XRechnung – The Guide to the Digital Invoice

Since 2025, XRechnung has been at the center of digital invoicing in Germany. This development affects everyone, whether small business, mid-sized company, or large corporation.

Why is this important? The switch to XRechnung offers enormous opportunities. You can accelerate processes, minimize errors, and meet all legal requirements.

With this guide, you’ll get a clear, practical roadmap. Step by step, we show how to successfully introduce digital invoices and avoid common mistakes.

Our goal: to provide you with an up-to-date guide to XRechnung. Look forward to definitions, legal foundations, benefits, challenges, concrete implementation steps, and best practices.

What is XRechnung? Definition, origin & standardization

XRechnung is at the heart of the digital transformation of invoicing in Germany. It is more than a new file format: it forms the basis for efficient and legally compliant business processes. Since 2025, companies of all sizes can no longer avoid digital invoices.

The origins of XRechnung

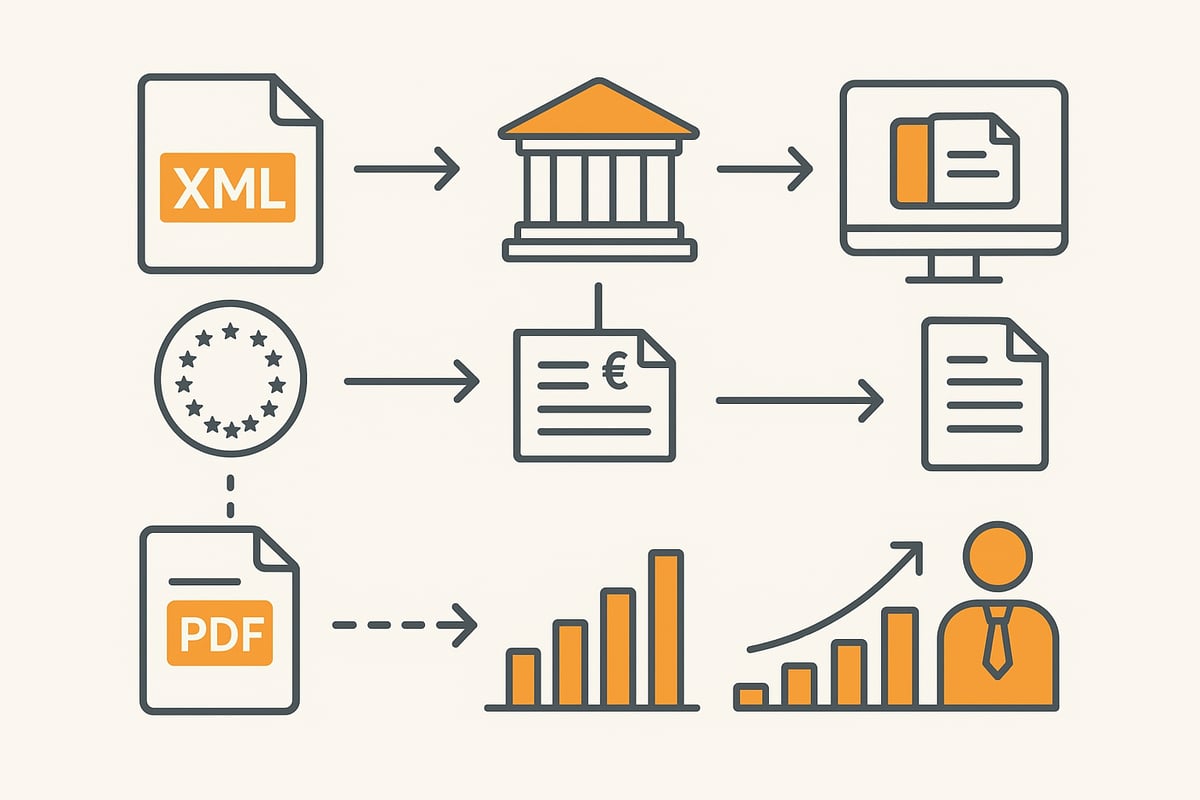

XRechnung was developed by the Coordination Office for IT Standards (KoSIT). It is the response to EU standard EN 16931, which defines uniform standards for electronic invoicing in Europe. The goal was to simplify and digitize invoice exchange between businesses and public administrations.

XRechnung has existed as a standard since 2017, and since 2020 it has been mandatory for suppliers to the public sector (B2G). From 2026, XRechnung will also be mandatory in B2B. Unlike formats such as ZUGFeRD, XRechnung is purely data-based. Public administration has accepted only XRechnung since 2020.

Further information on the legal background can be found in the Legal foundations of XRechnung.

Technical fundamentals and data structure

Technically, XRechnung is based on the XML format. This means it is machine-readable and structured, enabling automated processing. It is based on the semantic data model of EN 16931, which defines uniform mandatory and optional fields.

An XRechnung must contain certain mandatory fields such as invoice number, date, and amounts. Optional information can be added. Validation takes place automatically, so errors or missing information are quickly detected. Compared to PDF invoices, XRechnung is not just an image but contains clearly structured data.

XRechnung vs. other e-invoicing formats

XRechnung differs significantly from other formats such as ZUGFeRD or EDIFACT. ZUGFeRD combines PDF and XML, while the digital invoice relies exclusively on structured XML data. EDIFACT is an older standard mainly used in international contexts.

The advantages lie in automated processing and easy archiving. It is particularly suitable for companies that want to handle large invoice volumes efficiently and error-free. According to a Bitkom study, however, only 45 percent of companies are technically prepared for the introduction of digital invoicing. This shows how important early transition is.

Legal foundations & obligations from 2026

From 2026, the legal landscape surrounding XRechnung will become significantly more complex for companies in Germany. Anyone exchanging invoices digitally must know and implement the new requirements. Here you will find the most important legal cornerstones, obligations, and deadlines you need to observe.

Legal requirements and deadlines

XRechnung is based on EU Directive 2014/55/EU, which mandates uniform electronic invoicing in the public sector. Germany implemented these requirements with the E-Invoicing Act. Since 2020, digital invoices have been mandatory for B2G relationships, and from 2025/2026 they will be mandatory in the B2B sector. Transitional periods apply for smaller companies, allowing for a step-by-step transition.

The Growth Opportunities Act forms the legal basis for the new obligation to use XRechnung. Those who do not meet the deadlines risk rejections or tax disadvantages. Exceptions exist for small businesses and certain tax-exempt services. A comprehensive overview of the advantages and challenges can be found in the article E-invoicing obligation in Germany: Advantages and challenges.

Who has to use XRechnung?

The obligation to use XRechnung affects all suppliers to the public sector and, from 2026, almost every company in the B2B sector. Self-employed individuals and freelancers who issue invoices to business customers are also affected. Exceptions apply to small businesses and tax-exempt services. Industries with special requirements can use their own extensions to include industry-specific data.

Typical stakeholders in the process are invoice issuers, recipients, and IT and accounting departments. Compliance with the standard is especially crucial for companies with international business partners, as XRechnung is based on EN 16931.

Requirements for archiving & GoBD compliance

XRechnung is subject to a ten-year retention period. The electronic invoice must remain unaltered, machine-readable, and available at all times during this period. Companies are obliged to archive digital invoices in a GoBD-compliant and audit-proof manner. The GDPR also plays a role, as personal data must be protected.

Digital archiving solutions often offer automatic backups and make it easier to comply with legal requirements. Tax authorities can request an audit of XRechnung and the archiving systems at any time, so documentation should always be up to date and complete.

Transmission channels & platforms

The transmission of XRechnung takes place via central platforms such as ZRE (Central Invoice Receipt Platform of the Federal Government), OZG-RE, or the European Peppol network. Many companies also use email or direct interfaces to ERP systems to submit digital invoices automatically.

All platforms carry out automatic validation, so only correct and complete invoices are accepted. This ensures greater security and efficiency in the digital invoicing process.

Benefits & opportunities of XRechnung for companies

The introduction brings numerous advantages for companies. It opens up new opportunities to optimize processes and drive digitization forward. Those who adopt digital invoices early gain a real competitive advantage.

Increased efficiency and cost reduction

With XRechnung, invoice processes are automated, resulting in significantly fewer errors and higher speed. Manual data entry is eliminated because all relevant information is transmitted in a structured, machine-readable format. Payments can be processed faster, improving liquidity.

A comparison shows: Processing a paper invoice takes several days on average, whereas an XRechnung is often handled within a few hours. Especially with larger invoice volumes, automation leads to massive savings. Platforms like Automated invoice processing with filehub demonstrate how digital workflows with XRechnung work efficiently and without media disruptions.

With digital invoices, personnel costs can also be reduced, as fewer resources are tied up in routine tasks. This creates freedom for value-adding activities.

Improved data quality and security

Digital invoices rely on validation and structured data, minimizing sources of error. Mandatory fields ensure that all necessary information is present. This significantly reduces the risk of rejections or payment delays.

Through machine processing, all XRechnungen are traceable and archived in an audit-proof manner. This facilitates compliance with legal requirements and protects against compliance risks. Attempts at fraud are also made more difficult by clear identification and robust verification routines.

Companies benefit from greater transparency and control over their financial processes. This builds trust with business partners and authorities.

Digitization as a competitive advantage

The switch to XRechnung is an important step toward digital transformation. The standard meets the requirements of international business partners and facilitates cross-border collaboration. Companies that switch early are well prepared for future developments and new markets.

With XRechnung, integration into modern ERP and accounting systems is simplified. Processes run more efficiently and flexibly, allowing innovations to be implemented more quickly.

Those who integrate digital invoices into their strategy secure long-term competitive advantages and remain capable of acting even in the face of future legal changes.

Challenges & common pitfalls during implementation

Introducing XRechnung comes with numerous challenges that companies often underestimate. Technical, organizational, and human pitfalls occur especially when transitioning to digital processes. Those who recognize these early can avoid common mistakes and manage the transition in a targeted way.

Technical and organizational hurdles

Many companies encounter technical and organizational hurdles during implementation. Integration into existing ERP or accounting systems is often complex, especially when older software is in use. Small businesses without their own IT department face additional challenges, as they often lack resources and know-how.

Typical pitfalls are:

-

Missing interfaces to invoice receipt platforms

-

Incompatible software

-

Unclear responsibilities within the company

It becomes particularly critical when processes are not properly documented. Many companies underestimate the effort required to adapt their workflows. Those who inform themselves early and use external support can avoid these problems. Practical tips and a structured transition plan can be found in this XRechnung: How to transition successfully guide.

Sources of error and compliance risks

A common stumbling block with digital invoices is faulty or incomplete XML files. If mandatory fields are not filled in correctly, invoice receipt platforms quickly reject them. Sending PDF or Excel files instead of valid formats also leads to problems.

Compliance risks include:

-

Non-compliant file formats

-

Lack of validation before sending

-

Insufficient employee training

Without clear processes, delays and financial disadvantages threaten. Faulty invoices are not accepted and create additional effort. Thorough validation and automated checks are therefore essential.

Change management & employee involvement

Implementation is not only a technical but also an organizational challenge. Employees must understand and accept new tools and processes. Without targeted training and clear communication, uncertainties and resistance arise within the team.

Best practices for successful change management:

-

Early involvement of all relevant departments

-

Regular training on XRechnung and new procedures

-

Creation of checklists and guides for day-to-day work

Successful companies rely on an open feedback culture and continuous support. This turns XRechnung into an opportunity for sustainable process optimization and digitization.

Step-by-step guide: How to implement XRechnung in 2026

Do you want to process XRechnung successfully in your company? With a structured approach, the transition can be stress-free and efficient. This step-by-step guide shows you how to meet legal requirements, minimize sources of error, and benefit sustainably from digitization.

1. Assessment & requirements analysis

Before you introduce XRechnung, you should conduct a thorough assessment. Analyze your current invoicing processes and identify all interfaces affected by the transition.

Determine which departments and systems are involved in invoicing. Check whether digital solutions are already being used and whether they are suitable for XRechnung.

Identify the legal requirements that apply to your company. Clarify deadlines and check whether special regulations apply. This lays the foundation for a smooth transition to XRechnung.

2. Selecting the right software & tools

Choosing the right software is crucial for successful implementation. Consider whether you need standalone software, an ERP module, or an online generator.

Important criteria are compatibility with existing systems, user-friendliness, support, and scalability. Check whether the software supports both single and batch invoices.

Prepare a cost-benefit analysis to find the best solution. Many providers offer trial versions that allow you to test integration in advance. This helps you find the right tool for your processes.

3. Technical integration & interfaces

Technical integration is a central step. Connect the software to your ERP and accounting systems. Use interfaces to central platforms such as ZRE, OZG-RE, or Peppol.

Carry out test runs with real invoice data to validate the output. Automate error checking so that faulty invoices are detected early.

For efficient implementation, it is advisable to connect to accounting software such as Lexware. Here you will find a guide to the integration of accounting software, which shows how automated XRechnung workflows can be integrated into existing systems. This saves time and reduces sources of error.

4. Training & change management

For digital invoices to be accepted in your company, targeted employee training is essential. Build understanding for the new processes and make the benefits clear.

Create practical guides and checklists for all affected teams. Communicate clearly why the transition is necessary and which legal requirements must be observed.

Offer continuous support, for example through a feedback culture or regular updates. This ensures that all employees can use XRechnung safely and efficiently.

5. Monitoring, optimization & troubleshooting

After implementation, you should regularly monitor the processes. Identify sources of error early and optimize workflows if necessary.

Use monitoring tools to check compliance with legal requirements. Appoint a person responsible for compliance who acts as a contact for questions.

Automation solutions such as invoice download and processing help manage invoices efficiently and integrate them into digital workflows. This keeps your company flexible and compliant.

6. Retention & archiving

Audit-proof, digital archiving is mandatory. Implement solutions that ensure machine readability and immutability over ten years.

Pay attention to GoBD and GDPR compliance. Digital archiving systems with automatic backup functions offer additional security.

Ensure that you can access archived XRechnungen at any time. This prepares you optimally for audits by tax authorities and ensures compliance with all legal requirements.

Best practices & tips for successful implementation

Many companies face the challenge of introducing digital invoicing efficiently. Those who act early benefit not only from a faster transition but also from measurable advantages. One example: companies that have already switched to XRechnung report up to 60 percent less processing time. Sources of error have been reduced, payments are made faster, and process transparency increases. Companies are particularly successful when they involve all participating areas early and view the transition as a joint project.

Real-world case studies

XRechnung delivers tangible improvements in practice. Companies that switched early report:

-

Time savings: Automated processes speed up invoice processing.

-

Fewer errors: Structured data reduces the error rate.

-

Faster payments: Optimized processes lead to shorter payment terms.

Statistics show that companies with automated digital invoicing save up to 60 percent of processing time. Those who see implementation as a team effort can successfully overcome challenges such as interface adjustments or employee training.

Recommendations for sustainable digitization

Sustainable digitization works best if you introduce XRechnung step by step. Start with pilot projects before switching all processes. Rely on automation for recurring tasks and keep your systems up to date at all times. Working with experienced service providers helps to avoid pitfalls.

Regular exchange between IT and the finance department ensures smooth processes. For further inspiration, you can find concrete solutions for the finance department around invoices and digital workflows with practical relevance.

File automation with filehub: Efficient integration of XRechnung workflows

With filehub, processes can also be easily automated and integrated into existing systems. The platform connects web portals, downloads invoices automatically, and passes them directly to internal workflows—without any programming.

filehub is ideal for companies of all sizes, as the solution is GDPR-compliant and secure from Germany. Multi-stage workflows, simple archiving, and flexible customization make integration efficient and future-proof.

You have now seen how much potential there is in automating your processes—from increasing efficiency to secure archiving. If you want to take the next steps and truly future-proof your document workflows, just try filehub for yourself. The platform not only takes tedious routines off your hands but also connects all important systems without any programming effort. This way you benefit directly from fast processes and full GDPR compliance.

Would you like to experience how easily digital invoicing solutions fit into your daily work? Then try filehub.one for free now.