Allianz Direct - The Essentials at a Glance

The insurance industry is changing rapidly, and allianz direct is setting new standards in 2025 as a digital pioneer. More and more people are looking for flexible, transparent solutions for their protection.

In this guide, you’ll learn what makes this insurer unique, which benefits and innovations await you, and why digital services are becoming increasingly important. You’ll get a compact overview of history, product portfolio, plan options, customer service, and future trends.

The focus is on security, flexibility, and transparency so you can make an informed decision.

Allianz Direct – Company and Development

Allianz Direct is among the most innovative direct insurers in Germany. The company’s roots go back to 1999, when it was founded under the name Vereinte Spezial Versicherung AG. Over the years, the company underwent several name changes, including to Allianz24 and Allsecur. In 2019, it was finally renamed allianz direct to underscore its international orientation and digital business model. If you want to learn more about the company’s history, you’ll find details in the History of Allianz.

The focus at allianz is consistently on direct distribution via digital channels. Traditional insurance agents or branches no longer play a role. Customers take out their insurance entirely online and manage their policies digitally. This approach makes allianz direct particularly flexible and enables rapid adaptation to new market trends and customer needs.

The leadership structure is lean and modern. At the top, the executive board includes Philipp Kroetz, among others. The team consists of 288 employees (as of 2021), who primarily work in Munich. Despite a comparatively small workforce, the insurer generated revenues of 137 million euros in 2021. After several portfolio transfers, the company was able to further consolidate its position in the market.

Internationally, allianz direct is active in several European countries. The company adapts to local markets in terms of both product portfolio and brand presence. Renaming Allsecur to allianz direct was a strategic move to create a unified, digital brand experience across Europe. In the German insurance market, this insurer is now considered a pioneer of digital innovation and sets standards in online sign-up, service, and transparency.

Product portfolio 2025: Overview of insurance

Allianz’s product portfolio in 2025 is as diverse as it is digital. Here you’ll find a concise overview of the most important insurance products and new services that position allianz direct as a digital pioneer.

Car insurance

Allianz Direct’s car insurance is one of the core products and offers you maximum flexibility in 2025. You can choose between liability, partial comprehensive, and fully comprehensive. Each option protects you individually—from damage to your own vehicle to third-party claims.

Practical add-ons such as breakdown cover and passenger accident insurance provide even more safety on every trip. The digital claims notification is particularly popular: in an emergency, you can report claims conveniently via the app or customer portal and check the processing status at any time.

Online sign-up is standard with this insurer. You receive the instant policy directly by email—no paper, no waiting. According to current statistics, the market share of direct motor insurers is steadily growing. Customers particularly praise the simple processing and quick responses.

Plan options are designed to be flexible. Your premium depends on vehicle type, driving behavior, and no-claims history. Modern telematics plans reward safe driving with attractive discounts. This makes allianz direct one of the first choices for many drivers.

Other insurance products

Beyond car insurance, Allianz offers a broad range of property and personal insurance. Personal liability insurance protects you against the financial consequences of everyday mishaps, while household contents insurance protects your belongings against burglary, fire, or water damage.

For legal disputes, legal protection insurance is at your side—including advice and cost coverage in case of disputes. The dental supplementary insurance is offered in cooperation with Allianz Private Krankenversicherungs-AG and covers high-quality dental treatments.

Your family’s financial protection is also covered: Term life insurance is brokered via Deutsche Lebensversicherungs-AG and can be concluded directly in the online portal. Cross-selling offers make it possible to combine various policies and benefit from reduced premiums.

Online statistics show that demand for supplementary insurance in digital distribution continues to rise. Customers appreciate the transparency and quick access to individual products—clearly an advantage of this insurer.

Digital innovations and services

Digitalization at allianz direct is more than just a buzzword. Online sign-up is intuitive: a comparison calculator helps you find the right product. In the customer portal, you manage all policies centrally, upload documents, and always have an overview of your policies.

Automated processes ensure smooth workflows—from claims reporting and premium changes to switching contracts. The mobile app lets you keep insurance documents at your fingertips anywhere and check the status of requests or claims in real time.

A highlight is the chatbots and AI-powered services that answer questions and help with problems around the clock. The introduction of these systems has significantly increased the utilization of digital services at allianz direct. As Automation of processes shows, customers and providers alike benefit from more efficient workflows and lean processes.

Statistics show that more and more policyholders are actively using insurers’ digital capabilities. This makes the platform a pioneer in the digital insurance market.

Allianz Direct rates & pricing 2025

Want to know how allianz direct’s plans are structured and what to expect in 2025? Pricing is more flexible than ever. Here you’ll find a clear overview of how the plans work, which pricing factors matter, and how you can benefit from discounts.

Plan structure and pricing factors

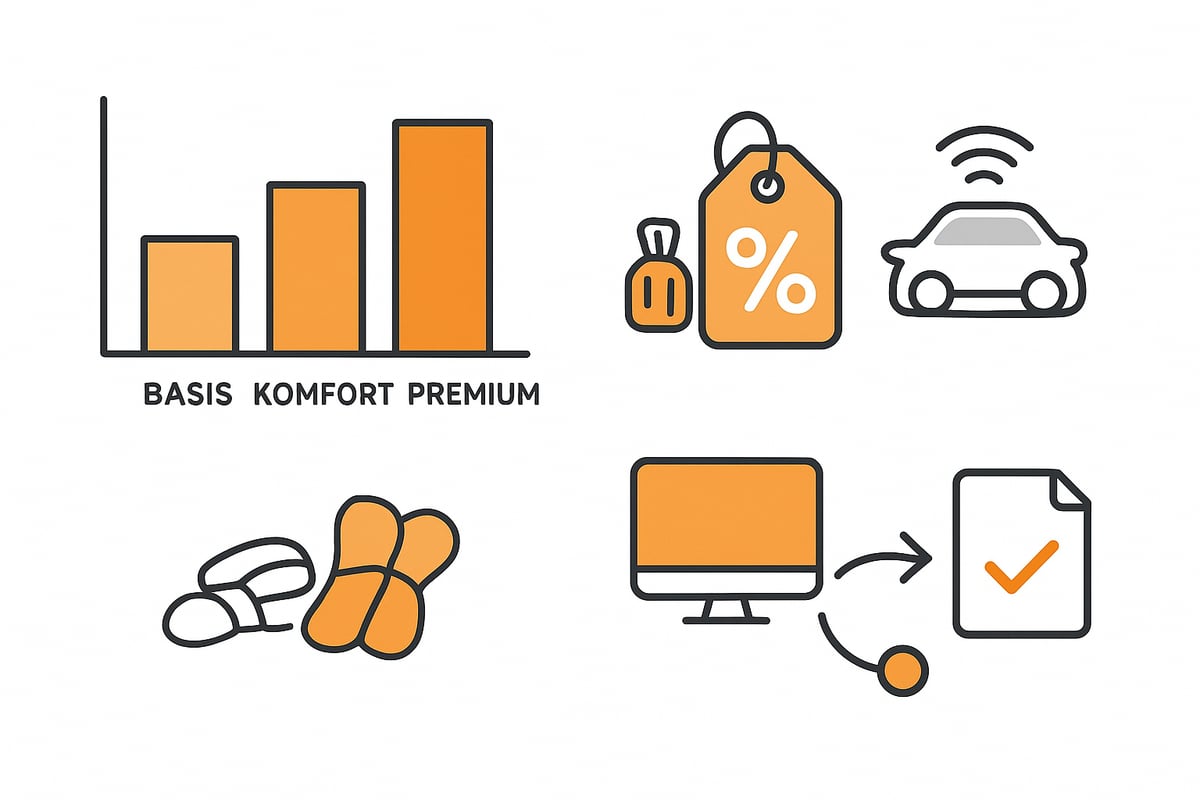

The plan model emphasizes transparency and adaptability. You can choose between Basic, Comfort, and Premium. Each plan offers a different scope of benefits and is tailored to your needs.

Premium calculation is individualized. Factors such as vehicle type, authorized drivers, and no-claims discount determine your premium. Annual mileage and place of residence also play a role. Particularly interesting: telematics plans reward safe driving with attractive discounts.

Here’s a comparison of the plan models:

|

Plan |

Benefits |

Target group |

|---|---|---|

|

Basic |

Statutory minimum coverage |

Price-conscious |

|

Comfort |

More benefits, e.g., international cover |

Frequent users |

|

Premium |

All-round protection, extras |

Demanding customers |

Further savings are available through bundle offers or a voluntary deductible. Those who sign a contract online often receive an additional discount. According to the Allianz Direct Annual Reports, the average premium in 2021 was well below the market average. This speaks to the efficiency of the insurer’s digital processes.

Transparency and comparability

Clarity is essential when choosing a plan. allianz direct places great value on transparent presentation of benefits and costs. With the online quote calculator, you can compare individual offers in just a few minutes. This lets you see at a glance how price and benefits differ.

Compared with other direct insurers, for example on CHECK24, this insurer regularly scores with fair premiums. The user-friendly interface makes it easy to try out different options. Price transparency is a crucial factor when deciding for or against a provider.

Want to know what to expect? The calculator immediately shows how changes to the driver group or deductible affect the premium. This helps you find the right combination for you and provides certainty in your decision.

Switching and cancellation

Switching is straightforward. You cancel your old policy online and can activate your new cover immediately afterwards. Taking over existing policies is possible without any issues.

Notice periods comply with legal requirements, usually at the end of the year with one month’s notice. Particularly practical: after online sign-up, you receive immediate insurance coverage. According to current statistics, the switching rate in the direct insurance market is around 15 percent and rising.

With just a few clicks, you can adjust or cancel your policy. allianz direct supports you with digital tools and a clear process. This gives you flexibility and saves time. You’re always optimally protected without unnecessary effort.

Customer service and digital support

In 2025, customer service stands out clearly from the competition thanks to consistent digitalization and high convenience. If you’re looking for quick answers, flexible solutions, and straightforward administration, allianz direct offers a service experience tailored to the needs of modern policyholders.

Availability and service channels

allianz direct offers various service channels around the clock. Whether by phone, email, live chat, or digital assistants such as the chatbot “Sophie”—availability is ensured at all times. The 24/7 online service is particularly popular, offering quick help with questions or policy changes.

The digital self-service platform allows you to handle many concerns on your own. Through the customer portal, you can view policies, upload documents, and make changes to your coverage. A particular advantage is the digital document management that gives you access to important documents in your account at any time.

Common concerns such as claim status, premium adjustments, or plan changes are handled directly online. This increases efficiency and ensures short wait times. Statistics show that over 80 percent of customers prefer digital channels to contact allianz direct. High customer satisfaction results from the simple operation and quick response time of the digital services.

-

24/7 hotline and email

-

Live chat and chatbot “Sophie”

-

Customer portal for policy management

-

Digital document management

-

FAQ and self-service area

With this mix of personal support and digital tools, this insurer positions itself as a pioneer in modern customer service.

Claims management and processing

Claims management is fully digitalized and relies on fast, transparent processes. In the event of a claim, you start the report conveniently online or via the customer portal on mobile. An intuitive step-by-step guide walks you through the entire process.

After submission, you receive regular updates on the status of your case directly to your smartphone or by email. Processing time is particularly short compared with the industry average: on average, claims at allianz direct are reviewed and paid within 48 hours.

Automated workflows ensure that documents are reviewed quickly and payouts are made without delay. Digitalization reduces sources of error and creates transparency—you always know the status of your claim settlement.

Customers praise the straightforward processing and clear communication paths. Especially in the car segment, many appreciate being able to complete the entire process without paper and waiting times.

Customer ratings and experiences

Experiences are predominantly positive. In independent tests, for example on CHECK24, the direct insurer regularly receives top marks for price-performance and service. allianz direct also scores highly on review platforms such as Trustpilot, with a high recommendation rate.

To present customer satisfaction transparently, here is an overview of the most important evaluation criteria:

|

Platform |

Rating |

Recommendation |

|---|---|---|

|

CHECK24 |

Very good |

92 % |

|

Trustpilot |

4.5/5 stars |

89 % |

Many customers emphasize the fast online sign-up, the simple claims reporting, and the friendly support. The transparency of the plans and the innovative strength are particularly highlighted.

The high service quality and the focus on digital support make allianz direct a popular choice in the direct insurance market.

Digitalization & future trends at Allianz Direct

Digitalization is shaping the insurance industry like never before. The insurer is deliberately focusing on innovative technologies and sustainable solutions to continue to be a digital pioneer in 2025. What new services, technologies, and trends can you expect? Here’s a practical overview.

Technological innovations

allianz direct is driving digitalization forward at full speed. The focus is on artificial intelligence and automated workflows that simplify many insurance processes. Chatbots handle the initial consultation, AI algorithms analyze claims and accelerate settlement.

One example: fraud detection at allianz direct is now predominantly AI-based. This speeds up processing and provides greater security in the system. Automated policy management and claims reporting save time—for customers and employees alike.

The Allianz Digital Times clearly shows how this insurer is driving digital services and innovation across the industry. According to internal statistics, over 60 percent of all claims processes are already automated. The goal: by 2025, almost all standard processes should run digitally.

-

AI in claims management

-

Automated policy and premium administration

-

Real-time status for claims

Sustainability and social responsibility

Sustainability has long been more than a trend for allianz direct. Digital policies replace paper documents, saving resources and speeding up processes. In e-mobility in particular, the company offers special insurance solutions for electric and hybrid vehicles.

CO2 offsetting in the car segment is gaining importance. allianz direct offers plans where part of the premium flows into climate protection projects. This not only benefits the environment but also strengthens the trust of modern customers.

Many customers appreciate the ability to manage their documents completely digitally. This noticeably reduces the ecological footprint. Sustainable insurance will be a decisive competitive factor in 2025—this insurer is well positioned here.

-

Digital documents instead of paper

-

Eco-friendly plans for electric cars

-

Contribution to climate protection projects

Outlook: Insurance market 2025

The future of the insurance market will be shaped by digitalization and personalization. allianz direct relies on data-based plans that take individual needs into account. Embedded insurance and platform solutions make it possible to take out insurance directly when buying a car or via partner portals.

Forecasts show that the share of direct insurers in the overall market will continue to rise. Allianz is regarded as a role model for digital transformation and flexible product design. By 2025, it is expected that over 40 percent of all new policies will be concluded online.

Trends at a glance:

|

Trend |

Significance for allianz direct |

|---|---|

|

Personalized plans |

Tailor-made offers |

|

Embedded insurance |

Integration into partner portals |

|

Automated services |

Faster processing |

allianz direct thus remains a key driver for the future of the insurance industry.

Frequently asked questions (FAQ) about Allianz Direct

Do you have questions about allianz direct? Here you’ll find concise answers to the most important topics customers ask about most often. This gives you a quick and clear overview of the special features, processes, and services.

What distinguishes allianz direct from traditional insurers?

allianz direct is a pure direct insurer without field sales. You complete your insurance entirely online and manage policies digitally. There are no in-branch personal consultations; instead, you can reach support flexibly via chat, phone, or email. As part of the Allianz Group, allianz direct benefits from its experience and stability. You can find details about the group structure at Allianz corporate structure.

How does the online sign-up work step by step?

Signing up with allianz direct takes just a few minutes: on the website, select the desired product, enter the relevant data, and compare plans. After selecting, you immediately receive an individual offer. Once confirmed, you’ll receive the policy directly by email. Practical: coverage can begin immediately if you wish.

What options are there for customizing my plan?

With allianz direct, you can adjust many parameters, such as deductible, coverage limits, or add-ons. Particularly popular are flexible plans with telematics options or discounts for multiple policies. The online calculator shows you transparently how changes affect the premium. This way you’ll find the optimal balance between price and benefits.

How secure is my data with allianz direct?

Your data is protected by modern encryption and strict data protection guidelines. Transmission is SSL-secured. In addition, access in the customer portal is monitored and regular security updates are applied. You can rely on your information being treated confidentially.

What to do in the event of a claim? Process and tips

In the event of a claim, you report the incident directly in the customer portal or via the app. allianz direct guides you step by step through the digital claims notification. You upload photos and documents, track the status, and are informed about every step. Tip: have all relevant documents ready to speed up processing.

How can I cancel or switch my policy?

Canceling with allianz direct is straightforward. You can submit it directly online in the customer portal. You’ll find the notice periods transparently in your policy documents. After successful cancellation, you’ll receive confirmation by email. Switching to another provider is also possible digitally and is supported.

What services are available in the customer portal?

The allianz direct customer portal offers numerous self-service features:

-

Policy overview and document download

-

Claims reporting and status tracking

-

Change personal data

-

Retrieve premium certificates

An intuitive navigation ensures you find everything quickly.

Example: Frequently asked questions from customer service evaluations

The questions most frequently asked to allianz direct support include topics such as switching policies, claims reporting, plan options, and login details. Many customers particularly appreciate the short processing times and transparent communication.

You can see how strongly digitalization is changing the insurance world—and how important smart, secure processes are in everyday life. If you’re looking for ways to make your own document workflows as efficient and automated as Allianz Direct’s services, it’s worth taking a look at filehub. With it, you can process documents seamlessly, connect various tools, and enjoy the highest data security. Just give it a try and discover how much time and effort you can save—Try filehub.one for free now.