XRechnung or ZUGFeRD: Comparison & Decision

Starting in 2025, companies face a crucial choice: XRechnung or ZUGFeRD? The legal obligation for e-invoices will soon render simple PDF invoices obsolete. Those who do not switch now risk compliance issues and additional effort.

But which format fits your company? In this article, you’ll learn the key differences, benefits, and use cases of both invoice types. We show what decision-makers should pay attention to and how to future-proof your accounting.

Background: The e-invoice obligation in Germany from 2025/2026

Digitalization is radically transforming accounting. Where paper and PDFs used to dominate, structured electronic invoices are now taking over. Lawmakers are serious: from 2025, companies in Germany must accept and issue e-invoices in business transactions. A simple PDF invoice is no longer sufficient.

Digitalization and legal requirements

The introduction of the e-invoice obligation follows a clear timeline. From 2025, receiving e-invoices in the B2B sector is mandatory; the obligation to issue them will be phased in until 2028. The foundation is the EU Directive 2014/55/EU and the EN 16931 standard, which mandate structured, machine-readable formats. Germany is implementing these requirements through the Growth Opportunities Act (Wachstumschancengesetz).

Unlike a PDF invoice, which is merely a digital image of paper, a structured e-invoice such as XRechnung or ZUGFeRD contains data in XML format. These can be automatically processed by accounting systems. Those who do not switch in time risk compliance issues and sanctions.

For companies of all sizes, this means: processes must be adapted and new software introduced. The advantage is obvious: automation saves time, reduces sources of error, and creates transparency. According to a recent study, around 37 percent of companies have already switched to e-invoicing. Willingness is growing, as the pressure to act is steadily increasing. You can find more details on the legal requirements in the article on the e-invoice obligation from 2025.

Overview: The most important e-invoice formats

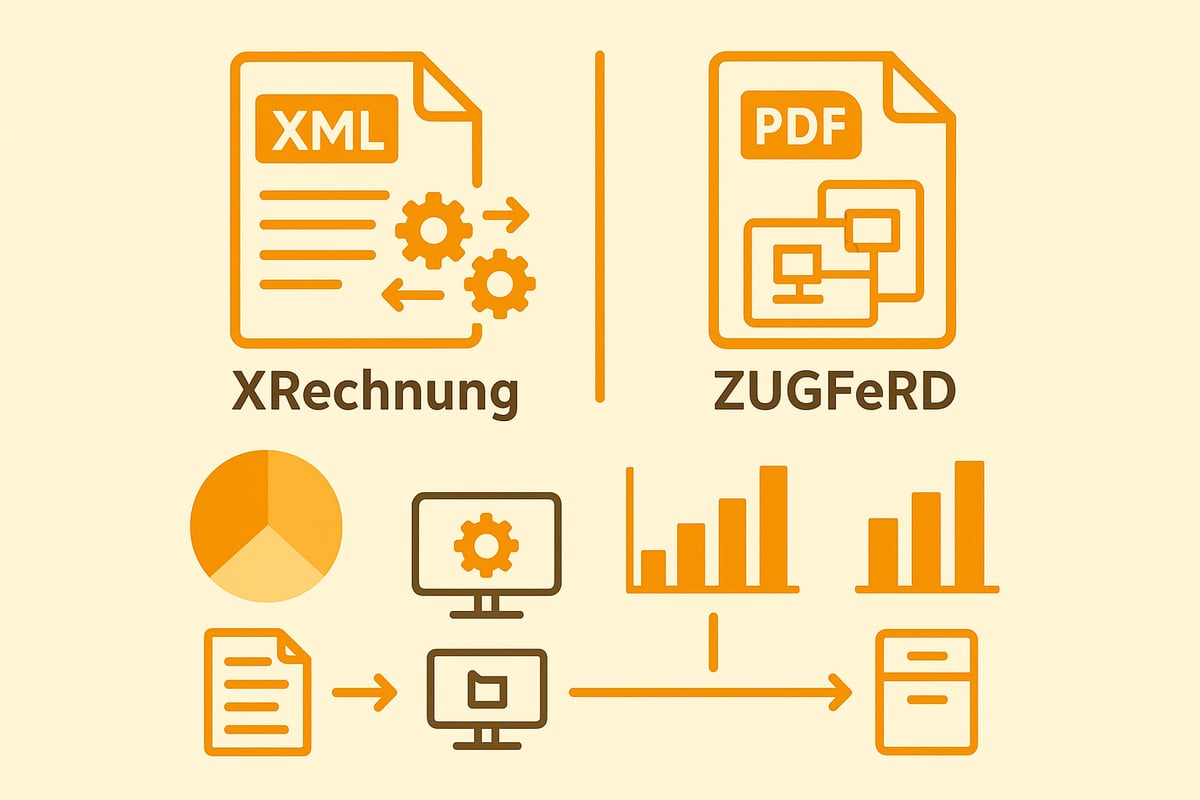

At the center of the discussion about XRechnung or ZUGFeRD are two standards: XRechnung and ZUGFeRD. Both formats meet legal requirements but differ in structure, application, and benefits.

XRechnung is a purely machine-readable XML format, developed primarily for public administration. Public contracting authorities accept only structured e-invoices such as XRechnung. The format is optimal for automated processes but is not directly human-readable.

ZUGFeRD, on the other hand, combines a PDF/A-3 file with an embedded XML structure. This makes the invoice suitable for both humans and machines. This eases the transition, especially for small and medium-sized enterprises. ZUGFeRD offers various profiles that can flexibly adapt to different business models.

In addition to these two, there are other formats such as Peppol or Factur-X, which are particularly relevant in an international context. The choice between XRechnung or ZUGFeRD depends heavily on your own requirements. Both offer advantages: XRechnung excels in automation, ZUGFeRD in flexibility and user-friendliness. For companies, a direct comparison is crucial to find the right solution for the e-invoice obligation.

XRechnung: The standard format for public administration

XRechnung is a central topic for all companies considering the question of XRechnung or ZUGFeRD. It is considered the official standard for electronic invoices to public contracting authorities in Germany. But what is behind this format and why is the choice between XRechnung or ZUGFeRD so important?

Technical and legal foundations

XRechnung was developed by the Coordination Office for IT Standards (KoSIT) and is entirely based on XML. Unlike ZUGFeRD, it contains no PDF component and is therefore not directly human-readable. The structured XML file ensures that all invoice data is transmitted unambiguously and in a machine-readable manner.

Since 2020, XRechnung has been mandatory for all invoices to public contracting authorities (B2G) in Germany. Implementation follows the European standard EN 16931 and EU Directive 2014/55/EU. This means that companies supplying public customers have no choice between XRechnung or ZUGFeRD—they must use XRechnung.

The structure of XRechnung is clearly standardized. It consists of mandatory fields such as invoice number, date, supplier data, amounts, and taxes. An integrated validation mechanism automatically checks compliance with the requirements. In addition, XRechnung is compatible with European standards such as UN/CEFACT CII and thus supports cross-border invoicing.

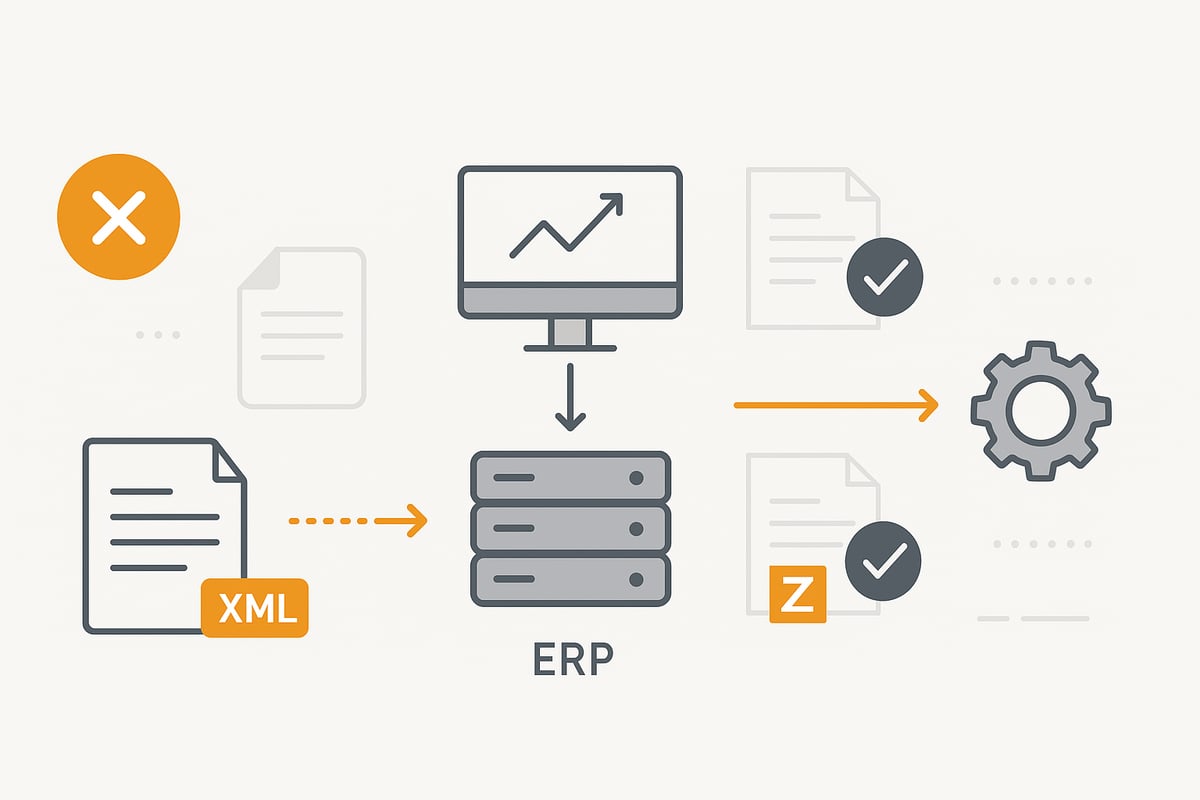

The legal requirements ensure high acceptance and legal certainty. Companies opting for XRechnung or ZUGFeRD must ensure correct technical integration of their ERP or accounting systems when using XRechnung.

Advantages and challenges of XRechnung

XRechnung offers numerous advantages for companies choosing between XRechnung or ZUGFeRD. The main focus is on complete automability: invoice data can be processed straight-through, minimizing errors and increasing efficiency.

Another plus is compliance assurance. The clear structure and validation mechanisms reduce the risk of formal errors and rejected invoices. This facilitates collaboration with public clients and secures payment.

However, there are also challenges. XRechnung is not directly human-readable, as it contains no PDF representation. This often requires adjustments to existing workflows and tighter integration with ERP systems. Especially for smaller companies, the technical transition can be a hurdle.

In practice, many suppliers to the public sector have already successfully digitalized their processes. Solutions such as Automated e-invoice processing help companies create, validate, and seamlessly integrate XRechnungen efficiently into existing systems.

A recent study shows: acceptance of XRechnung is steadily growing in the public sector. Companies that address XRechnung or ZUGFeRD early secure a decisive advantage in digitizing their invoicing processes.

ZUGFeRD: The hybrid e-invoice format for flexible application

ZUGFeRD offers companies a particularly flexible solution when choosing between XRechnung or ZUGFeRD. As a hybrid e-invoice format, ZUGFeRD combines the advantages of machine-readable data with a human-readable representation. This makes it attractive for many businesses preparing for the new e-invoice obligation.

How it works and structure

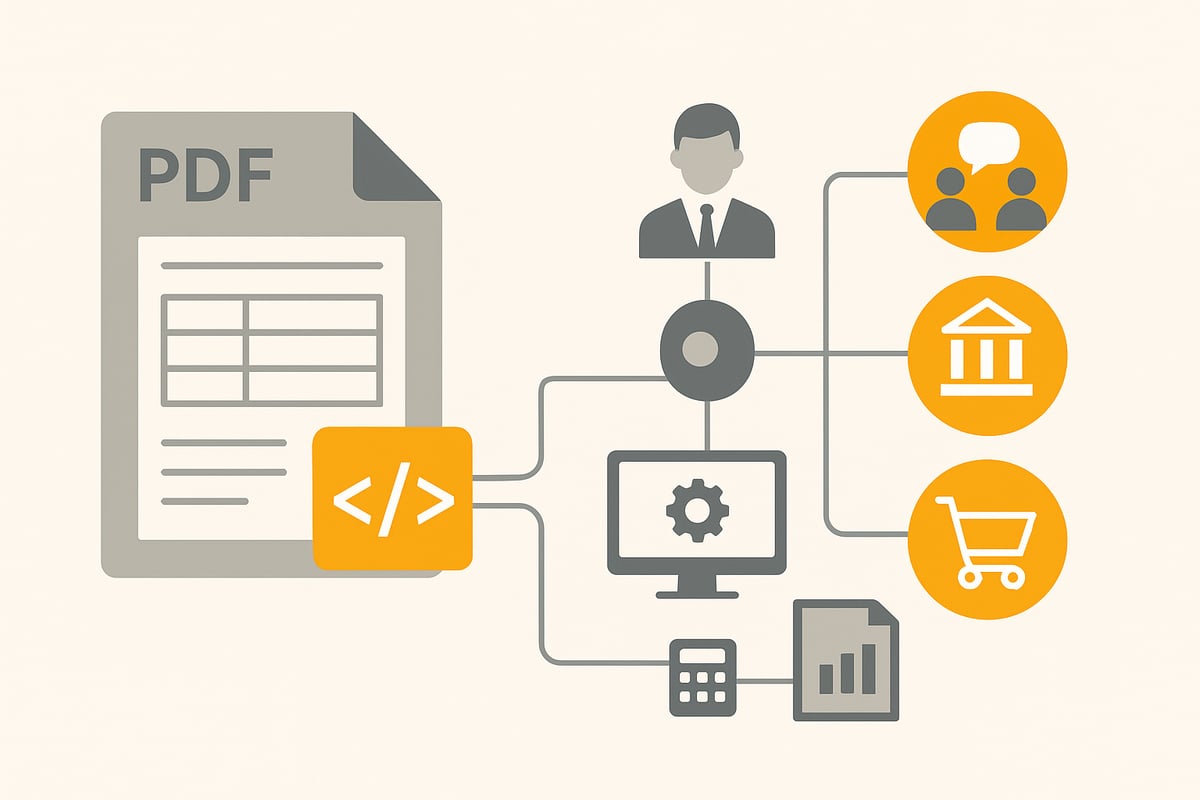

ZUGFeRD stands for “Central User Guide of the Forum elektronische Rechnung Deutschland” and was developed to bridge the gap between traditional PDF invoices and structured XML data. The format is based on PDF/A-3, into which a standardized XML file is embedded. This makes invoices both human-readable and machine-readable for automated processing.

The heart of ZUGFeRD lies in its various profiles: Basic, Comfort, and Extended. Each profile offers a different level of detail, tailored to specific requirements—from simple transactions to complex business cases. The technical foundation is UN/CEFACT XML, which ensures high compatibility with international standards. The ISO 19005-3 standard for PDF/A-3 is also met.

Integration into existing workflows is straightforward, as ZUGFeRD is supported by many ERP and accounting systems. Especially for companies looking to integrate XRechnung or ZUGFeRD into their finance processes, solutions for financial accounting are helpful, as they enable seamless connections and automation.

ZUGFeRD meets the legal requirements in Germany and the EU, which further simplifies implementation. This makes it a future-proof choice when companies face the decision between XRechnung or ZUGFeRD.

Advantages and challenges of ZUGFeRD

ZUGFeRD scores with a variety of advantages, particularly relevant for small and medium-sized enterprises (SMEs). The most important include:

- Readability: Invoices can be viewed directly in PDF without special software.

- Flexible use: Suitable for B2B, B2G, and even B2C.

- Easy introduction: Existing processes hardly need to change, as many systems support ZUGFeRD.

- Low entry barriers: Particularly suitable for companies implementing structured e-invoices for the first time.

In the direct comparison of XRechnung or ZUGFeRD, ZUGFeRD comes into play especially when companies want a smooth transition or serve a wide variety of customers. But there are also challenges:

- Discrepancies between PDF and XML: Potential sources of error when transferring data.

- Software requirements: Not every solution can process all ZUGFeRD profiles correctly.

- Profile complexity: Choosing the right profile requires technical understanding.

Example: Companies with mixed customer structures benefit from flexibility, while internationally active firms appreciate compatibility. Studies show that acceptance of ZUGFeRD in Germany is steadily growing, especially among companies deciding between XRechnung or ZUGFeRD.

XRechnung vs. ZUGFeRD: Detailed comparison of the two formats

The decision between XRechnung or ZUGFeRD is central for many companies to implement the e-invoice obligation from 2025/2026 in a legally compliant and efficient manner. Both formats aim to digitize invoicing processes but differ significantly in structure, application, and benefits. Those who understand the differences can deliberately choose the right format and thus strengthen compliance, efficiency, and future readiness.

Structure and technical differences

The key technical difference between XRechnung or ZUGFeRD lies in the structure. XRechnung is a pure XML format. This means the invoice consists exclusively of structured, machine-readable data. There is no PDF component, which enables complete automation.

ZUGFeRD, on the other hand, combines the best of both worlds. Here, the invoice is a PDF/A-3 document that remains human-readable. At the same time, the PDF contains an embedded XML file that is machine-readable. This allows both accounting systems and employees to use the invoice without issues.

Another difference: with XRechnung, all mandatory fields according to EN 16931 must be strictly adhered to. Validation is usually automated. ZUGFeRD offers different profiles that can be chosen depending on complexity and use case. This makes ZUGFeRD more flexible, but also a bit more complex in selection and implementation.

Use cases and legal requirements

XRechnung or ZUGFeRD also differ in legal requirements and areas of application. XRechnung has been mandatory since 2020 for invoices to public contracting authorities (B2G) in Germany. The format was specifically developed for the needs of public administration and complies with EU Directive 2014/55/EU and national regulations.

ZUGFeRD is more flexibly applicable. It is suitable for B2B, B2C, and B2G processes and is particularly used by companies that serve a mix of private and public customers. The hybrid structure eases introduction, especially for small and medium-sized enterprises.

Those who want to be legally on the safe side should carefully review the current requirements. A comprehensive overview of the legal requirements can be found in the specialist article Electronic invoice becomes mandatory: e-invoice at a glance.

Advantages and disadvantages in direct comparison

The choice between XRechnung or ZUGFeRD strongly depends on the respective company processes and requirements. Both formats offer their own strengths and weaknesses, which become clear in direct comparison.

| Criterion | XRechnung | ZUGFeRD |

|---|---|---|

| Structure | Pure XML | Hybrid: PDF/A-3 + XML |

| Readability | Machines only | For humans & machines |

| Automation | Very high | High, but profile-dependent |

| Mandatory field check | Strictly per EN 16931 | Varies by profile |

| Use case | Mandatory for B2G | Flexible: B2B, B2C, B2G |

| Implementation | Higher requirements | Easy introduction, especially for SMEs |

| Sources of error | Low, but less flexible | Possible discrepancies between PDF and XML |

| Future readiness | Very high | High, especially due to EU-wide recognition |

Advantages of XRechnung:

- Full automability

- Legal certainty for B2G

- Clear data structure

Advantages of ZUGFeRD:

- Readable for all stakeholders

- Easy integration into existing workflows

- Flexible with mixed customer groups

Companies facing the choice between XRechnung or ZUGFeRD should carefully weigh their own processes, customer structure, and technical capabilities. The right decision ensures a smooth transition and lasting efficiency in accounting.

Technical implementation & integration into business processes

The technical implementation of XRechnung or ZUGFeRD presents new challenges for companies. Both formats require specialized software solutions and adjustments to existing processes. A structured approach helps avoid pitfalls and ensure compliance.

Requirements for using both formats

For XRechnung or ZUGFeRD, companies need suitable e-invoice software that can process either pure XML files (XRechnung) or hybrid PDF/XML documents (ZUGFeRD). Adjustments to the ERP system, validation tools, and digital archiving in accordance with GoBD are mandatory. Invoices can be transmitted via email, web portal, API, or Peppol.

| Requirement | XRechnung | ZUGFeRD |

|---|---|---|

| Software needs | XML parser, ERP | PDF reader, ERP, XML |

| Readability | Machine only | Human & machine |

| Transmission | Portal, Peppol | Email, portal, Peppol |

There are also differences in archiving: XRechnung is stored as a pure XML file, while ZUGFeRD archives both components together.

Practical examples and tips for the transition

The transition to XRechnung or ZUGFeRD works best with a clear roadmap. Start with an inventory of the IT landscape and check which processes can be digitized. Training employees and collaboration between IT and accounting are essential.

- Analyze existing workflows and identify automation potential

- Test both formats in parallel operation to check compatibility

- Use validation tools to avoid errors before sending

A mid-sized company can, for example, gradually switch from PDF to ZUGFeRD while introducing XRechnung in parallel for public clients.

Automation potential with specialized platforms

Automating invoice processing is a key advantage of XRechnung or ZUGFeRD. Specialized platforms like filehub make it possible to automatically download, validate, and integrate e-invoices into existing systems. Through automatically downloading invoices, invoices can be obtained directly from various portals and processed seamlessly.

Such solutions increase efficiency, reduce sources of error, and make it easier to comply with legal requirements. This way, the digital transformation of accounting can be achieved with minimal effort.

Decision aids: Which format fits which company?

The choice between XRechnung or ZUGFeRD will become a central question for companies from 2026. The decision depends on various factors, as both formats offer specific advantages. Those who find the right solution early reduce risks and ensure efficiency. But how do you determine which format fits best?

Criteria for selecting XRechnung or ZUGFeRD

Whether XRechnung or ZUGFeRD is the better choice depends on company structure, customer relationships, and technical equipment. Public contracting authorities usually require XRechnung, while ZUGFeRD offers more flexibility for B2B and B2C.

Important selection criteria include:

- Company size: Large companies and corporations often benefit from XRechnung, as they typically already have the necessary ERP systems.

- Customer structure: Those who regularly supply the public sector cannot avoid XRechnung. For mixed target groups, ZUGFeRD is advantageous.

- Technical infrastructure: Companies with digitized accounting processes can integrate both formats. Smaller firms appreciate ZUGFeRD’s visual readability.

- Future readiness: Both formats meet legal requirements; XRechnung is mandatory for B2G, ZUGFeRD scores with international compatibility.

- Degree of automation: XRechnung is ideal for fully automated, straight-through processes. ZUGFeRD eases introduction thanks to the PDF component.

A current overview of the legal requirements can be found in the specialist article E-invoice obligation from 2025: What companies need to consider now.

Here is a tabular comparison of the two formats:

| Criterion | XRechnung | ZUGFeRD |

|---|---|---|

| Structure | Pure XML | Hybrid: PDF + XML |

| Readability | Machine-readable only | For humans and machines |

| Mandatory field | B2G (public sector) | B2B, B2C, B2G |

| Automation | Very high | High, but more flexible |

| Introduction hurdles | Higher, tech-heavy | Lower, user-friendly |

| Internationality | Recognized EU-wide | EU-wide, Factur-X compatible |

In the end, what matters is this: XRechnung or ZUGFeRD—the decision should fit your customers and your processes.

Decision tree and practical examples

How can you concretely decide whether XRechnung or ZUGFeRD will move your company forward? A decision tree helps:

-

Do you invoice the public sector?

→ Yes: XRechnung is mandatory

→ No: Check how high your B2B or B2C share is -

Do you want a quick, visual introduction?

→ Yes: ZUGFeRD offers advantages thanks to the PDF component

→ No: XRechnung for fully automated workflows -

How digital is your accounting?

→ Modern ERP integration in place: Both formats are possible

→ Not very digitized: ZUGFeRD as an entry point

Practical example: A mid-sized company with public-sector clients and private customers uses both formats in parallel. This covers all requirements and enables a step-by-step transition.

For companies with international ambitions, ZUGFeRD is recommended because it also supports Factur-X. Those who value the highest degree of automation are better off with XRechnung.

Ultimately, you should regularly check whether XRechnung or ZUGFeRD fits your current and future business strategy. Investing in flexible solutions pays off in the long run.

Outlook: Trends and future developments in e-invoicing

The discussion about XRechnung or ZUGFeRD is far from over, as the e-invoicing market is evolving rapidly. Companies face the challenge of not only meeting current legal requirements but also keeping an eye on future developments. Those who act with foresight now will secure competitive advantages and remain flexible for upcoming changes.

European harmonization and format evolution

European harmonization is progressing. Formats like Factur-X and interfaces like Peppol are gaining importance to simplify cross-border invoicing processes. XRechnung and ZUGFeRD are continuously adapting to these standards: with ZUGFeRD 3.0, for example, the profiles are moving closer to European requirements. Mandatory fields are also becoming increasingly standardized to improve interoperability.

Current developments show that national peculiarities are decreasing and cross-border compatibility is becoming more important. Companies should therefore proactively examine how XRechnung or ZUGFeRD can be used in international contexts.

Automation, AI, and impacts on accounting

Automation and artificial intelligence are becoming the engine of greater efficiency. Modern e-invoicing solutions automatically detect errors, check mandatory fields, and support archiving. Digital audit trails and real-time reporting simplify tax audits and provide transparency.

Particularly with regard to integration into existing systems such as DATEV, the degree of automation becomes the decisive factor. Those who optimally use XRechnung or ZUGFeRD benefit from faster processes and reduced manual effort. Further details on technical integration can be found in the integration with DATEV Unternehmen Online.

Recommendations for action and future readiness

For companies, the time is now to prepare for upcoming requirements. Invest in flexible and scalable solutions that support both XRechnung or ZUGFeRD and cover future standards. Pay attention to open interfaces, automation potential, and close coordination with your IT.

Digitalization in accounting is not a short-term trend but the key to greater competitiveness. Those who act early can use the transition as an opportunity. For practical tips and real-world insights, check out the video E-invoice obligation from 2025: We have the solution!.

You are now facing the decision: XRechnung or ZUGFeRD—which format best fits your company and your processes from 2026 onward? Both offer opportunities for automation, efficiency, and greater legal certainty, especially if you use smart tools like filehub. With filehub, you can easily retrieve, process, and archive e-invoices automatically—no programming skills required and always GDPR-compliant. Just give it a try and take the next step toward digital accounting—try filehub.one for free now.