Proforma Invoice – What Is It Anyway?

In this post, you’ll learn what makes a proforma invoice, when it is needed, and how to issue it correctly. We clearly and understandably show you the differences from the commercial invoice, legal requirements, bookkeeping tips, practical examples, and typical mistakes.

Get ready to avoid uncertainties and optimize your processes. With the right knowledge about the proforma invoice, you’re well prepared.

What is a proforma invoice? Definition, purpose, and distinctions

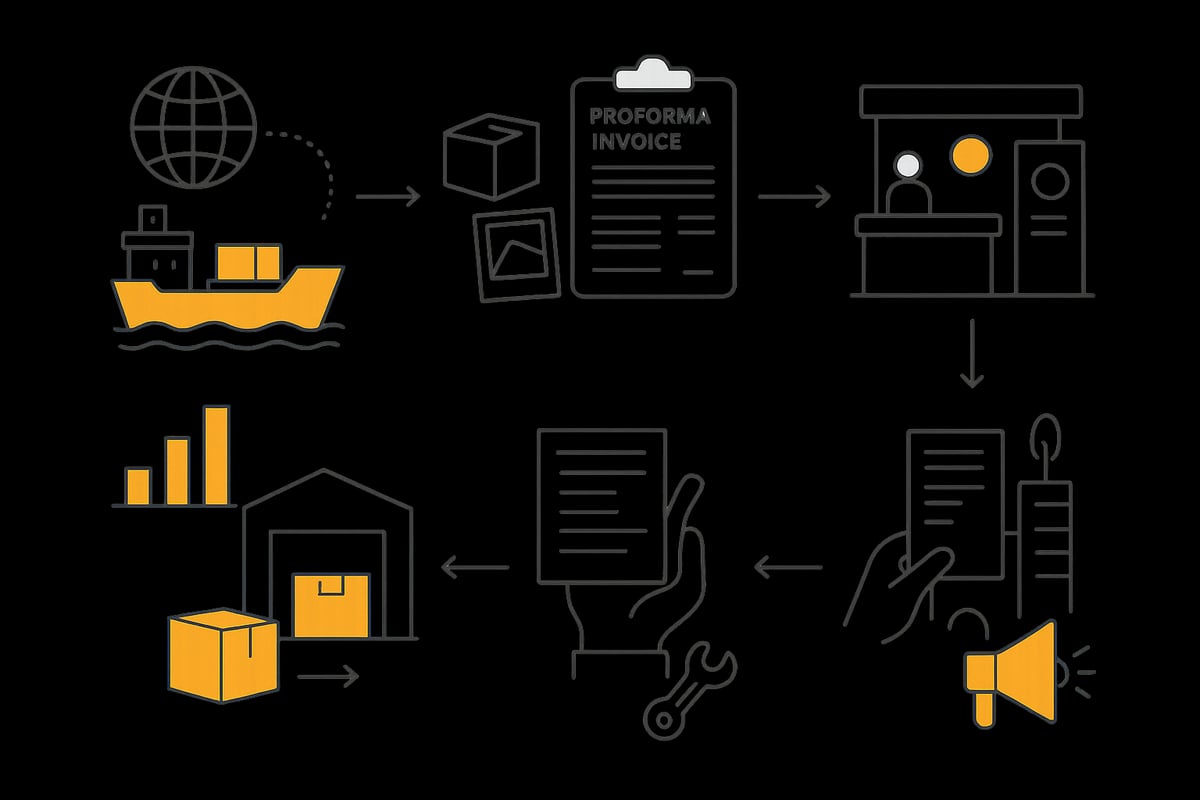

This type of invoice plays a central role in international trade and in special business transactions. But what exactly is behind it, and why isn’t it the same as a normal invoice? Anyone who regularly ships goods abroad or works with sample shipments should know the specifics of the proforma invoice to avoid costly mistakes.

Terminology and legal classification

A proforma invoice is a document that serves as proof of the value of goods but does not contain a request for payment. It is often created for information purposes or as an accompanying document for customs. Legally, this type of document is not considered a proper commercial invoice under §14 UStG. This means it neither triggers an obligation to pay nor entitles the recipient to an input VAT deduction.

In the international context, people often refer to it as “Proforma Invoice” or “proforma invoice.” Historically, it was used primarily in exports, for example as evidence for sample shipments or free-of-charge deliveries of goods. It is important to distinguish it from other documents such as delivery notes, because only this type of document fulfills the purpose of declaring the value of goods without a claim to payment. A classic example: When sending product samples abroad, a proforma invoice is required for customs.

If you want to dive deeper into the legal foundations and exact definition, you’ll find a comprehensive overview at Proforma invoice – learn all the essentials here.

Proforma invoice vs. commercial invoice: the most important differences

The most important difference between a proforma invoice and a commercial invoice lies in the payment function. While a commercial invoice documents the claim to payment, the proforma invoice serves solely as proof of the value of goods. It is not a basis for posting receivables or VAT.

The proforma invoice is typically used for free-of-charge deliveries such as samples, gifts, or for prepayment. For customs, it is indispensable, as it serves for declaration and control. A commercial invoice, on the other hand, is necessary for sales, tax calculation, and accounting.

|

Characteristic |

Proforma invoice |

Commercial invoice |

|---|---|---|

|

Request for payment |

No |

Yes |

|

Relevant for VAT |

No |

Yes |

|

Use for samples |

Yes |

No |

|

Customs clearance |

Yes |

Yes |

In 2024, according to a Lexware study, 70% of German exporters used proforma invoices for deliveries to third countries. An example: While a commercial invoice is created for a sale to a customer, this type of document is used for a gift or a sample shipment.

When is a proforma invoice necessary? Typical use cases

This type of invoice is required whenever goods without commercial value are sent abroad. This particularly applies to sample shipments, gifts, or temporary exports, such as for trade fair equipment. It is also needed for international transactions with non-EU countries such as Switzerland or Norway.

Other typical use cases are:

-

Advance copies for prepayment or letter of credit

-

Spare parts shipments under warranty

-

Donations and deliveries to non-profit organizations

For example: If a company donates goods to a relief organization, this type of invoice serves as proof for the donation receipt. Important to know: A proforma invoice cannot be subsequently converted into a commercial invoice.

Mandatory information and structure of a proforma invoice

A proforma invoice is only valid for export or as evidence if it contains all mandatory information and is set up correctly. The requirements are clearly defined, but in practice mistakes can creep in quickly. Here you’ll learn which details you must not forget, which wordings are crucial for customs, and what a professional proforma invoice should look like.

Which details are mandatory?

Certain mandatory information always has to be included for this type of invoice. This includes a clear label such as “Proforma Invoice.” In addition, complete details of the sender and recipient, including a contact person, must be provided.

Important mandatory information:

-

Invoice number and issue date

-

Delivery or performance date

-

Exact description of goods and quantity

-

Unit and total price or value of goods

-

VAT ID, EORI number, possibly commercial register number

-

Packaging, insurance, and transport costs

-

Delivery terms and country of origin of the goods

For international shipments, you should pay particular attention to the accuracy of all details. This type of document often serves as the basis for customs clearance. A clear template for documents and invoices helps you fill in all mandatory fields correctly and avoid errors.

Typical wording and notes for customs

Certain wording is indispensable for the proforma invoice when it is intended for export. Classic notes such as “No commercial value,” “For customs purposes only,” or “Not for sale” are standard and should always be included.

Such notes must appear in German and English so that customs authorities in Germany and in the destination country can understand them. Stating the purpose is especially important, as this document is usually used as value evidence for declaration.

Typical examples:

-

“No commercial value – For customs purposes only”

-

“No commercial value – For customs purposes only”

-

“Not intended for sale”

According to studies, over 80% of export proforma invoices contain bilingual notes. If these are missing, you risk delays in customs clearance or even fines. Carefully check the wording so that your proforma invoice is accepted without issues.

Structure and design: format, language, copies

The structure of this type of document follows the layout of a standard invoice. However, the unmistakable note “Proforma Invoice” is crucial. The language should be either German, English, or the recipient’s local language, depending on the destination country.

For shipping, it’s recommended to create the original and at least three copies. One copy goes inside the parcel, one is affixed to the outside of the parcel, one is for the freight forwarder, and one is for your accounting department. For sample shipments, this distribution is mandatory to properly inform all parties involved.

From a goods value of €1,000, an electronic export declaration is also required. This ensures your proforma invoice meets all legal and customs requirements.

Practical examples: when and how proforma invoices are used

The proforma invoice is a flexible tool in many companies’ daily operations, used in various business situations. Whether in international trade, payment processing, or special cases such as donations – the correct application saves time and avoids trouble with customs or accounting.

Proforma invoice in international trade

In international trade, the proforma invoice is indispensable, especially for exports to countries outside the EU such as Switzerland, Norway, or the USA. It serves as a value document for customs when goods without direct sales value – such as samples, promotional gifts, or temporary exhibition items – are shipped.

Typical examples in exports:

-

Shipping product samples to business partners

-

Delivery of promotional materials or gifts

-

Temporary export for trade fairs, events, or repairs

Especially for sample shipments, customs require this type of document to correctly declare the value of goods. According to statistics, around 60% of all proforma invoices in Germany are issued for export. Those looking for concrete guidelines and templates will find practical information for international use at Export and proforma invoice – IHK Lüneburg-Wolfsburg.

Proforma invoice for prepayment and letter of credit

Proforma invoices also play a central role in transactions with prepayment or letters of credit. Customers often request a preliminary copy before payment as confirmation of the order and as proof for the bank.

Typical situations:

-

The customer pays in advance and needs a proforma invoice as a basis for payment

-

Banks require this type of document to open a letter of credit (LoC)

-

Difference from an order confirmation: The proforma invoice contains detailed information on goods, value, and delivery terms

A common mistake is confusing it with the commercial invoice. The proforma invoice is not a request for payment and does not entitle the recipient to an input VAT deduction. If you handle this cleanly, you’ll avoid later discrepancies in accounting or customs clearance.

Other use cases: donations, spare parts, warranty cases

This type of document is also used for donations, spare parts deliveries, and warranty cases. Non-profit organizations use it as proof of in-kind donations to issue donation receipts. In warranty cases or replacement deliveries, a proforma invoice is created when spare parts are shipped abroad free of charge.

Example use cases:

-

Shipping spare parts to Poland under a warranty case

-

Documenting in-kind donations to non-profit organizations

-

Replacing defective products without a claim for payment

In accounting, the proforma invoice is recorded as an internal document, without creating an open item. This keeps the overview and meets requirements for tax and customs.

Proforma invoice and accounting: posting, tax, and input VAT deduction

This type of document plays a special role in accounting. It is not a classic request for payment but serves as evidence for certain business transactions, for example for sample shipments or spare parts deliveries. Especially in international business, it is important to know the accounting specifics to avoid errors and eliminate tax risks.

Accounting treatment and distinction

In accounting, the proforma invoice is often used as an internal document when a proper commercial invoice is not yet available or not required. It is used for accrual purposes on the vendor or customer side, for example when goods are sent abroad as samples. In practice, this type of document is initially recorded as a neutral posting without creating an open receivable or triggering dunning runs.

As soon as the actual commercial invoice arrives, the proforma invoice is reversed and the posting is transferred to the regular invoice. This ensures period-accurate allocation in the annual financial statements and prevents inconsistencies in the balance sheet. A typical example: At the end of the year, a delivery is in transit, but the original invoice is not yet available. This type of document is used as a preliminary voucher and subsequently neutralized. For a deeper understanding of the accounting basics, it’s worth taking a look at Accounting and bookkeeping basics.

VAT and input tax deduction: what is allowed?

For VAT purposes, the proforma invoice is clearly defined by law. It is explicitly not considered a proper invoice under §14 UStG, even if a value of goods or even VAT is shown. An input VAT deduction based on this type of document is therefore excluded. Only when the commercial invoice with all mandatory information is received may input VAT be claimed.

There are no exceptions to this rule, even if the proforma invoice contains all formal details. In 2024, around 15% of companies’ input VAT claims were rejected because they were based on a proforma invoice instead of a commercial invoice. Companies should therefore always ensure that tax postings are only made after receipt of the final invoice.

Risks and sources of error in accounting

Incorrect use of a proforma invoice entails significant risks. If, for example, incorrect value information is provided, this can lead to back taxes or fines during an audit. A subsequent conversion of this type of document into a commercial invoice is also not permitted and violates regulations.

Typical sources of error also include missing mandatory information or incorrect declaration in sample shipments. This can not only delay customs clearance but also have criminal consequences. Companies should therefore establish clear processes and carefully check each proforma invoice to minimize risks.

Step-by-step guide: how to create a proforma invoice correctly

Creating a proforma invoice isn’t rocket science, but every step counts. With this guide, you’ll avoid typical mistakes and ensure all requirements for 2025 are met.

Step 1: Determine the reason and purpose

Before issuing a proforma invoice, carefully check the reason. Is a sample being sent abroad, is it a gift, or has prepayment been agreed?

Consider whether only the value of the goods or a commercial value is relevant. Typical cases are sample shipments, promotional gifts, temporary exports such as trade fair equipment, or spare parts deliveries.

Choose this route only if no actual payment request is desired and the focus is on evidence or customs processing.

Step 2: Compile the mandatory information

Gather all mandatory information before you start. This includes:

-

Name and address of sender and recipient

-

Contact person, invoice number, issue date

-

Description of goods, quantity, unit and total value

-

Delivery date, delivery terms, country of origin

-

VAT ID, EORI number, if applicable commercial register entry

Especially for international shipments, up-to-date and complete information is crucial. Practical tips and a free template can be found at Proforma invoice: What you need to know (+ template).

Step 3: Issue and label the proforma invoice

Now create the document. Clearly mark it as “Proforma Invoice.” All details regarding the value of goods, quantity, and delivery terms must be clear and comprehensible.

Add notes such as “No commercial value” or “For customs purposes only,” ideally in two languages. For customs, wording such as: “This shipment is a sample, not intended for sale.” is often sufficient.

This ensures that customs clearance runs smoothly.

Step 4: Shipping and documentation

Distribute the original and three copies of the proforma invoice to the right places:

-

One copy in the parcel

-

One on the outside of the parcel (in a clear pouch)

-

One for the freight forwarder

-

One for your own accounting

From a goods value of €1,000, an electronic export declaration is mandatory. Document the shipment carefully so that all records are at hand in case of queries.

Step 5: Accounting entry and follow-up

In accounting, this type of document is recorded as an internal document if a commercial invoice is not yet available. No open item is created, and dunning processes are not triggered.

Once the official commercial invoice is received, a reversal entry is made and the amounts are transferred. Modern accounting systems make this process easier and help you keep track.

This keeps your accounting clean and audit-proof.

What to watch out for in 2025: tips, pitfalls, and current developments

2025 brings decisive innovations for the proforma invoice in international trade. Anyone exporting goods should already be aware of the most important changes to avoid errors and delays.

Electronic invoices and export declaration:

From 2025, stricter rules will apply to electronic documents in exports. Anyone using this type of document must ensure that all data is archived digitally, in an audit-proof manner, and according to the new requirements. The electronic export declaration is mandatory from a goods value of €1,000. This also applies to sample shipments and temporary exports.

Export controls and sanctions lists:

Before every export, check whether permits are required and whether the recipient is on a sanctions list. Incorrect or missing checks can lead to fines. Stay informed about current regulations, especially for shipments to sensitive countries.

Value declaration for sample shipments:

From 2025, the following applies to sample shipments:

|

Criterion |

Requirement according to the customs exemptions regulation |

|---|---|

|

Max. quantity |

5 units per sample |

|

Max. value per sample |

€50 |

A proforma invoice must contain these details exactly. Estimates below the threshold to circumvent checks are risky and can cause problems during customs audits.

Error prevention and documentation:

Ensure complete and correct information on all documents. Incomplete documentation is a common reason for delays in customs clearance or even for penalties. During audits, only seamless proof counts.

Digitization and automation:

More and more companies are using digital tools to automate the creation and management of proforma invoices. Modern accounting software saves time and reduces sources of error. In 2024, 40% of SMEs in Germany were already using digital solutions. You can find more in the article on automation in accounting.

Outlook 2025:

Expect further changes in customs and tax law. Stay informed, check for updates regularly, and use digital workflows to keep track. This is the only way your proforma invoice will remain legally compliant and efficient in 2025.

FAQ: frequently asked questions about the proforma invoice

Do you have questions about the proforma invoice? Here you’ll find the most important answers regarding creation, legal requirements, and practical implementation. For an in-depth overview, you can find more background at Proforma invoice – Wikipedia.

Does every proforma invoice need an invoice number?

Yes, each of these documents should have a unique number. This makes tracking easier and is essential for documentation, even if it is not a classic invoice.

When is a proforma invoice legally binding?

A proforma invoice is not a payment document and does not create a claim for payment. It only serves as proof of the value of goods, for example for customs.

Can I show VAT on a proforma invoice?

No, VAT must not be shown on the proforma invoice. It is not a proper invoice within the meaning of the VAT Act.

What happens if the information is incorrect?

Incorrect values or missing mandatory information can lead to delays in customs clearance. In the worst case, fines or audits may follow.

How many copies do I have to create for export?

Create at least four copies:

|

Purpose |

Copy required? |

|---|---|

|

Recipient |

Yes |

|

Freight forwarder |

Yes |

|

Exporter |

Yes |

|

Accounting |

Yes |

Can a proforma invoice be converted into a commercial invoice?

No, a proforma invoice cannot subsequently be turned into a commercial invoice. A separate commercial invoice must be created for the sale.

Which software supports creating proforma invoices?

Many accounting and ERP programs offer special templates, for example Lexware, SevDesk, or DATEV.

What special features apply to donations and spare parts deliveries?

For donations to non-profit organizations and spare parts under warranty, this type of document is used as evidence. Special documentation requirements apply here, but no VAT.

You now have a comprehensive overview of how important the proforma invoice will be in 2025 for international business, accounting, and legally compliant processes. You may have noticed while reading how much time and effort correct creation and management can take. This is exactly where filehub comes in: With smart automation, you save yourself tedious routines, improve your workflows, and always have all documents under control – of course GDPR-compliant and developed in Germany. Just try it out and see for yourself how easy proforma invoices and more can be – try filehub.one for free now.