O2 Invoices - Important Information at a Glance

Many users know this: the annual O2 invoices land in the inbox and often cause uncertainty. Is the amount correct, were all discounts applied, is the billing really accurate?

If you understand your O2 invoices, you have a clear advantage. You’ll spot errors faster, can save strategically, and always keep an eye on your costs. This keeps you well informed and protects you from unpleasant surprises.

With this O2 invoices guide, you’ll get a compact overview of how to view, interpret, and securely manage invoices correctly.

Read on now to learn everything important about provisioning, analysis, and archiving your O2 invoices.

O2 invoices 2026: What’s new?

The O2 invoices for 2026 bring numerous innovations relevant to both private and business customers. At the turn of the year, invoicing and the legal requirements in the Telecommunications Act were modernized. New is the introduction of digital invoice types that offer more transparency and simplify handling O2 invoices. VAT and fee structures were also revised, which directly affects the final amounts. If you’re looking for a quick overview of all the new features and ways to access them, you’ll find useful information directly from O2 at View O₂ invoice online and manage payments.

Overview of new legal requirements and O2-specific changes

There are important legal adjustments for O2 invoices in 2026 as well. The Telecommunications Act (TKG) obliges providers to offer even more transparency. The new digital invoice types are clearer and easier to export. O2 has also adjusted the fee structures, which affects monthly and one-off costs. Private customers benefit from more understandable invoices, while business customers receive improved VAT disclosure. This makes tax and accounting easier. Clarity has been deliberately improved so that errors are noticed more quickly.

New features in the O2 customer portal and the Mein O2 app

In 2026, O2 invoices can be viewed even more conveniently. The user interface in the Mein O2 portal and app has been greatly optimized. With just a few clicks, you have access to current and older invoices. New notifications inform you immediately when a new invoice is available. Thanks to extended download and export options (PDF, CSV), you can back up your data flexibly. Explainer videos and step-by-step guides make navigation and understanding the individual items easier.

Data and facts about O2 invoices 2026

According to the O2 community, the average invoice amount in 2025 was around €34.50. Over 80 percent of O2 users now increasingly rely on digital invoices. Features such as direct download and filtering by period are particularly in demand. The most common support requests concern missing discounts or duplicate debits. Processing time for complaints averages 3 to 5 business days. These figures show how important a transparent and modern invoicing process is for all O2 customers.

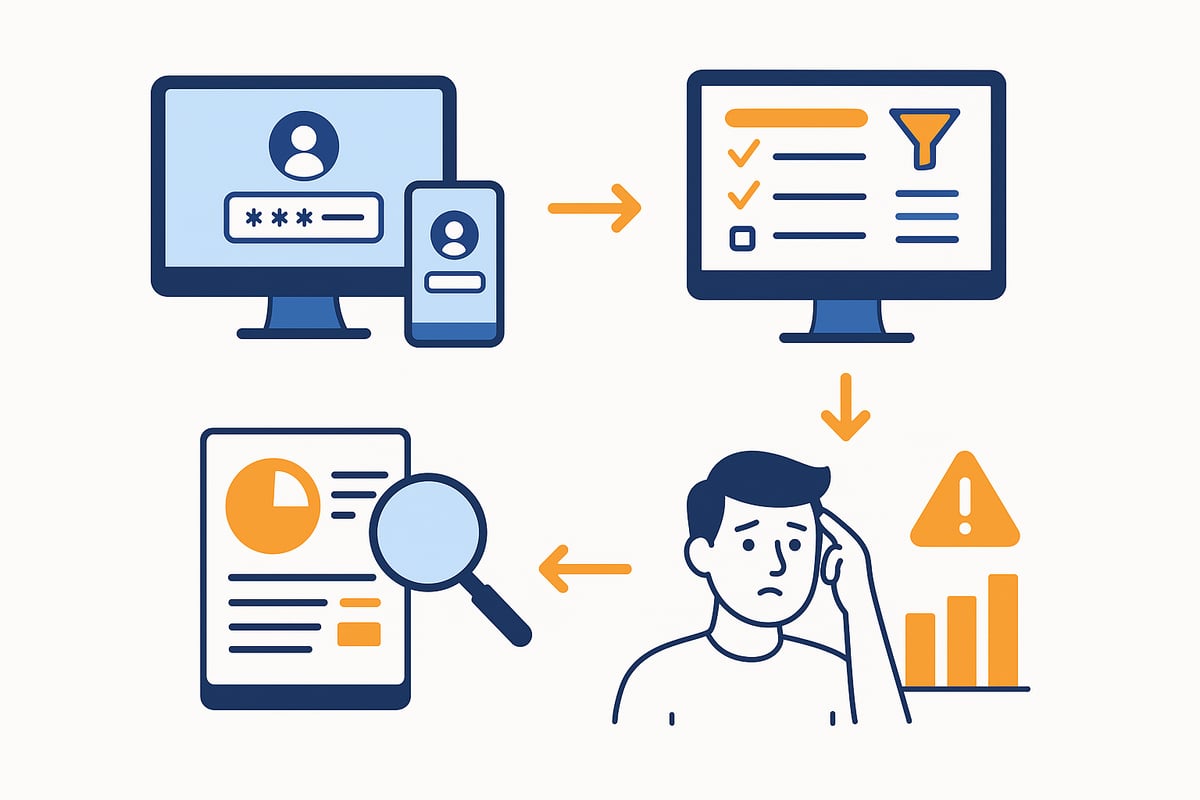

View, download & understand your O2 invoice: step-by-step

With O2 invoices, you always maintain full control over your mobile and DSL costs. Below you’ll find step-by-step instructions on how to securely view, download, and correctly interpret your O2 invoices.

Step 1: Sign in to the Mein O2 portal or the app

To manage invoices online, start by signing in to the Mein O2 portal or the Mein O2 app. Both platforms are available for web, iOS, and Android. Your login credentials consist of a username or email and a password. For additional security, O2 recommends two-factor authentication, which protects your account from unauthorized access.

If you’ve forgotten your password or have login issues, you can quickly get help via the “Forgot password” function. Be sure not to share your login details and update them regularly. You can also find a detailed step-by-step guide at View O₂ invoice online – here’s how.

Step 2: Find, filter & download invoices

After a successful login, you’ll find all invoices clearly listed under the “Invoices” menu item. You can filter specifically for mobile, DSL, prepaid, or business contracts. Particularly practical: Using the search and filter function, invoices can be sorted by month or year.

Various formats such as PDF, CSV, or ZIP are available for download. This makes it easy to save or forward O2 invoices directly. For long-term archiving, it’s advisable to store them on an external hard drive, in the cloud, or in an encrypted folder. That way, you’ll always have your invoices at hand and securely filed.

Step 3: Understand the structure and contents of an O2 invoice

Each O2 invoice follows a clear structure. At the beginning you’ll find the invoice number, customer number, and invoice date. The main section lists the individual items: These include the basic fee, usage costs (e.g., minutes, data volume), and booked add-on services.

Pay attention to whether one-off costs such as connection fees, credits, or discounts are listed correctly. Here is a simplified example of the structure of an O2 invoice:

|

Item |

Amount (€) |

|---|---|

|

Basic fee |

19,99 |

|

Usage |

7,50 |

|

Special services |

2,00 |

|

Credit |

-5,00 |

|

Total amount |

24,49 |

With this knowledge, you can quickly check your O2 invoices and immediately identify inconsistencies.

Step 4: Common sources of errors and how to spot them

Sometimes errors creep into O2 invoices. Common causes are deviating amounts, duplicate debits, or discounts that weren’t applied. Therefore, check each invoice carefully for unclear items or unexpected costs.

If you notice irregularities, you should contact O2 support promptly. It’s best to have your customer number and the affected invoice number ready. In the customer portal, you’ll also find an overview of all previous invoices, which helps you quickly understand any discrepancies.

Securely save and manage O2 invoices

Want to always keep track of your O2 invoices? Then you should rely on secure and structured filing. This saves time, fulfills all legal requirements, and lets you find any invoice in no time.

Digital archiving and data protection

Digitally archiving your O2 invoices brings clear advantages: you have all receipts at your fingertips at any time, save space, and comply with GDPR requirements. It’s recommended to keep invoices for at least ten years, especially if you’re self-employed or run a business.

Whether cloud storage, local hard drive, or external backups—the important thing is that your invoices are protected from unauthorized access. You can find more tips on proper digital filing in the article Document archiving made easy.

Secure archiving also means creating regular backups. This way, you’re on the safe side in case of device failure and won’t lose important invoices.

Password protection and access control

To keep your O2 invoices from falling into the wrong hands, you should always protect documents with a password. Many PDF programs offer an encryption function to secure sensitive data.

In the Mein O2 portal, you can further increase security by activating two-factor authentication. Use complex passwords for your invoices. Good password management helps you keep track and prevent unauthorized access.

Only share access rights with trusted individuals and regularly check who has access to your stored O2 invoices.

Automated management and integration into accounting software

Automated invoice management is particularly worthwhile for freelancers and companies. Many accounting programs such as DATEV, Lexoffice, or SAP offer interfaces to import and process invoices directly.

With automatic invoice import, you save time and reduce sources of error. A reconciliation with bank transactions is also possible, ensuring all O2 invoices land seamlessly in your accounting.

Use the export functions in the Mein O2 portal to regularly save your O2 invoices as PDF or CSV and import them directly into your accounting software.

O2 invoice explained: items, abbreviations and typical questions

Many users regularly face the challenge of reading their O2 invoices correctly. A precise explanation of the individual items, abbreviations, and common questions is therefore essential. Those who know the structure can spot errors faster and ask targeted questions.

Explanation of the most important items on the O2 invoice

You’ll find a variety of items on invoices that explain the total amount. Central are the basic fee for your plan, possible plan options such as data packages, and add-on services such as music services or roaming.

One-time costs such as a connection fee or hardware purchase are listed as separate items. International calls, premium-rate numbers, or roaming charges also appear separately.

Table: Typical invoice items

|

Item |

Example |

|---|---|

|

Basic fee |

Plan S, 19,99 € |

|

Plan option |

EU roaming, 4,99 € |

|

One-time costs |

Connection fee, 39,99 € |

|

Add-on services |

Music streaming, 9,99 € |

|

Premium-rate numbers |

0900, 2,00 € |

This way you’ll always keep track of your O2 invoices. Regularly check whether all items are plausible.

Abbreviations and terms explained clearly

Many O2 invoices contain abbreviations that can be confusing at first glance. Here are the most important ones at a glance:

-

AP: Connection fee – one-time fee at the start of the contract

-

Credit: A refund, e.g., as a discount or correction

-

Subsequent charge: Subsequent billing of outstanding amounts

-

VE: Usage unit – often for minutes, SMS, or MB

For example: “AP credit” means that the connection fee has been refunded. If you want to dive deeper into the topic, the Accounting and bookkeeping basics provide further background on terms and abbreviations.

With knowledge of the key terms, you’ll read O2 invoices much more confidently in the future.

Typical questions and answers about O2 invoices

The same questions keep coming up about invoices in everyday life. Here are the most important answers:

-

What to do if an invoice is incorrect? First check all items, document any irregularities, and contact O2 support.

-

How long are invoices available in the portal? Usually 24 months from the invoice date.

-

Can invoices be changed afterwards? No, O2 invoices cannot be edited once issued. Corrections are made via credits on subsequent invoices.

This way you’ll always be well prepared for any questions about O2 invoices.

Statistics and community experiences

The O2 community frequently reports recurring issues on O2 invoices. Most often, incorrect discounts, duplicate debits, or unclear individual items are mentioned.

Statistics show: The average processing time for complaints is three to five business days. Over 80 percent of users now use digital invoices, which makes archiving easier.

Many experience reports from O2 forums help identify typical sources of error more quickly and ask targeted questions.

O2 invoices for business customers and the self-employed

Business customers and the self-employed have special requirements for their O2 invoices. Clarity and management play a central role so that cost control and tax obligations can be easily fulfilled. Depending on company size and industry, details vary, but some features and tools are relevant to everyone.

Special features of business invoices

O2 invoices for business customers differ from private customer billing in several ways. The layout is often more extensive, with clearly separated items for individual users or cost centers. A key aspect is the correct display of VAT, which is central to accounting and tax returns. There are also special contacts and support channels for corporate customers. With the O₂ Business Bill Manager for business customers, you can analyze and conveniently manage invoices. This facilitates oversight, especially with multiple contracts or complex billing.

Integration into accounting and ERP systems

Modern companies rely on digital processes to manage invoices efficiently. Many use accounting software such as DATEV, Lexoffice, or SAP. Thanks to automated interfaces, regular downloading and importing of invoices is possible. Tools like Automatically download O₂ invoices with GetMyInvoices offer direct integration so that all receipts are managed centrally. This saves time, reduces sources of error, and ensures complete documentation. Digital processing is a real advantage, especially for the self-employed.

Tips for process optimization for companies

To optimize the management of O2 invoices, a structured approach is worthwhile. Regularly check all invoices and reconcile them with your accounting. Use collective invoices if you have multiple contracts, and clearly assign cost centers. For audit-proof archiving, a digital filing system with regular backups is recommended. This way, you have all documents at hand and meet legal requirements. A well-thought-out process not only saves time but also minimizes the risk of errors in invoice management.

O2 invoice: contact, complaints and support

Clarity and quick help are especially important for O2 invoices. Whether it’s general questions, ambiguities, or complaints—O2 offers you various ways to get support easily.

Contact options for invoice questions

You have several contact options for all questions regarding O2 invoices. The O2 hotline is directly reachable—ideal for urgent matters. In the O2 live chat, you’ll often get help particularly quickly—perfect when you’re directly in the customer portal.

Many users prefer support via email, especially when documents such as invoices need to be attached. The O2 community also offers exchanges with other customers and quick help from moderators. Have your customer number ready so your request can be processed faster. The hotline is usually available on working days from 7 a.m. to 8 p.m., and the chat often even longer.

Procedure for complaints and incorrect invoices

Did you discover an error on your O2 invoices? Then you should proceed in a structured way. Note the affected items and check what supporting documents you have on hand. Then it’s best to contact support via the O2 portal or by email.

It’s important to submit complaints promptly—usually there is a period of eight weeks after receipt of the invoice. Document the process with screenshots and save every response. This keeps you up to date during follow-up. O2 will inform you about the processing status; the processing time is often three to five business days. However, in more complex cases it can take longer.

Useful resources and help pages

There are many helpful resources around O2 invoices. The O2 help pages offer step-by-step instructions, FAQs, and current notices on changes. In the O2 community, you’ll find best-practice posts and can benefit from others’ experiences.

Particularly practical: Many tips for digital invoice management are also relevant to other providers such as Telekom. You’ll find a detailed comparison in the article Manage Telekom online invoices, which provides additional ideas for handling your invoices efficiently. With regular updates, you’ll always be up to date on support options and changes.

You now have all the key tips to efficiently understand, check, and securely manage O2 invoices in 2026. Especially if you want to simplify digital processes and automate recurring tasks, it’s worth taking a look at filehub. The platform helps you automatically retrieve invoices, store them securely, and integrate them directly into your accounting or workflows—without any programming knowledge. Save time, reduce sources of error, and always keep an overview of your documents.

Try filehub.one for free now