Bavariadirekt Insurance

The insurance world is becoming ever more complex in 2025. Digital offerings, new risks, and numerous policies often cause confusion. How do you keep an overview in this jungle?

With bavariadirekt, you not only find the right insurance for your situation, but you also benefit from modern, digital services. This article shows you how to choose purposefully, manage contracts smartly, and automatically structure documents with smart tools like filehub.

Look forward to a practical guide to bavariadirekt: from product variety to digital management to future trends—this is how you secure yourself efficiently and with ease.

BavariaDirekt at a glance: The company and its strengths

Bavariadirekt is a modern insurer that makes managing policies and documents especially easy for its customers. The combination of digital infrastructure and personal services helps you save time in your insurance everyday life. Particularly practical: with filehub you can automatically download all documents and integrate them directly into your individual workflows. This makes everyday life more efficient, productive, and clearer.

History and development of BavariaDirekt

This insurer was founded as part of the Sparkassen-Finanzgruppe and has developed into one of the leading digital insurers in Germany in recent years. The company deliberately focuses on innovation and digitalization to offer customers modern, flexible insurance solutions. You can find a comprehensive overview of the history and offerings directly in the BavariaDirekt company profile.

Digital orientation and customer benefits

Bavariadirekt scores with a fully digital approach. You can take out and manage insurance online—around the clock, without paperwork. Modern customer portals and apps allow you to access contract data at any time. You particularly benefit from fast, digital processing and paperless communication in the event of a claim, which noticeably makes everyday life easier.

Insurance products offered

The insurer’s product portfolio is clearly structured and flexible. Key offerings include car, liability, household contents, legal protection, and other specialized insurance policies. Modular rates are particularly popular, for example in car insurance, where you can flexibly choose additional modules. This way, you’ll find exactly the protection that suits your situation in life.

Customer service and availability

The insurer’s customer service can be reached in many ways. A 24/7 hotline, digital chat assistants like Sophie, as well as personal advice by phone, email, or online chat make getting in touch easy. Many customers praise the quick help and straightforward handling in service cases. Awards and positive reviews underscore the high service quality.

Security and data protection

BavariaDirekt places great emphasis on data protection and security. All customer data is processed in compliance with the GDPR and stored in encrypted areas. Data transmission is always secure, and transparent privacy policies build trust. This way, you always know how your sensitive information is handled.

The most important insurance policies at BavariaDirekt in detail

The variety of insurance policies offers the right protection for every life situation. All policies and documents are provided in the secure customer portal. With tools like filehub, you can automatically download all documents from bavariadirekt and store them in clear workflows. This way, you always maintain an overview and save valuable time managing your insurance documents.

Car insurance: benefits and special features

Bavariadirekt’s car insurance offers flexible protection tailored to your individual needs. You can choose between third-party liability, partial coverage, and comprehensive coverage. Particularly practical: you can report claims easily online, enabling quick settlement.

With digital services like filehub, all insurance documents from bavariadirekt are automatically captured and sorted into structured workflows. This not only simplifies management but also ensures maximum efficiency in everyday life. If you value additional services, you’ll find car insurance additional benefits such as roadside assistance, premium protection, or price guarantees directly in the rate comparison.

Legal protection insurance: for whom and why?

Bavariadirekt’s legal protection insurance is aimed at private individuals, employees, and road users. It covers costs in legal disputes and offers free choice of lawyer. Especially in times of rising legal disputes in Germany, this protection is becoming increasingly important.

With digital management via the bavariadirekt portal and integration into filehub, you can centrally store all relevant documents, such as policies and pleadings, and retrieve them immediately when needed. This facilitates communication with lawyers and ensures smooth processes in legal cases.

Household contents and residential building insurance: Protection for your home

Household contents and residential building insurance protect you against the financial consequences of burglary, fire, tap water, or natural hazards. The rates can be flexibly adapted to your living situation and increases in value.

Damage statistics from 2024 show how important comprehensive protection is. With filehub, you can automatically archive documents provided by bavariadirekt, such as claim reports and policies, and forward them to property management or family if necessary. This way, no important proof gets lost.

Liability insurance: indispensable for everyone

Bavariadirekt’s liability insurance protects you against the financial consequences of small and large mishaps. Over 80 percent of Germans rely on this basic protection. The plans are available for both families and singles and can be tailored to individual needs.

Through digital management in the customer portal and connection to filehub, you always have all certificates, policies, and claim documents at your fingertips. Reminders for premium payments and deadlines help keep your insurance coverage up to date.

Other insurance: additional cover and specialized products

Bavariadirekt also offers specialized insurance such as pet owner’s liability, accident, or bicycle insurance. Modular plans for e-bikes and e-scooters, which can be flexibly combined, are currently particularly on trend.

With filehub, you can also automatically download these documents from the bavariadirekt portal and store them in personal or company-wide workflows. This boosts productivity and ensures that no proof of insurance gets lost.

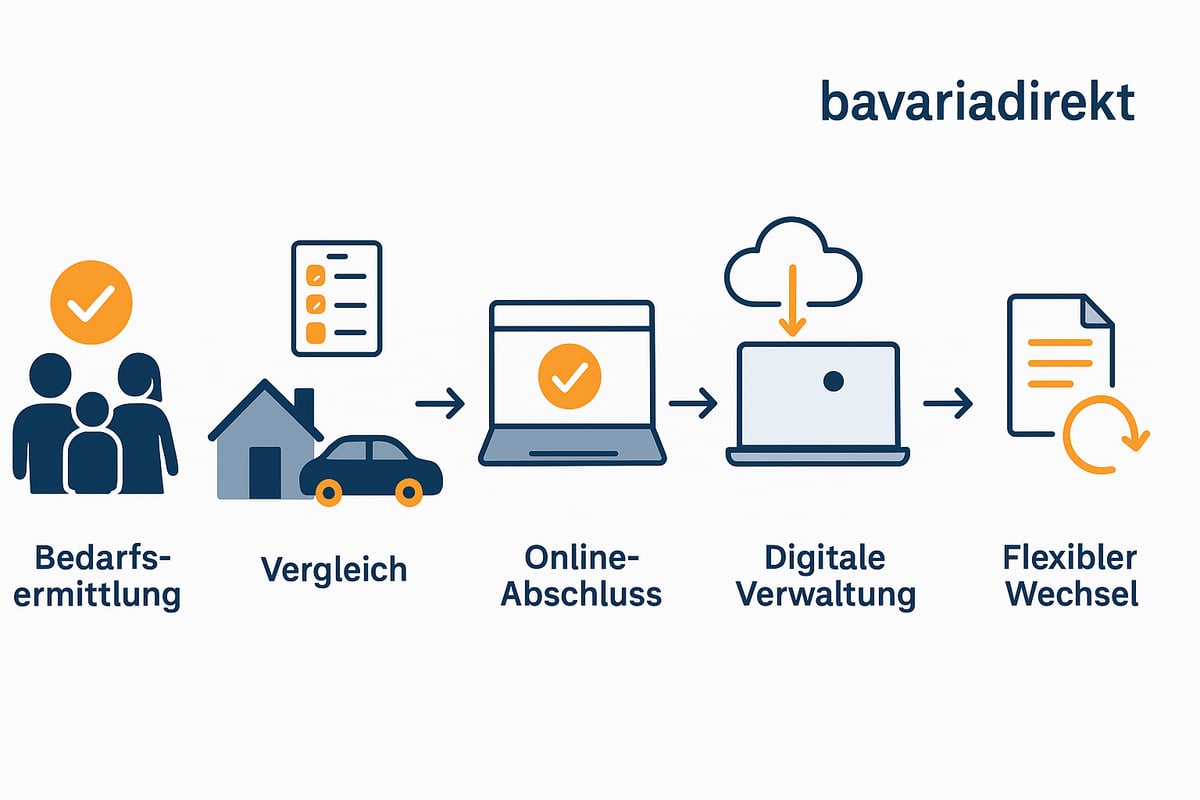

Step by step: Selecting the right insurance with BavariaDirekt

Choosing the right insurance is a crucial step for your financial security. In the jungle of options, you need a clear strategy. With the right approach, you can select, compare, and manage digitally—more efficiently than ever before.

Determining your needs: Which insurance policies are truly necessary?

Start with an honest analysis of your life situation. Which risks do you want to cover? With this insurer, you’ll find suitable policies for singles, families, or the self-employed.

Mandatory insurance such as car liability is required by law. Voluntary policies, such as household contents or accident insurance, should be taken out based on your personal needs. Consider: Are there children, pets, or valuable property? A structured checklist helps you stay on top of things.

Comparison and tariff selection

Use comparison portals and bavariadirekt’s online calculators to transparently compare different plans. Pay particular attention to these criteria:

-

Premium and scope of benefits

-

Deductible and optional add-ons

-

Flexibility in contract terms

A table can help you compare offers clearly. Statistics show that online sign-ups are often cheaper than traditional routes. Check regularly whether your current plan still fits your needs.

Online sign-up and digital services

Signing up digitally with bavariadirekt is quick and straightforward. Follow these steps:

-

Select the desired product online.

-

Enter all required data.

-

Use digital contract signing.

You benefit from immediate insurance coverage and have all documents directly in the customer portal. Paperless management saves time and reduces sources of error. With apps and push notifications, you always stay informed about what is happening with this insurer.

Contract management and adjustments

All contracts can be easily viewed and managed in bavariadirekt’s digital customer portal. Changes to coverage, plan switches, or extensions are possible at any time. Automatic reminders help you keep track of deadlines.

Management becomes especially efficient when you use tools that automatically download documents and integrate them into your workflows. Learn more about how you can process insurance documents automatically and make your daily work more productive.

Cancellation and switching: How to stay flexible

You should always keep cancellation periods and special termination rights in mind. With bavariadirekt, you can cancel or switch contracts easily, for example, car insurance at the end of the year.

A smooth switch succeeds if you compare in good time and cancel digitally. With the flexible services, you are on the safe side and can react flexibly to changes in life. This way you remain optimally insured at all times.

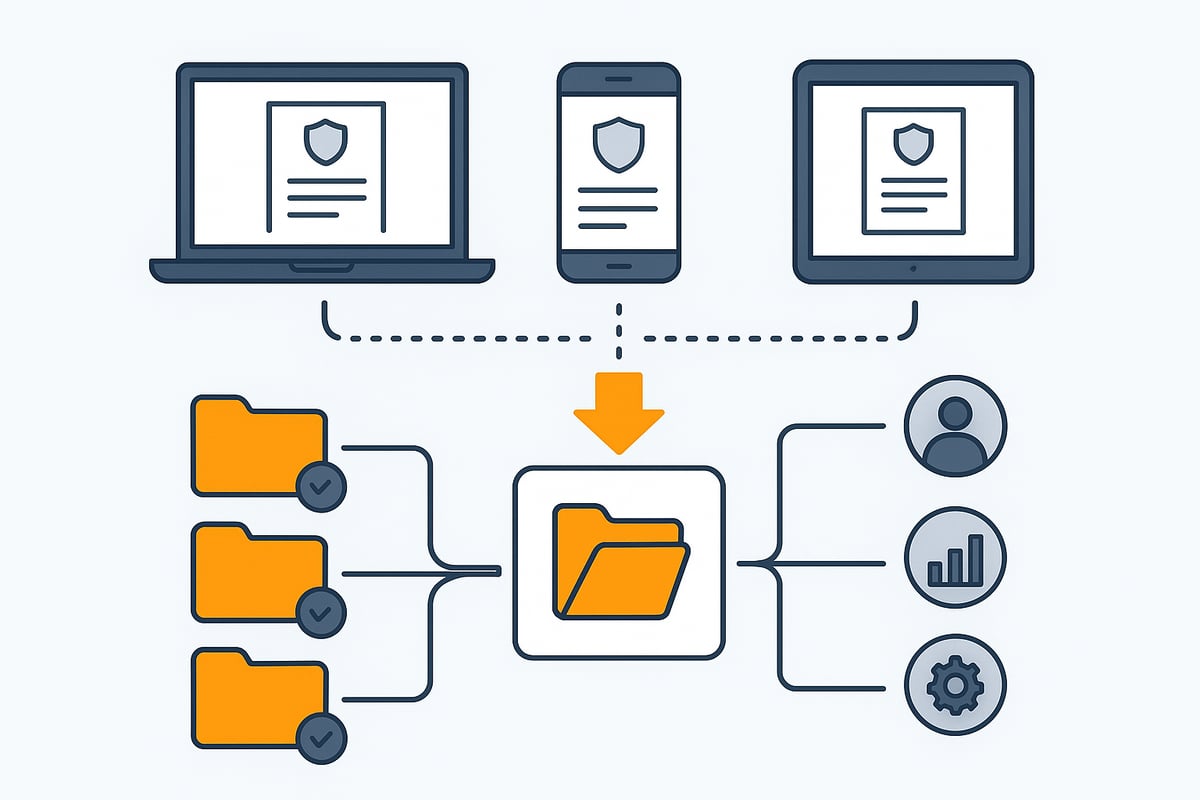

Digital document management and automation with filehub

Managing insurance documents can quickly become confusing, especially if you have taken out several policies digitally. Important documents such as policies, invoices, or claim reports often end up on different platforms. This costs time and nerves and carries the risk of losing track of deadlines or documents.

With filehub, managing your bavariadirekt documents becomes much easier. The platform connects directly to the customer portal, automatically downloads all relevant documents, and stores them securely in individually configurable workflows. This way, you have all policies, premium invoices, and correspondence available centrally at any time.

The advantages of automated document management with filehub:

-

Time savings by eliminating manual downloads

-

Error reduction, since nothing gets lost anymore

-

GDPR-compliant, encrypted archiving

-

Flexible workflows for individuals and companies

A practical example: claim reports received by bavariadirekt are automatically forwarded to accounting or management. This increases productivity and ensures seamless documentation.

If you want to dive deeper into the topic, you’ll find more tips for efficient management of insurance documents in the article Digital document management with filehub.

With filehub, you always maintain an overview and can focus on what matters: your security and the optimal use of all bavariadirekt services.

Tips for optimal management and protection of your insurance policies

Managing your own insurance is often time-consuming and complex. With the right digital tools and well-thought-out processes, dealing with bavariadirekt policies becomes much easier. Those who rely on automation benefit in the long term from more transparency, security, and efficiency.

Use digital tools and apps wisely

With bavariadirekt’s customer portal and mobile apps, you can conveniently manage your entire insurance routine digitally. You can view policies, manage contracts, and report claims online at any time. Push notifications inform you immediately about contract changes or new documents.

Particularly practical: automated tools like filehub connect directly to the bavariadirekt portal and automatically download all important documents. This greatly increases efficiency. You can find even more tips on how digital solutions increase productivity in insurance management in the article Increase productivity with digital solutions.

Document management and deadline control

The multitude of insurance documents can quickly become confusing. With digital folders in the bavariadirekt customer portal and automated workflows, you always keep an overview. Filehub ensures that all policies, invoices, and letters are stored in a structured way.

Automatic reminders help you not miss important deadlines such as cancellations or premium payments. Deadlines are particularly crucial for residential building insurance, such as the residential building insurance cancellation deadlines. This keeps your protection up to date.

Regular insurance check

Once a year, you should review your insurance coverage. Changes in life circumstances such as moving, family growth, or a career change may require adjustments. Many people forget this check—even though it not only minimizes risks but often saves premiums.

Use the digital customer portal to compare your existing contracts and optimize them if necessary. The annual insurance check is a simple routine that creates long-term security.

In the event of a claim: respond correctly and report digitally

If a claim occurs, speed matters. With bavariadirekt, you can report claims directly in the customer portal or via the app. Upload photos and all required documents digitally to speed up processing.

A complete digital claim report ensures swift settlement. By storing all documents in a structured way with filehub, your accounting or management can be involved directly. This saves time and avoids errors.

Save costs through bundling and discount programs

Those who bundle multiple policies with bavariadirekt often benefit from attractive discounts. Combine, for example, car, household contents, and liability insurance to reduce premiums. In addition, there are regular bonus programs and promotions.

A tip: regularly check whether you can benefit from new discount options. Combining different insurance policies is not only cheaper but also provides more clarity and less administrative effort.

Future trends: insurance in 2025 and beyond

The insurance world is on the verge of change. The focus is on digital innovations, sustainability, flexible solutions, and new risks. Those who work with bavariadirekt benefit from modern services and a clear focus on the future. Here’s an overview of how insurance will develop in 2025 and how you can benefit.

Digitalization and artificial intelligence

In 2025, the insurance industry will rely more heavily on digital processes. At bavariadirekt, customers benefit from automated processes such as digital claims handling and rapid risk assessment. AI-based rate advice analyzes individual needs and recommends suitable products.

A large proportion of insurers, including bavariadirekt, use digital platforms to provide policies, invoices, and documents. Tools like filehub automate downloading and storing these documents—saving time and reducing errors. If you want to learn more about automation, you’ll find details in the article Automation of insurance processes.

Sustainability and green insurance

Sustainability is also becoming more important at bavariadirekt. Digital services enable paperless management and reduce the CO2 footprint. Environmentally friendly rates, for example for e-cars, support the mobility transition.

In addition, some policies offer the option of CO2 compensation as a flexible module. This makes insurance coverage not only more efficient but also more environmentally conscious. Customers appreciate this development and increasingly prefer sustainable products.

Personalization and flexible plans

Insurance solutions will be more individual than ever in 2025. At this insurer, flexible plans and modular policies are in focus. Through intelligent data analysis, offers can be tailored precisely to the respective life situation.

Whether single, family, or self-employed, bavariadirekt’s policies adapt flexibly. Statistics show that demand for personalized insurance solutions is continuously increasing. This ensures more transparency and tailored protection.

New risks in focus: cyber and digital insurance

With advancing digitalization, new dangers such as cybercrime and data loss are coming to the fore. Bavariadirekt is responding with special cyber and digital insurance that protects individuals and companies from financial consequences.

Cyber protection can be chosen here as an add-on. This equips you against online fraud and hacker attacks. The demand for such coverage is steadily growing as risks in digital everyday life increase.

Conclusion on the most important developments

Insurance is changing rapidly. The future is digital, sustainable, individual, and secure. With bavariadirekt, customers benefit from innovative services, efficient processes, and tailored protection.

Now is the ideal time to manage your insurance digitally and prepare optimally for upcoming challenges. This keeps you flexible and well protected.

You’ve seen how important structured and digital management of your insurance is—especially when many policies, invoices, and letters come together from different sources. With filehub, you can finally automate exactly that, save time, and avoid errors. Whether you’re working as a private individual or in a company: you always maintain an overview and ensure GDPR-compliant storage of your documents. If you want to manage your insurance documents as efficiently and easily as possible, then just try it yourself and try filehub.one for free now.