invoices. Clean separation and verification of both types of invoices is essential for correct financial reporting. If you want to learn more about digital formats like ZUGFeRD and XRechnung, you’ll find valuable insights in the article on automation of incoming invoice processes.

Incoming invoice in paper form vs. digital documents: formats, differences & the future

The invoice is a central document in everyday business. But how do paper invoices differ from digital documents? And what does the law require from 2025? Here’s a concise overview of formats, processes, and the future of invoicing.

Incoming paper invoices: characteristics and challenges

Paper invoices are still part of everyday life in many companies. The invoice usually arrives by post, is checked by hand, stamped, and filed in folders. Every step takes time: from the incoming stamp to circulation for approval and archiving.

Paper documents are prone to errors. They can be lost or misfiled. Delays often arise due to manual checks and approvals. There are also statutory retention obligations of ten years, which tie up space and resources.

Statistics show: In 2025, over 40 percent of companies still work with paper invoices. This hinders digitalization and makes processes less efficient. The incoming invoice on paper is therefore both a risk factor and a cost item.

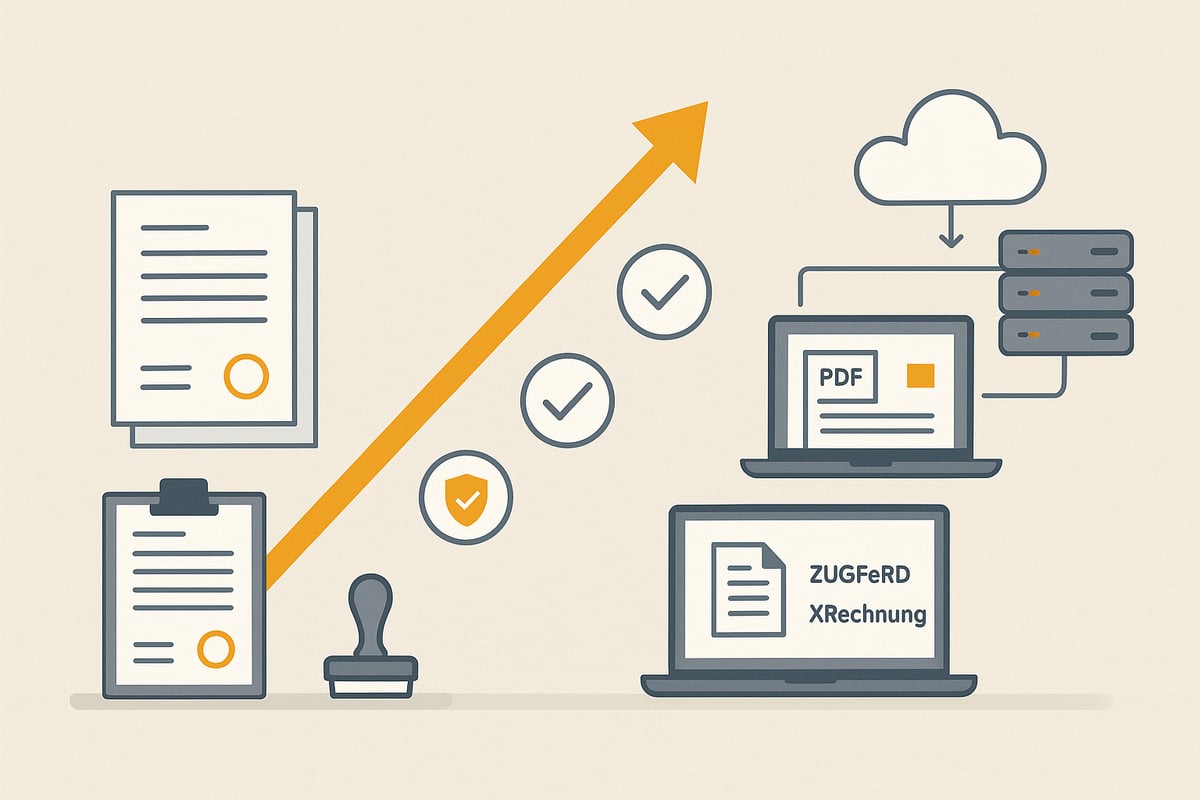

Digital incoming invoices: PDF, ZUGFeRD & XRechnung

Digital documents such as PDF, ZUGFeRD, and XRechnung offer decisive advantages over paper. The invoice in PDF format is widespread but often not structured enough for automatic processing. ZUGFeRD addresses this: the hybrid format combines a readable PDF with embedded structured data, enabling automatic import into accounting software.

XRechnung is the standard for electronic invoices in the public sector and will be mandatory for many companies from 2025/2026. Both formats meet high requirements for authenticity, integrity, and legibility. The electronic invoice can be processed, checked, and archived automatically. This saves time, reduces errors, and increases transparency.

A detailed overview of the formats and their advantages can be found in the article on ZUGFeRD & XRechnung. Here you can learn how modern software integrates these standards and how digital archiving can be achieved in a GoBD-compliant manner.

Digital incoming invoice also means: Electronic archiving replaces the physical file folder. This allows invoices to be found faster, stored in a legally compliant manner, and presented in an audit-proof way if necessary.

The future of incoming invoices: e-invoice mandate from 2025/2026

Since 2025, the electronic invoice has been mandatory in the B2B sector. This means companies have to adapt their processes and systems. Those who make the switch now benefit early from automated processing, time savings, and greater traceability.

Requirements are increasing: invoice data must be machine-readable, unalterable, and archived digitally. Modern software solutions enable integration into existing accounting and ERP systems. Staff should be trained to avoid errors.

Forecasts show: By 2027, over 80 percent of companies will have fully digitized the incoming invoice. This creates a clear competitive advantage through greater efficiency, security, and compliance.

Mandatory details & special cases: How to meet the legal requirements

The incoming invoice is a central document in every company and is subject to strict legal requirements. Those who know the requirements ensure that all invoices are recognized for tax purposes and that the company is protected from unnecessary risks.

Mandatory details on the incoming invoice under §14 UStG

For recognition for tax purposes, certain mandatory details must be included under §14 UStG. These include the name and address of the supplier and recipient, tax number or VAT ID, the invoice date, a consecutive invoice number, the exact description of services, the consideration/amount as well as the VAT amount and the delivery date.

A correct invoice is a prerequisite for the input tax deduction. If details are missing, the input tax claim may be lost. Especially for digital invoices such as PDF, ZUGFeRD, or XRechnung, GoBD compliance is crucial. While paper invoices are usually checked and filed manually, digital formats such as GoBD-compliant accounting automation enable automated processing and archiving. ZUGFeRD combines the PDF with structured XML data, XRechnung is mandatory for B2B and public clients from 2025/2026. Typical errors include missing invoice numbers or unclear descriptions of services.

Checklist of mandatory details:

|

Mandatory detail |

Example |

|---|---|

|

Name, address |

Max Mustermann GmbH |

|

Tax number/VAT ID |

DE123456789 |

|

Invoice number |

2026-00123 |

|

Date |

12.01.2026 |

|

Description of service |

IT service |

|

Amount, VAT, delivery date |

1.000 €, 190 €, 10.01.2026 |

Small-amount invoices & simplified requirements

An incoming invoice up to €250 is considered a small-amount invoice. The requirements are simplified here: the supplier’s name and address, the issue date, the type and quantity of the goods or services supplied, the consideration/amount, as well as the tax rate or a note on tax exemption are sufficient.

Typical examples are fuel receipts or hospitality receipts. Even for small amounts, completeness must be ensured, otherwise the input tax deduction is at risk. According to §33 UStDV, details such as the recipient’s address or invoice number may be omitted; however, a standardized review of all documents is recommended. Around 60 percent of all documents in companies are small-amount invoices. Errors such as unclear descriptions of services or missing tax rates can cause problems during tax audits.

Special cases: Tax-exempt supplies, travel services, margin scheme

Special rules apply to some invoices. For tax-exempt transactions, the invoice must include a note on the tax exemption and its legal basis. For travel services under §25 UStG, a corresponding note is required, as is the case for the margin scheme pursuant to §25a UStG, as found, for example, in the used car trade or travel agencies.

If these additional details are missing, this can result in tax disadvantages. Examples include invoices for intra-community supplies or services to end customers in the used goods trade. Each of these variants is subject to special formal requirements that are often overlooked in practice. If you are unsure, you should consult your tax advisor.

What to do with incorrect incoming invoices?

If you discover errors in a document, the recipient is obliged to request a correction. Without a complete and correct invoice, no payment and no input tax deduction should be made; otherwise, financial risks may arise. A template text for the correction request can help standardize the process. Around ten percent of all input tax corrections arise from incorrect incoming invoices. It pays to be particularly thorough here and check all invoices before payment.

Review process & posting of incoming invoices: step by step

Efficient processing of an incoming invoice is a central component of modern accounting processes. Errors in the workflow often lead to delays, unnecessary costs, or even the loss of the input tax deduction. A structured review and posting process ensures security, transparency, and compliance in the company.

Checking an incoming invoice: substantive, arithmetic, legal

The substantive review ensures that the delivery or service corresponds to the purchase order. This involves checking whether quantities, items, and prices are correct. The next step is the arithmetic review: Do gross prices, tax rates, and totals match? Rounding differences are also checked.

Legally, the completeness of the mandatory details under §14 UStG is particularly important. If details such as the invoice number, tax number, or service date are missing, the input tax deduction is at risk. Typical sources of error are unclear descriptions of services or missing addresses.

Checklist for the review process:

-

Match purchase order and delivery note

-

Check amounts and tax rates

-

Verify mandatory details under §14 UStG

-

Check the document for legibility and integrity

Using digital tools can reduce the error rate for incoming invoices by up to 30 percent.

Posting and filing: How correct posting works

After a successful review, the incoming invoice is posted in the accounting system. The principle “No entry without a document” remains central. The invoice is posted to the correct general ledger account (e.g., goods received, services, input VAT).

There are clear differences between incoming and outgoing invoices: while the incoming invoice represents a liability to the supplier, the outgoing invoice represents a receivable from the customer.

Typical journal entries:

|

Transaction |

Debit account |

Credit account |

|---|---|---|

|

Goods received |

Goods received |

Accounts payable |

|

Services |

Expense |

Accounts payable |

Filing is carried out in compliance with GoBD, either electronically or in paper form. Both variants are subject to the 10-year retention obligation. Errors when posting the incoming invoice can lead to disadvantages during audits.

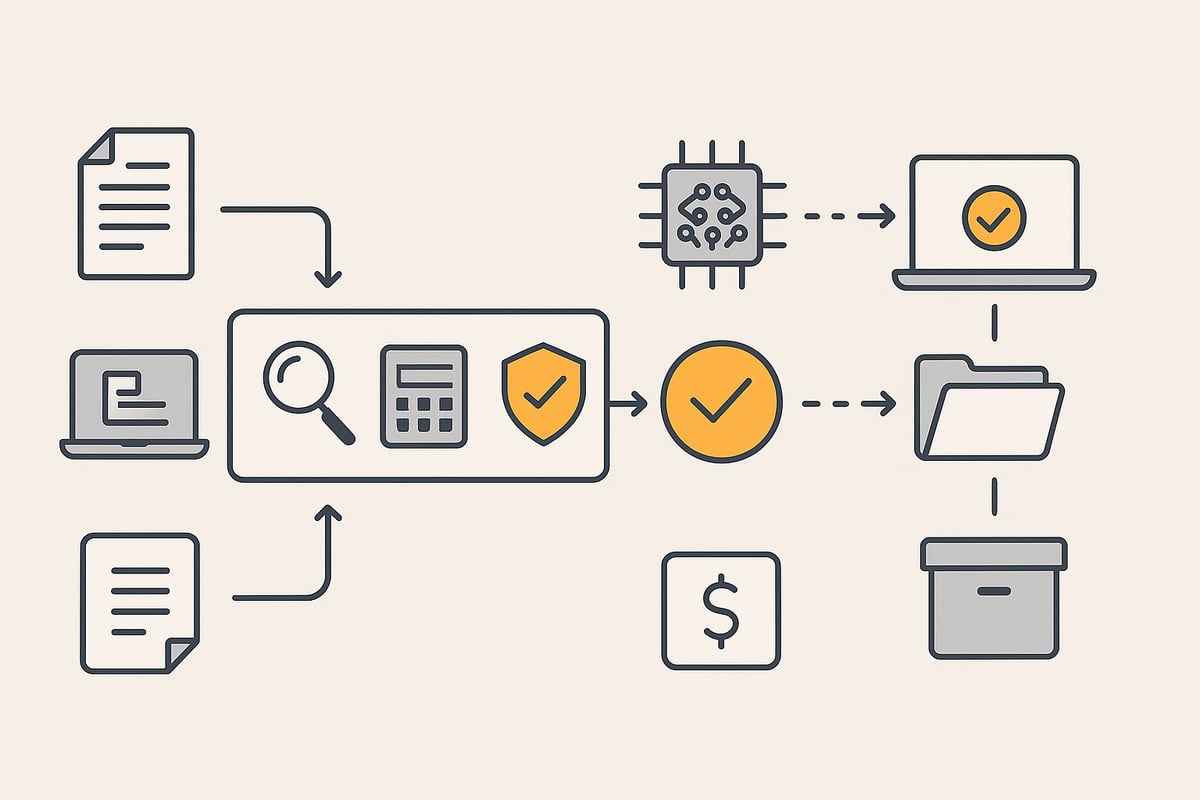

Automation and workflow optimization for incoming invoices

Automated workflows significantly increase efficiency when handling documents. Digital solutions make recurring tasks such as checking, approval, and posting much faster. Modern accounting software enables the integration of AI-powered data extraction, automatic review processes, and digital approvals.

Benefits of automated workflows:

-

Time savings of up to 50 percent

-

Transparency in the approval process

-

Reduction of manual errors

Choosing the right software is crucial. Automation in accounting provides an overview of how companies can future-proof their processes.

filehub: Automation of incoming invoice processes

filehub is a specialized platform that automates the entire workflow around the incoming invoice. Invoices are automatically retrieved from email inboxes, web portals, or cloud storage, processed, and handed over to accounting.

Integration with common accounting software works without any programming effort. Storage is GDPR-compliant in German data centers. A practical example: the invoice is archived automatically, checked, and forwarded to the responsible employee for approval.

filehub reduces errors, saves time, and ensures that all legal requirements are met. A free trial and flexible pricing make it easy to get started.

Digital archiving & retention obligations: How to stay legally compliant

Digital archiving is a central component of any modern accounting system. Strict legal requirements apply especially to incoming invoices to ensure companies are safe from a tax perspective. Those who know and implement the requirements protect themselves from risks and save time and costs in the long term.

GoBD-compliant archiving of incoming invoices

The GoBD apply to every incoming invoice, requiring audit-proof, unalterable, and traceable archiving. Electronic documents must be just as readable and available at all times as paper documents. Typical formats are PDF/A, ZUGFeRD, and XRechnung. It is important that every change is documented and the original state is preserved.

During audits, the tax office requires complete proof. Errors in archiving quickly lead to estimates or even tax disadvantages. According to statistics, 25 percent of companies risk fines due to inadequate archiving.

Practical tips:

-

Use only permitted archiving formats.

-

Record all processing steps in a traceable manner.

-

Regularly check the legibility of digital documents.

You can find detailed requirements in this GoBD-compliant archiving of incoming invoices-article.

Retention periods and locations: What you need to consider

Every invoice is subject to a statutory retention period of ten years. It does not matter whether the document is in digital or paper form. The decisive factor is that the storage location ensures access within Germany and that the data can be retrieved at any time.

Electronic invoices do not need to be printed additionally. Modern archiving solutions often offer automatic reminders of deadlines and audit-proof storage.

Checklist for retention:

-

Check whether all invoices are archived in full.

-

Ensure that only authorized persons have access.

-

Prepare for audits by performing regular spot checks.

Missing deadlines can lead to high fines. A digital solution that automatically monitors deadlines and access rights is therefore recommended.

Data protection and security for digital incoming invoices

Data protection is a must for incoming invoices. The GDPR stipulates how invoice data may be processed and stored. Encryption, access management, and regular deletion policies are mandatory. Especially for cloud solutions, it is important to ensure a server location in Germany.

For example: Platforms like filehub store invoice data in a GDPR-compliant manner in German data centers and offer C5 certification for the highest level of security. Modern tools log all access and support regular audits.

Tips for greater security:

-

Encrypt every incoming invoice from the moment it is received.

-

Define clear access rights and log all changes.

-

Carry out regular IT security audits.

You can find further digital best practices for finance departments in the digital solutions for finance processes.

Best practices & tips for efficient incoming invoice processes 2026

Efficient processes around the incoming invoice are a real success factor in 2026. Companies that continuously optimize their workflows not only save time and costs, but also minimize risks in accounting and tax law. With clear workflows, smart tools, and regular training, the invoicing process can be improved sustainably.

Process optimization: From capture to payment

A seamless, digital workflow is more of a must than a nice-to-have today. Standardized processes help avoid errors and accelerate processing. Automated workflows take over recurring tasks such as reading invoice data or forwarding it to responsible persons.

Digital approval processes, for example with electronic signatures, ensure transparency and traceability. Dashboards and monitoring tools make bottlenecks visible. Companies that rely on integration with accounting software can automatically transfer incoming invoices from email, web portal, or cloud directly into the ERP – saving up to 30% in processing costs.

Avoiding errors and ensuring compliance

The most common source of error is a lack of knowledge about legal requirements. Regular training of employees is therefore worthwhile. A well-documented process chain with clear responsibilities prevents invoices from being lost or not being checked.

Checklists and digital control mechanisms help avoid errors such as missing mandatory details or duplicate payments. Collaboration with tax advisors and the IT department is essential to continuously meet technical and legal requirements. Those who document all steps are also on the safe side during audits.

Trends 2026: Digitalization, AI & automation in accounting

The future of the incoming invoice is digital and intelligent. AI-based tools automatically detect and extract invoice data, assign it to the correct accounts, and trigger approvals in real time. Innovative integrations with ERP, DMS, and banking ensure seamless data flow.

Predictive analytics enables forecasts of cash flows or bottlenecks. Companies that embrace digitalization early gain a real competitive advantage. Those who stay informed about the e-invoice mandate from 2025 remain capable of action and compliant even when faced with future legal changes.

You now have a concise overview of what really matters for incoming invoices in 2026 – from the new legal requirements to the opportunities of digitalization. If you want to make your invoicing processes more efficient, secure, and future-proof, it’s worth taking a look at the possibilities of modern automation. With filehub, you can easily digitize recurring tasks and noticeably relieve your accounting – without any programming skills and always GDPR-compliant. Just try it yourself and discover how much time and stress you can save: Try filehub.one for free now